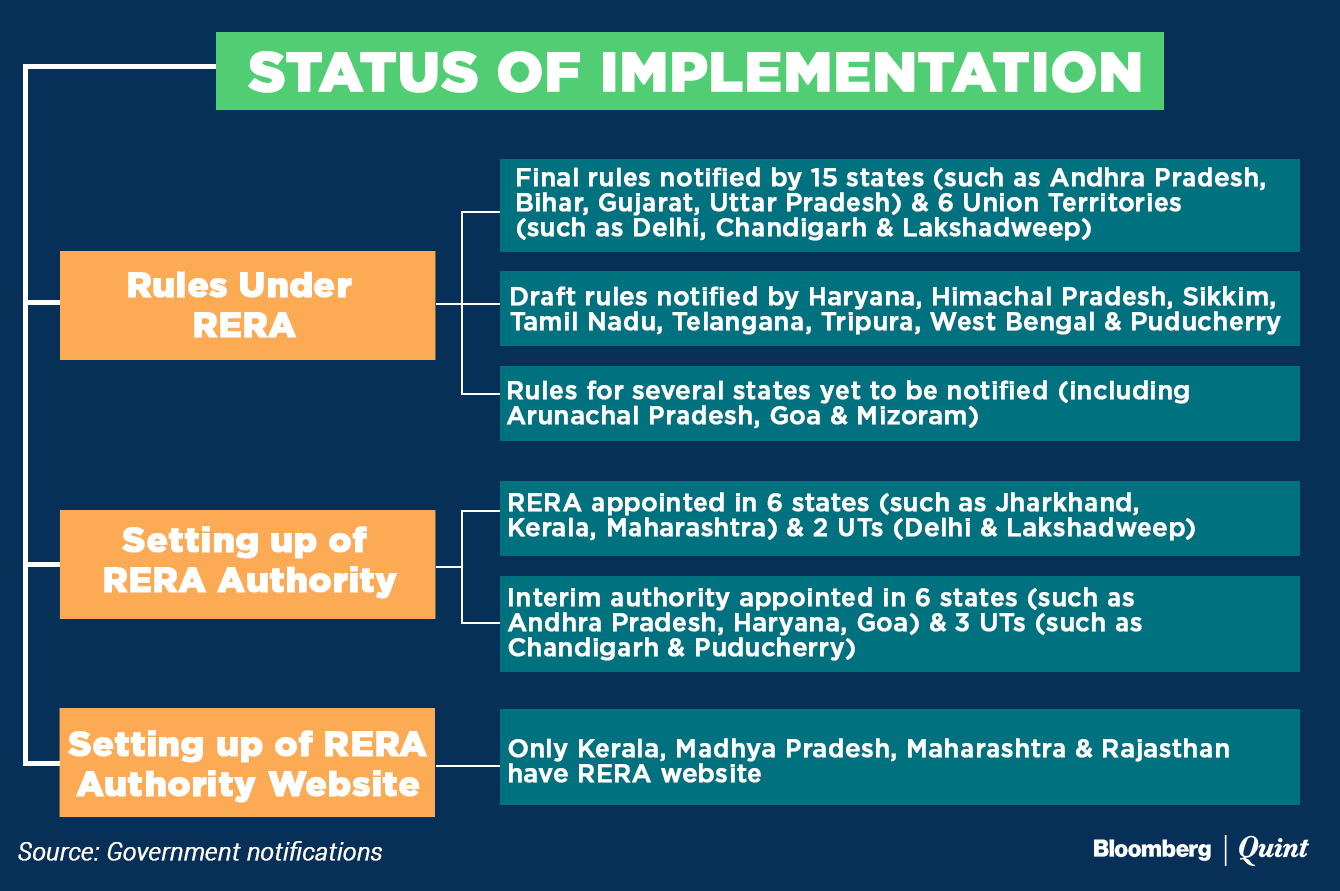

Two months since the notification of the Real Estate Regulatory Authority (RERA), its effective implementation is yet to run on full throttle. The status varies from state to state. The following chart sets out a snapshot of the status of RERA's implementation.

To ensure that developers comply with the timelines and obligations prescribed under RERA, it is imperative that states ensure that the legislation is effectively and promptly implemented and appropriate infrastructure is put in place at the earliest.

Implementation status aside, certain pertinent issues arise from RERA, and the rules so far notified by a few states.

Marketing and sales prohibition and registration requirement: Given that RERA only prohibits sales and marketing of unregistered projects, it is safe to conclude that sold-out projects pending grant of possession until issue of completion certificate, need not register under RERA.

Registration timeline: In states where neither the RERA authority nor an interim authority is in place, and in the absence of an express close shops till registration rule, developers can continue marketing and sales activities for their ongoing projects till the end of the three-month timeline (i.e. July 31, 2017).

If the Authority or rules are not in place till then, it is very likely that this timeline for applying for registration may be extended.

Ongoing projects: While most provisions of the state rules are in line with RERA, one key concern is the expansive definition of ongoing projects provided under the rules notified by few states.

The central government's view is that only those projects for which a completion certificate has been obtained as of May 1, 2017 are exempted from the applicability of RERA.

However, states like Uttar Pradesh and Haryana have also included, within the ambit of ongoing projects, those projects for which an application for a completion certificate has been made by the developer. This has led to developers rushing to apply for the completion certificate to seek an exemption from RERA.

The constitutional validity of the aforesaid deviations under the state rules is currently under debate. Given that any property situated in a state is a subject of legislation by the relevant state government, there is room to argue in favour of these deviations.

However, since these state rules are a subordinate legislation, they cannot, as a general rule of law, be in violation of the provisions of the principal legislation.

While the position on this is yet to be settled, the courts and central government have, in certain cases, reached out to such states and directed them to align the provisions of their state rules with the central legislation.

Deposit requirement: RERA mandates developers deposit 70 percent of the sale proceeds received from the allottees in a separate bank account, which can be used only towards payment of land and construction costs. A few states have, under their RERA rules, extended this requirement to proceeds received for ongoing projects prior to RERA.

For instance, the Haryana RERA rules also mandate developers to fulfill the deposit requirement for ongoing projects from the amounts already realized from the allottees of such projects which have not been utilized for construction or land cost of such project.

Though the provision looks to address the consumers' concern regarding diversion of funds, uncertainty prevails on whether any monies remain undiverted and at the developers' disposal to comply with this requirement.

Re-execution of sale documents with consumers: Despite the state rules providing templates of the agreements to sell, RERA as well as most of the state rules do not specify whether re-executing transactions – with the existing allottees of ongoing projects – is mandatory. Without an express provision, such a requirement can be safely assumed to not apply.

However, in cases where the existing documentation is developer friendly (a very likely scenario), or contains commercials that may not be implementable under the RERA regime (such as assured returns to consumers), it may be worthwhile for developers and consumers alike to execute fresh agreements, which are compliant with RERA.

Security offered while fund raising: The Maharashtra RERA has recently issued an order concerning arrangements between promoters and third parties where such third parties are promised either a share in:

- Total revenue generated from the project; or

- Total area developed for sale.

The order mandates that any payouts for such arrangements should not be considered as cost of project and therefore no withdrawal from the deposited sums shall be permitted for such payouts. Cash starved promoters looking to secure such funding should take note of this provision. While at present, other than Maharashtra, none of the other state rules have similar provisions, the updates in this space should be closely monitored.

Yogesh Singh is Partner, at Trilegal. The author was assisted by Ramya Suresh, Senior Associate and Itisha Gupta, Associate.

The views expressed here are those of the author's and do not necessarily represent the views of BloombergQuint or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.