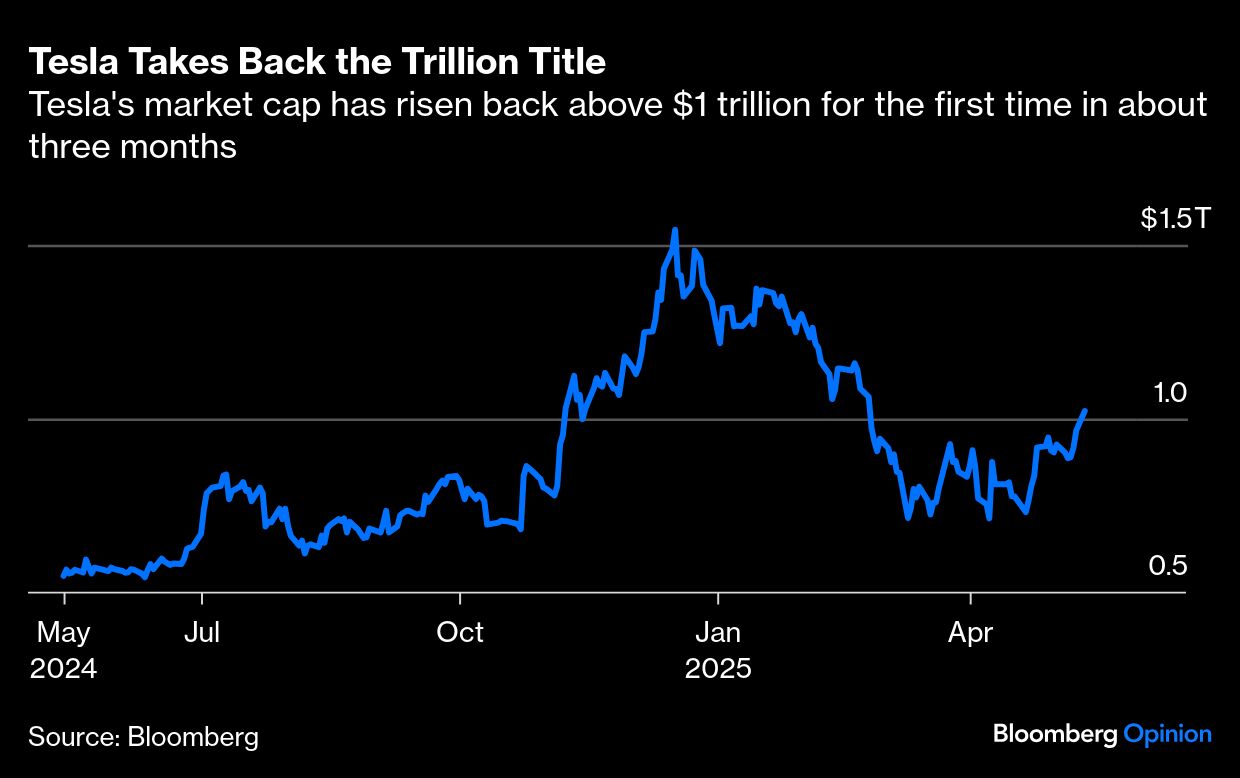

Tesla Inc. is back in the trillion-dollar club for the first time since February. Elon Musk's electric vehicle maker added about $65 billion of market value on Monday morning, as of writing this, taking it into thirteen figures again.

The obvious catalyst is the partial truce in the US-China trade war, fueling a 2.5% rally in the S&P 500 Index. Tesla's gain is more than double that, presumably reflecting the specific benefits it stands to reap from all this. These include… vibes?

While Tesla recently suspended what it questionably calls guidance due to tariff turmoil, it also pointed out that its core EV business enjoys more immunity than other automakers. Its supply chains tend to be local, with vehicles sold in the US enjoying 85% compliance with the United States-Mexico-Canada Agreement in terms of their content. That doesn't confer total immunity, but it is far better than for the likes of General Motors Co. Tesla's power business is more exposed, since it imports batteries from China, but it's tough to justify a $60-odd billion surge on the back of a business with a trailing gross profit of $3 billion.

Perhaps the feeling is that any sign of a thaw must be good since Tesla's two biggest markets and factory footprints are in the US and China. The two obvious rejoinders to this are that (a) taking any development in Trump's twisting tariff saga as the final chapter is tantamount to madness at this point, and (b) US-Sino relations are not Tesla's biggest problem, by a long way.

Its biggest problem was neatly captured in data released last week — and seemingly ignored — showing that shipments from Tesla's plant in Shanghai fell in April for the seventh month straight. Its share of China's “new energy vehicle” market, the most important EV market on the planet, is running at 5.1% so far this year, according to figures compiled by Goldman Sachs Group Inc., down from 6.9% at this time last year. Chinese rival BYD Ltd. is at 27.3%. This is despite a much-ballyhooed ‘refresh' of the Model Y, to which Tesla tried to attribute its poor first-quarter earnings, due to factory downtime, and pin hopes of a rebound this quarter. Sales data out of Europe were similarly weak in April, further undercutting the idea that the first quarter's problems were temporary and supply-led.

Rather, Musk's political activities have damaged a brand that was faltering anyway due to a lack of affordable and exciting new EV models. A ‘refresh' isn't an adequate alternative for a brand new vehicle and Tesla's last in that department, the Cybertruck, has flopped so far.

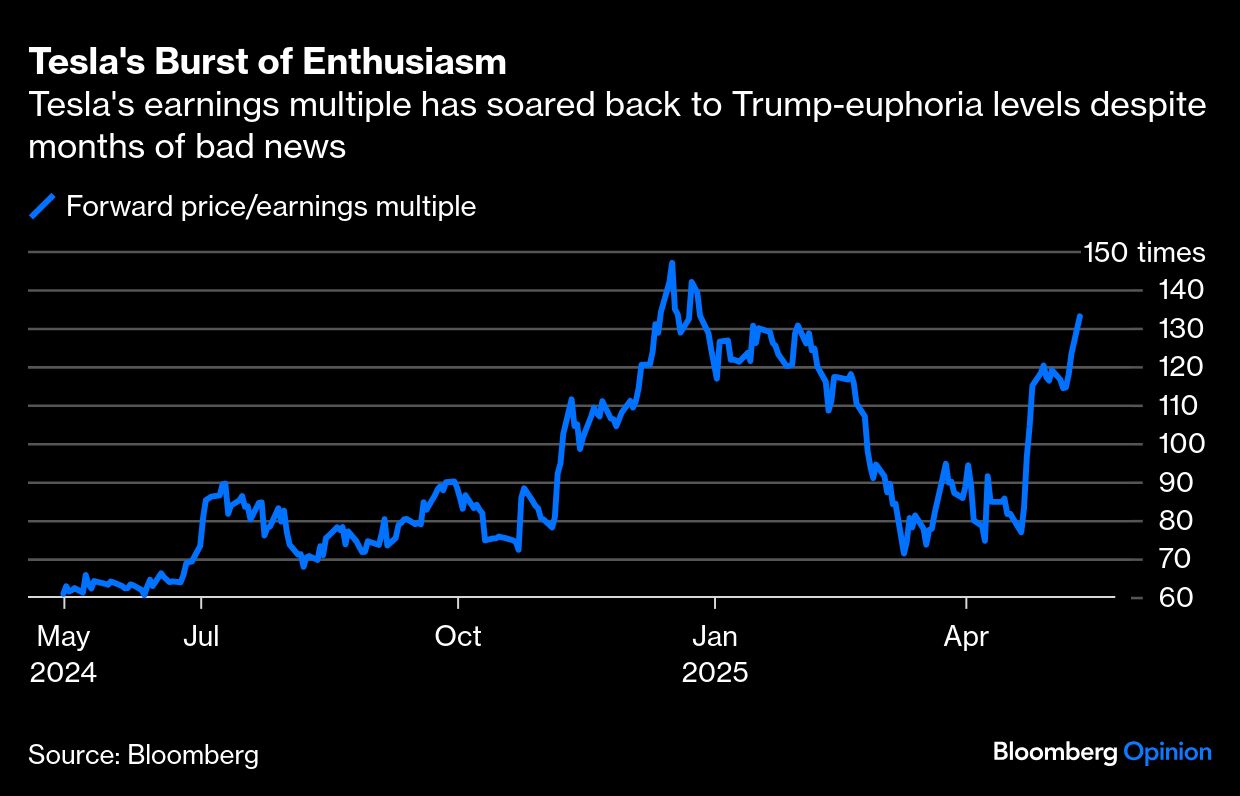

Yet, remarkably, Tesla's valuation is now back above $1 trillion for the first time since the avalanche of weak sales reports from Europe and horrible financial results, which included an underlying loss on operations in its EV business for the first time in years. The shares have soared even as estimates have been cut, so Tesla's valuation multiples have ballooned.

At 133 times forward earnings, the stock is back to where it was in the phase of post-election euphoria, when Musk's proximity to the new US president was viewed as an unalloyed good for Tesla. Not only was that also vibes, it was plainly incorrect, as was quickly demonstrated.

If Monday's rally rests on similarly nebulous reasons, the underlying facts remain. Tesla's core business has stopped growing. Its enormous valuation is lashed to Musk's pledge to launch a limited robotaxi service next month which, even if achieved, would represent a big climbdown from oft-repeated promises of self-driving Teslas everywhere. What happens in Austin in June is at once the most important catalyst for Tesla's stock and also a demonstration of why too much is baked in already. Washington today is a side-show magnified to carnival proportions.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.