Nifty In Technical Charts: Dismal Portfolios, But Opportunities Remain

As the year draws to a close, there is little to show for the past several months.

No changes even though another week has gone by. The market has become a bore for traders, investors and analysts alike. What does one do or say when the market keeps churning in the same range? Soon, there is little left to add. Yet everyone still asks the same question: Kya lagta hai market? The reality is simple. No one knows.

Technical analysts do not know. They keep shifting ranges marginally, moving levels by 50 to 100 points. Option traders do not know either. Many remain content shorting option strangles and straddles around the 35 delta, accepting lower returns and paying little attention to the VIX. Investors do not know beyond the fact that their portfolios are down. Despite churning holdings, little changes. Fund managers also do not have clarity, though they cannot admit it publicly. Instead, they fall back on familiar phrases around the long term and structural strength. Foreign institutional investors also appear uncertain. Their representatives call India attractive across media platforms, yet continue to sell equities and derivatives day after day.

What can one make of all this? Very little. Confusion becomes the obvious conclusion. When confusion prevails, action dries up. Traders withdraw, and volumes fall. Last week reflected this clearly, with NSE volumes hitting record lows. Some traders attempt shorts, but with no damage to the trend, those trades also lose money. Frustration builds. Investors step back as well, leading to lower volumes, higher intraday volatility and persistent confusion.

Domestic institutional investors remain active because systematic investment plan flows continue. These inflows support prices and sustain the trend, creating a market that refuses to fall. Foreign investors and IPO issuers continue selling into this demand, with their supply getting absorbed smoothly. At least some participants are content.

As the year draws to a close, there is little to show for the past several months.

For five consecutive years, microcaps delivered strong returns. Gradually, many portfolios became concentrated in that segment.

This reflects recency bias, where recent experience shapes future expectations. Many investors held on to stocks through the early part of the year as prices fell, expecting a recovery similar to the past. The data tells a different story. Of the 2,667 listed stocks on the NSE, about 72% have declined more than 50%. That scale of decline explains why portfolio pain was largely unavoidable.

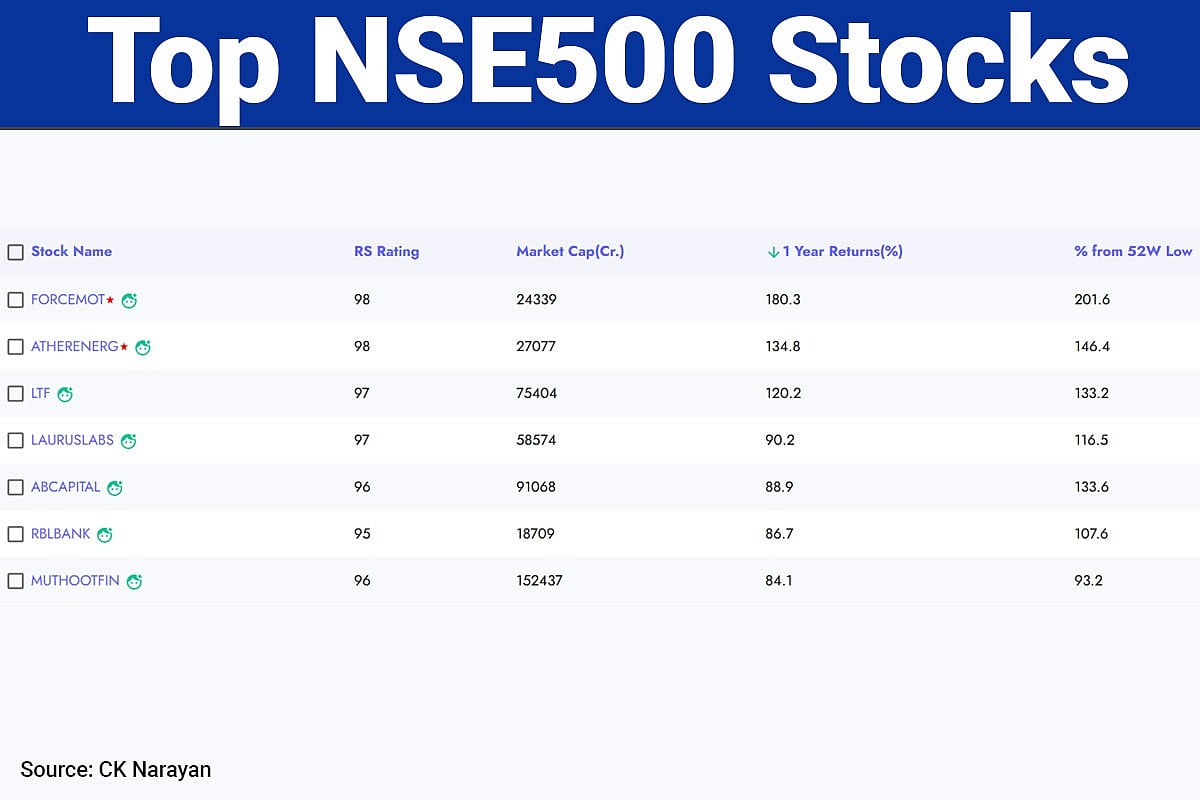

This does not mean opportunities have disappeared. In 2025, the NSE 500, which includes the top 500 stocks by market capitalisation, has returned around 6%. That appears modest. This table tells a different story.

The table highlights stocks that delivered strong positive returns over the past year. These gains occurred in the same market, over the same period. The difference is simple. Many investors were not positioned in these stocks or were not tracking them.

This suggests 2025 was neither a year of blind optimism nor one of extreme fear. It was a year that rewarded research, conviction and patience. Many investors, however, waited for a sharp market fall that would make all stocks appear cheap. Others waited for clear positive headlines to provide comfort. Neither played out. Loss aversion dominated behaviour. Investors held on, or switched stocks at similar prices to avoid acknowledging losses.

Looking ahead, 2026 may not look very different, at least until a few more quarters of results emerge. The market demands closer analysis of sector trends, stock-specific performance, relative valuations and momentum. This is not a market where everyone wins. Preparation and effort matter.

Large-cap stocks appear at the top of recent performance tables. There is hope around mid-, small- and micro-cap stocks after steep corrections. However, without improvement in fundamentals, further selling remains possible. Large-cap valuations, by contrast, have moderated. The Nifty does not appear overvalued, suggesting these stocks could hold up better in 2026.

In closing, the Nifty remains stuck in a narrow range that has persisted for weeks. Fresh triggers are needed to push it out of this zone, but few ideas remain. Even the removal of external policy risks may not generate a strong response. Waiting appears unavoidable.

There is little value in debating index levels endlessly, given the volume of commentary already available. The focus instead should remain on identifying potential winners beneath the surface. The tables suggest such opportunities exist. Gold and silver continue to hit record highs, raising the case for future portfolio allocation, though that discussion may be better timed after a pullback.

Option traders continue to benefit from range-bound conditions, until volatility eventually returns. When that happens remains uncertain. Until then, the market continues to offer frequent 2% to 5% moves. For active participants, opportunities still exist.

Disclaimer: The views expressed in this article are solely those of the author and do not necessarily reflect the opinion of NDTV Profit or its affiliates. Readers are advised to conduct their own research or consult a qualified professional before making any investment or business decisions. NDTV Profit does not guarantee the accuracy, completeness, or reliability of the information presented in this article.