See the sequence of headlines we have had for our articles over the past several weeks. It tells the story of expectations gone wrong, promises not lived up to, of market designs varying from forecasts and analysis.

Writing on 27th June, I had titled the piece, 'Breakout at last'. This is when we got the strong decisive move on 20th June and saw some follow through price action on it. On the face of it, we looked to be in the clear after several weeks of consolidation.

We all got busy making higher targets etc. But the market stalled and the next week letter was entitled, 'Taking a Pause'. Here our expectation was that the market was digesting gains made from the decisive move but made a pause before more gains would accrue.

This was followed up with the next letter titled, 'Waiting Time'. Obviously, the market was not making a go for it like it was expected to do so. Then we moved on to a safer headline, 'Stock Specific Moves to Continue'.

This was because the indices did not really move but stocks did – mainly because the earnings season was unfolding and there were enough triggers. By end of July (27th July letter), we had some hint of warning when we entitled the letter, 'Lower supports Attacked'. The attacks survived but just about, so the next one was titled, 'Consolidation time Ahead'.

But, the market had different designs by early Aug. and our Aug. 1 letter was entitled, 'A Bit of a Slip'. Here, I highlighted the fact that the bulls were losing their grip and the market trends were slipping as was the default buy approach. Since this continued further, I was forced to call the next one, 'Sell Rallies remains the Approach'.

This was getting in step with the new reality, one where the expectations laid in June 20th breakout was almost busted. Finally, we segued into the last week where we stated that even though the local cues were decent, it was really the cold winds from overseas that were keeping the trends pressured.

Hence, it was entitled, 'Awaiting triggers from Overseas', signaling a surrender of sorts on the bullish longer-term picture and succumbing to the pressures of the near term. So, as can be seen, from end June (bullish) to end August (bearish), has been a full circle turn of sentiments.

However, the local news flow continues to be good- GDP expectations spike to over 7%! So, will the market stop attacking the 24,500- support zone and start rallying again, or perhaps get into another consolidation?

Everything seems possible right now. Or, will the market refuse to buy into the optimistic numbers? We shall know basis the trading pattern of early next week. In the last week's letter, I had stated that the 24,300 is the stronger support area so we should keep the possibility of that open.

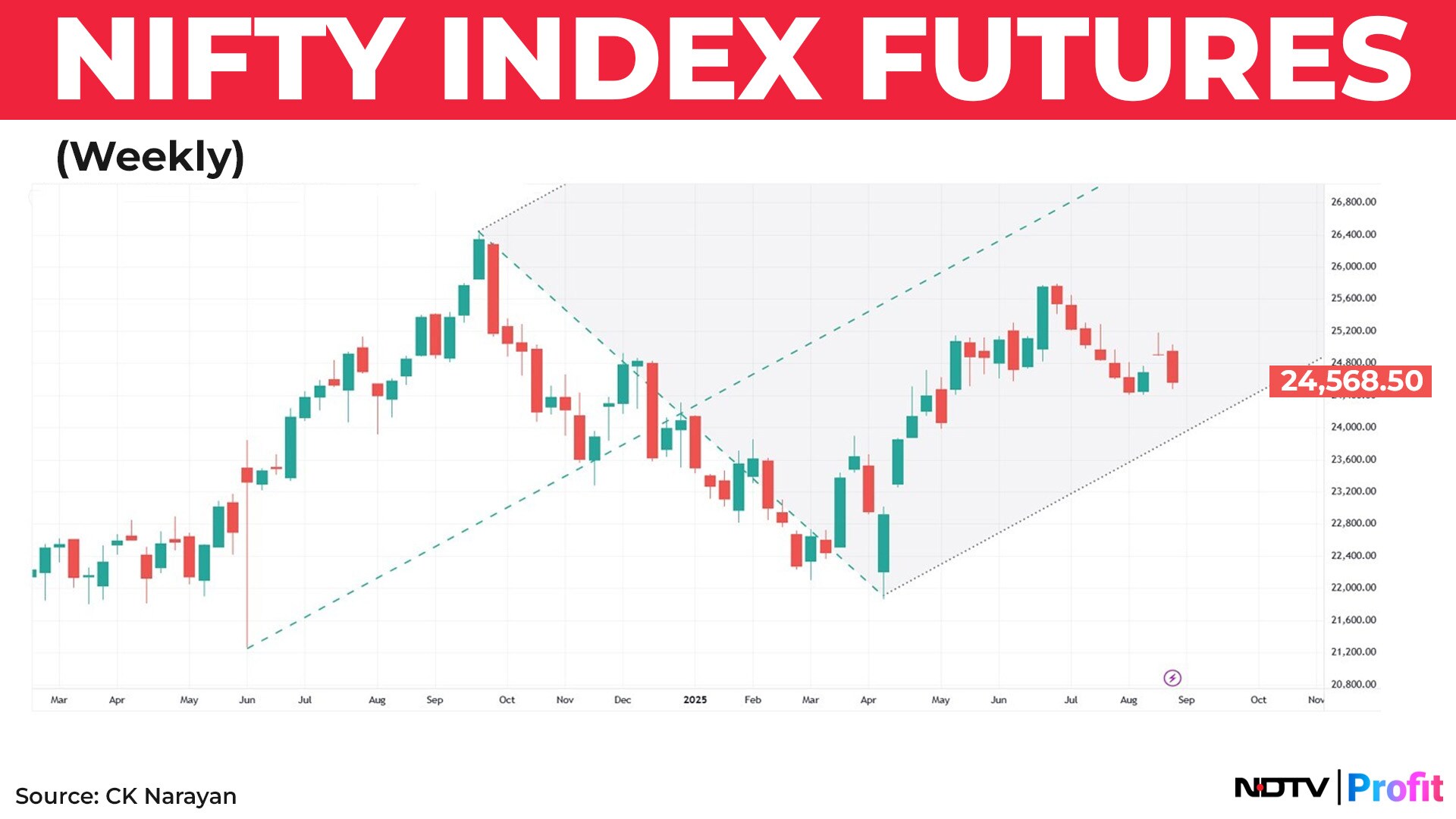

Nifty Index Futures (Weekly). Source: CK Narayan

As can be noted in the weekly chart of the Nifty futures (chart 1), the lower supports have moved up slightly from around 23,800 to near 24,000 levels now. So, short term swing traders need to keep that as a stop loss point.

But are 500-point stoploss traders still around? I doubt that very much. Most people seem to be swinging around in 100 points or so kind of moves. So, that 24,000 area is more for analysts, than for traders. They need a pitchfork channel like the one shown in chart 2.

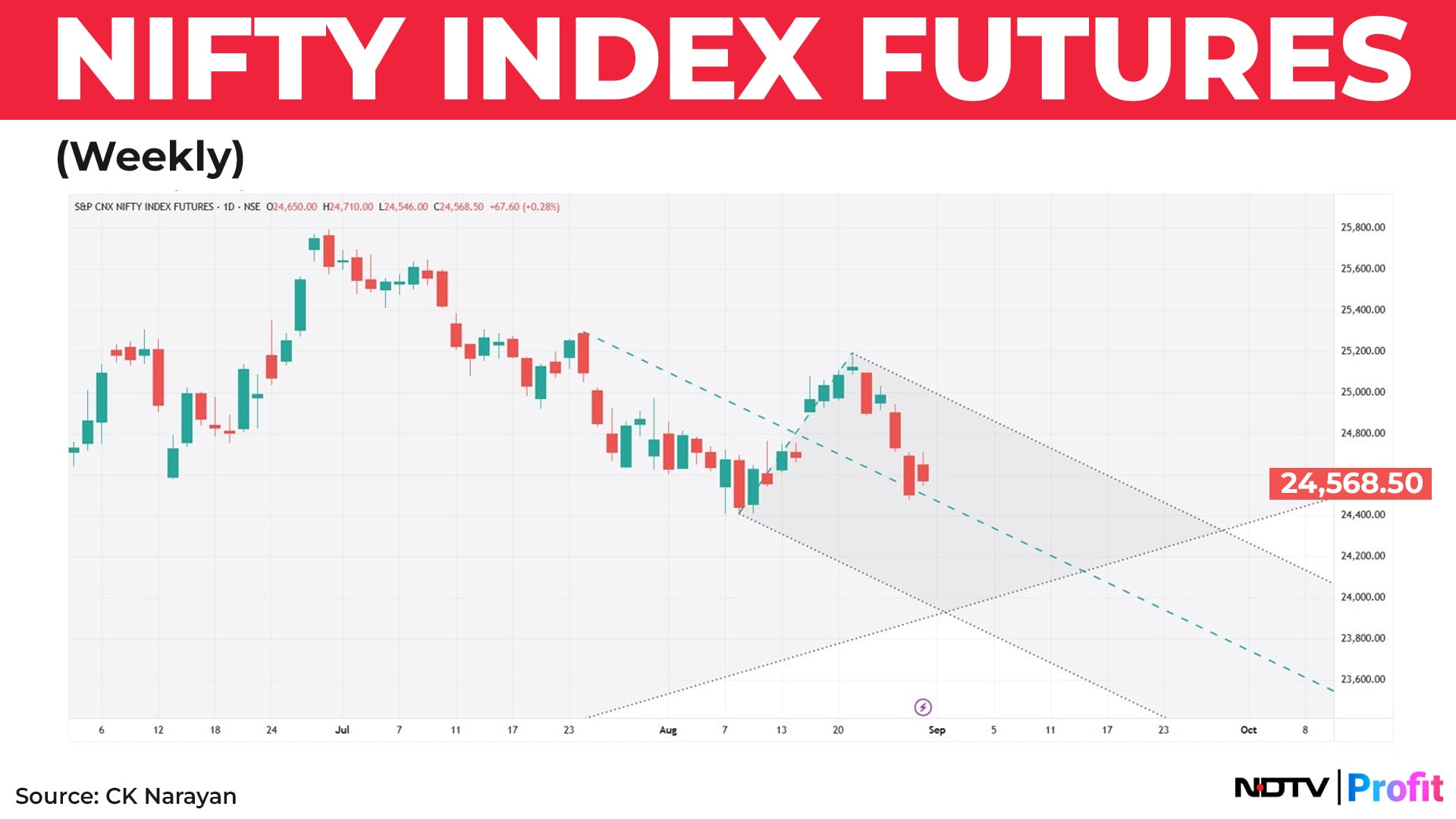

Nifty Index Futures. Source: CK Narayan

Here, we find that if the Nifty futures were to show a follow thru down below 24,450 levels then the down-sloped median line would break and that would open up a fall towards 24,00 areas. It is more likely that traders may want to play these sorts of moves as of now. Like I had written before, 'Sell on Rallies' is still the approach.

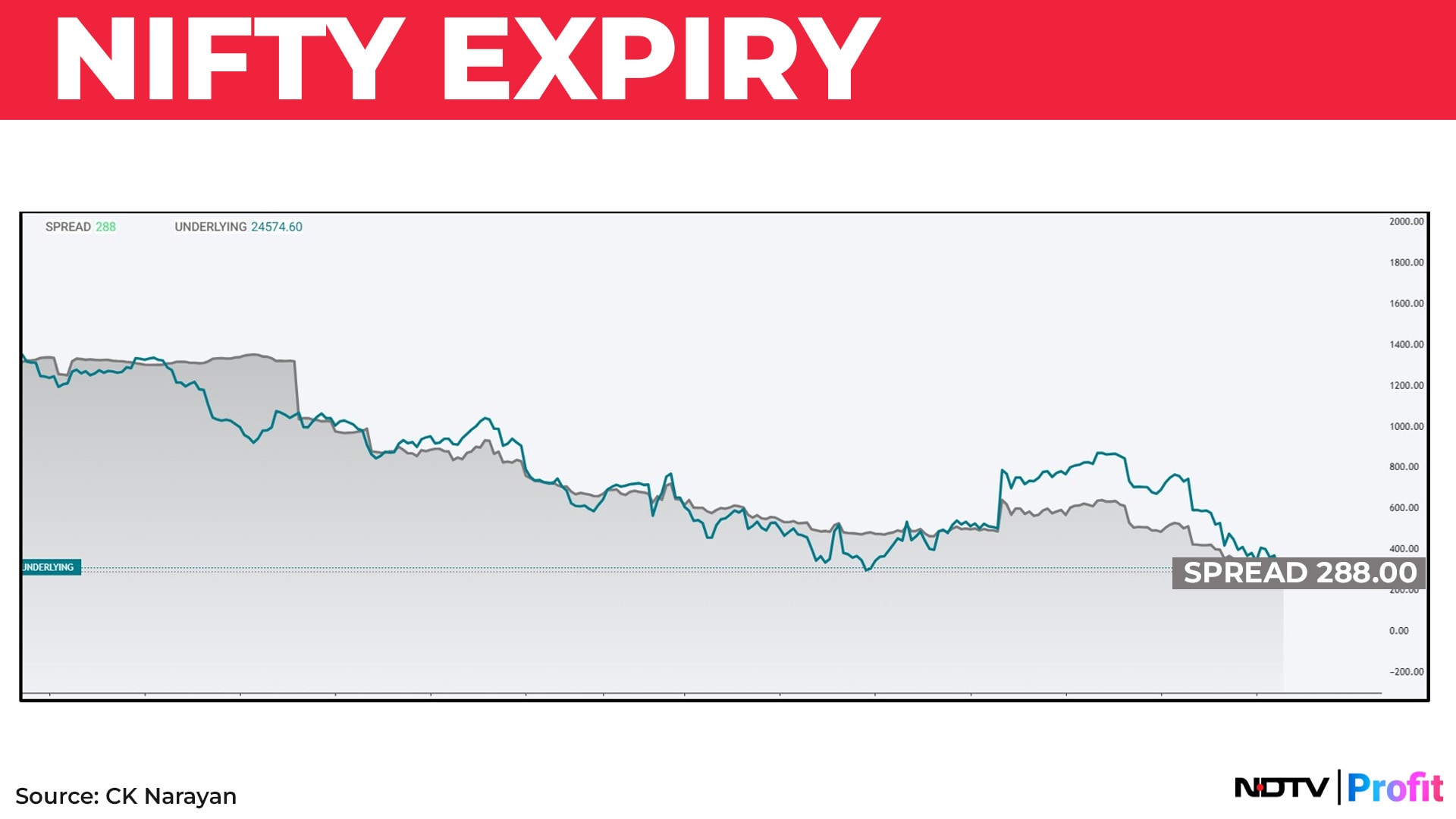

Unless, this market can make something out of the GDP data. Next week is also the GST committee meeting. If the rationalisations are to the satisfaction of the market, then it can be a cause for a rally. There is stark difference between the PCR of the weekly series (0.5) and the monthly series (1.20).

Some of this could be attributable to the changes in settlements now with the Nifty expiry shifting to Tuesday. So, the weekly traders may yet not have worked out the kind of option pricing adjustments that happens. But at 0.50, the PCR denotes high bearishness and a possible oversold status. Good news in the face of such positioning could produce some short covering, perhaps.

The same daily pitchfork shows that the upper channel starts the week at around 24,950 and that seems like a tall order now for the bulls to cross to get back into the game. The levels may fall to about 24,850 levels by the end of the week.

So, the focus area for the week widens a bit to 24,000 on the lower side and 24,900 at the higher side. Maybe, try a long strangle using those strikes, assuming that good news won't allow the market to fall much while upside still seems like a struggle but not too far either? This is priced around 290 levels at the end of the week and the chart shows a slight uptick.

Nifty Expiry. Source: CK Narayan

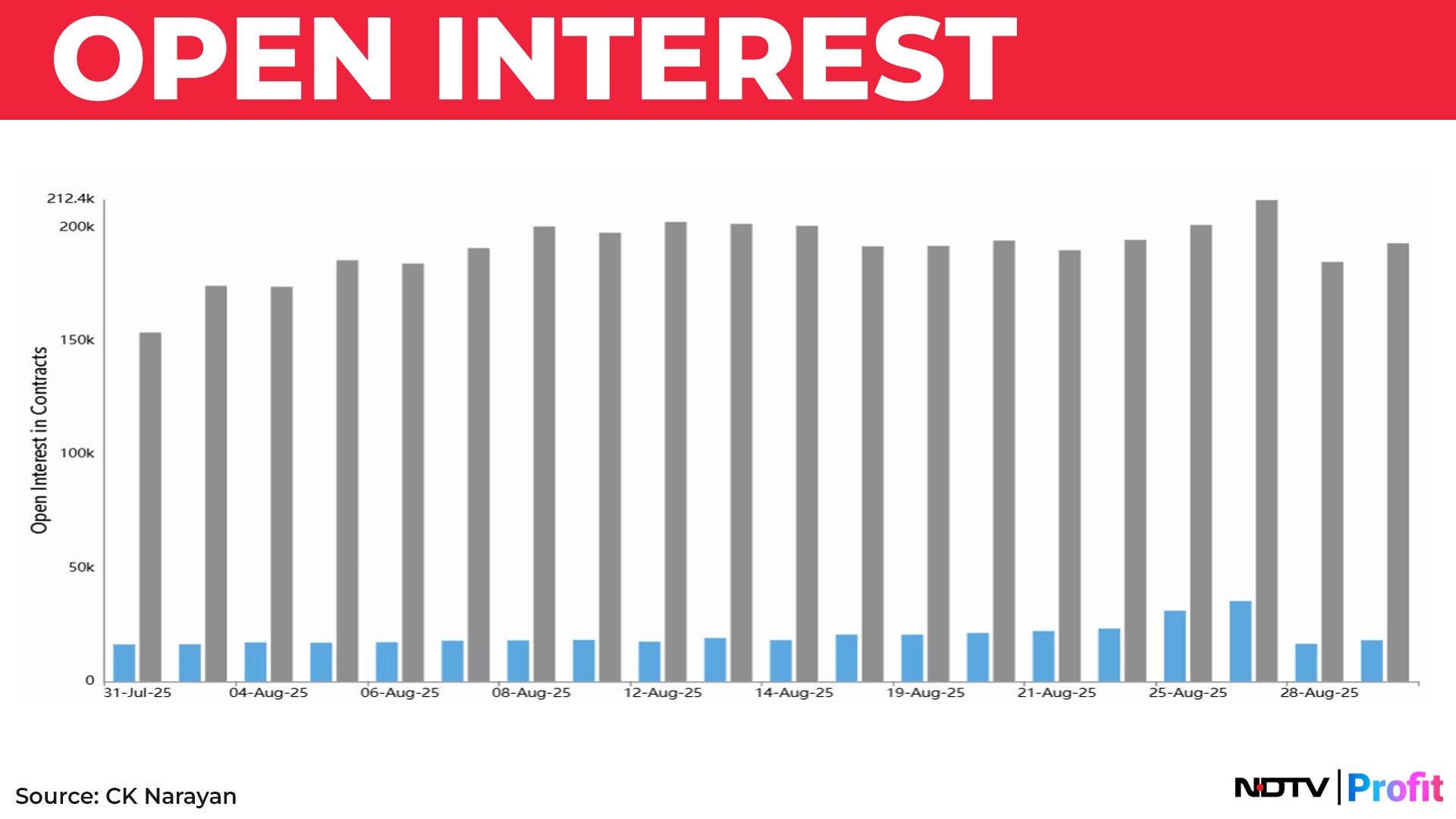

In the meanwhile, the FIIs continue to crank it up with the shorts. Slight easing from the extremes of 2.12L contracts short now to 1.93L contracts short. Still very high.

So long as this situation holds, there isn't much of a hope of a big rally. But if we are not looking for anything big, then this data can be ignored for now.

Open Interest in contracts. Source: CK Narayan

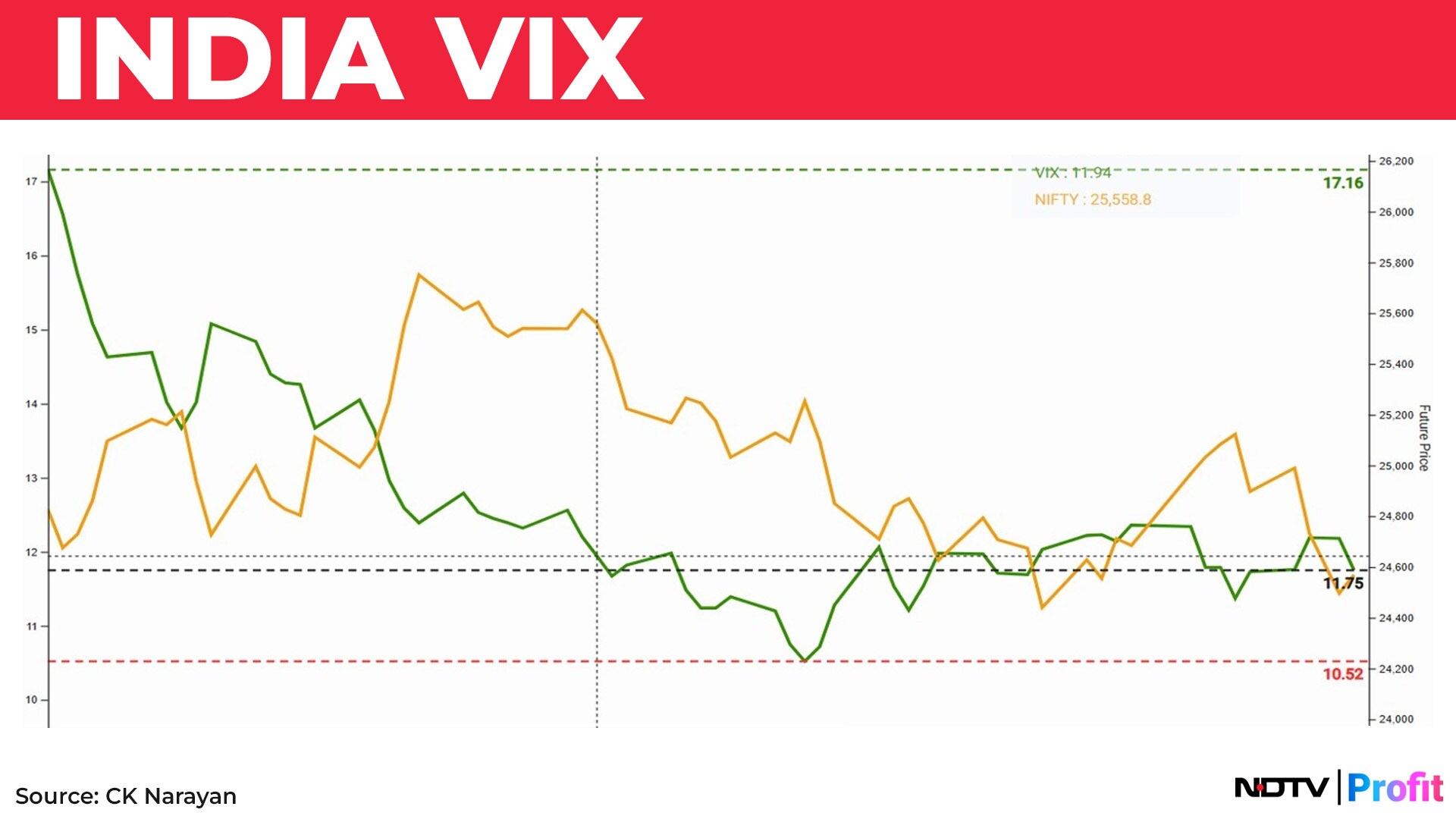

The strange thing is that India Vix seems subdued. Trump tariff and its impact is digested then? What gives here? I can't quite make this out.

India VIX. Source: CK Narayan

This is to be seen in the light of the powerful move made by the Dollar vs the Rupee. Normally, this would have me very worried as weakening INR has been a definite weakening factor for the Nifty.

US Dollar Vs Rupee. Source: CK Narayan

But then a possible thought enters the mind…….could the govt be allowing the Rupee to weaken gradually to battle the tariff levies? For, that could be one of ways to combat the impact. Besides, the Indian 10y bond prices have got into a sharp decline in August.

Do they know something that the equity markets don't or is that vice versa? The DXY has been ranging, so the INR is moving independently. Trump tariff effect only or something more? Time will tell.

Too many balls to juggle right now and hence, the pathway is completely unclear. Best is to stay on the sidelines but for those who are compulsive traders, the approach is unchanged. Short the rallies. Correlations may be changing, so use price analysis only and that too for very short term positions.

CK Narayan is an expert in technical analysis, the founder of Growth Avenues, Chartadvise, and NeoTrader (https://neotrader.in), and the chief investment officer of Plus Delta Portfolios.

Disclaimer: The views and opinions expressed by experts and investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.