There is hardly anything new to report. As long as we continue to stay within the same range, we continue to play the same game.

Daily commentators on the market are having quite a tough time. I really feel sorry for them as they have to twist the same information, the same levels, the same Put-Call ratios, the same Moving average levels over and over again, every day and try to present it as though it is something new!

Here, I am having difficulty in seeing if there is something different at the turns of a week and still not finding anything! Pity is, more for the millions who are clued on to such daily and intraday analysis and trying to make some trade out of it!

Nifty 50 range

Give it up, guys! The market just isn't ready to do anything different just yet. As has been commented upon in recent issues, the Nifty remains locked in the 25,500-24,400 area and refuses to get out of it, no matter what the recent blandishments have been.

Those trying to make sense of a few points up or down are being paid to do so, but you don't need to follow. Within a small range, someone or the other is bound to be correct. So, they all make much of it and try to gather even more followers and those that have no ability to think for themselves, do so. Time to get out of that mindset.

Why this obsession with a few points on the Nifty? Over the last one year, the return on the Nifty has been Zero! Yea, it has. Go check. But, while the Nifty has struggled there are many stocks that have returned 10/20/30% or even more in the last year. Why are people not looking at those?

Because everyone feels that trading stocks are riskier while index trading is safer! The only truth of this market is what returns you produced with whatever you traded. If you are trading the Nifty option out of a compulsion from the past, you need to take a relook at what you do. Many have moved to Sensex options, making that the new Bank Nifty for option trades.

Well, if trading thrills are your game, then I wish you well and hope you find it. But, if you are serious about trading markets and making an income as well as building some wealth while at it, then I suggest casting your net wider and look at the rest of the market.

No doubt, there was a brief period when option sellers made a lot of money in short periods of time. But that game has changed, guys, and your chances of winning that game are reducing every single day as time passes. Don't let those Twitter champs mislead you into thinking that the game is very much on. It isn't.

Getting back to the present, curiously, within this range, price action has depicted a 78.6% retracement twice now, each of which has produced some turn. Is that meaningful? Too small an iteration for us to base any calls on. But each time, there has been a candlestick pattern too near the retracement.

First up (Jun 2025), the levels were hit and a bearish engulfing pattern occurred. Second, (Aug. 25), the fall to the same retracement level was a Tweezer bottom. Third, (18th Sep), we saw a small Evening start candle form and now the fourth time (30th Sept), we have a Record session count.

So, I suppose there is some empirical evidence that the market wants to respect that 78.6% retracement level. So should we. Like, do we have any other choice? In a market that seems to be defying logic, some pattern is better than no pattern, right?

Now, the index has rallied from the lower end of the range (and retracement zone) yet again. Should we then forecast a move to 78.6% above? Not really. Note that we check for levels and patterns at that stage to nail it down a bit. There was some time count also coming through in the last week. For the next week there are no time counts for now.

The range of about 1,000-1,200 points is roughly divisible into two portions, roughly about 500-600 points each. A simple trick to follow would be to be a Sell-the-rally person when in the lower portion of the range (24,400-25,000) and switch to Buy-the-dip guy when prices move into the upper portion.

And to remember to fade the last 50 points on either side in expectation of a reversal, provided there are some additional signals like Patterns, momentum or Time signals near the range extremes. What about shorting straddles and strangles that many people resort to? Well, with Vix refusing to get up from the lower levels, would tell you that it would be a dangerous game.

What about long strangles then? Well, that is also not a game to play right now too as events are also passing by rather quietly. Chart 2 shows the India Vix lying quiet near the lows of a year. So the best thing to do, if you are a compulsive index option trader is to be a day trader and take your chances on small income and hope that you don't get caught out any day.

India VIX Index

There is a lot of soul searching of when the FIIs would return to buy? As I have discussed in a recent episode of Charts & Beyond (see Ep 24), there is just no trigger for them to return as yet. So, they continue to be sellers, waxing and waning in the quantity thru the weeks. In Sept, they have sold 30,000 crore but the domestic funds managed to save the day by buying 55,000 crore.

Sometimes this is difficult to understand- when you throw 30,000 at me and I throw back 55,000 at you, how come you win? Or at least, I don't win? Maybe it has to do with you selling the big names and me buying the small names? Could that be it?

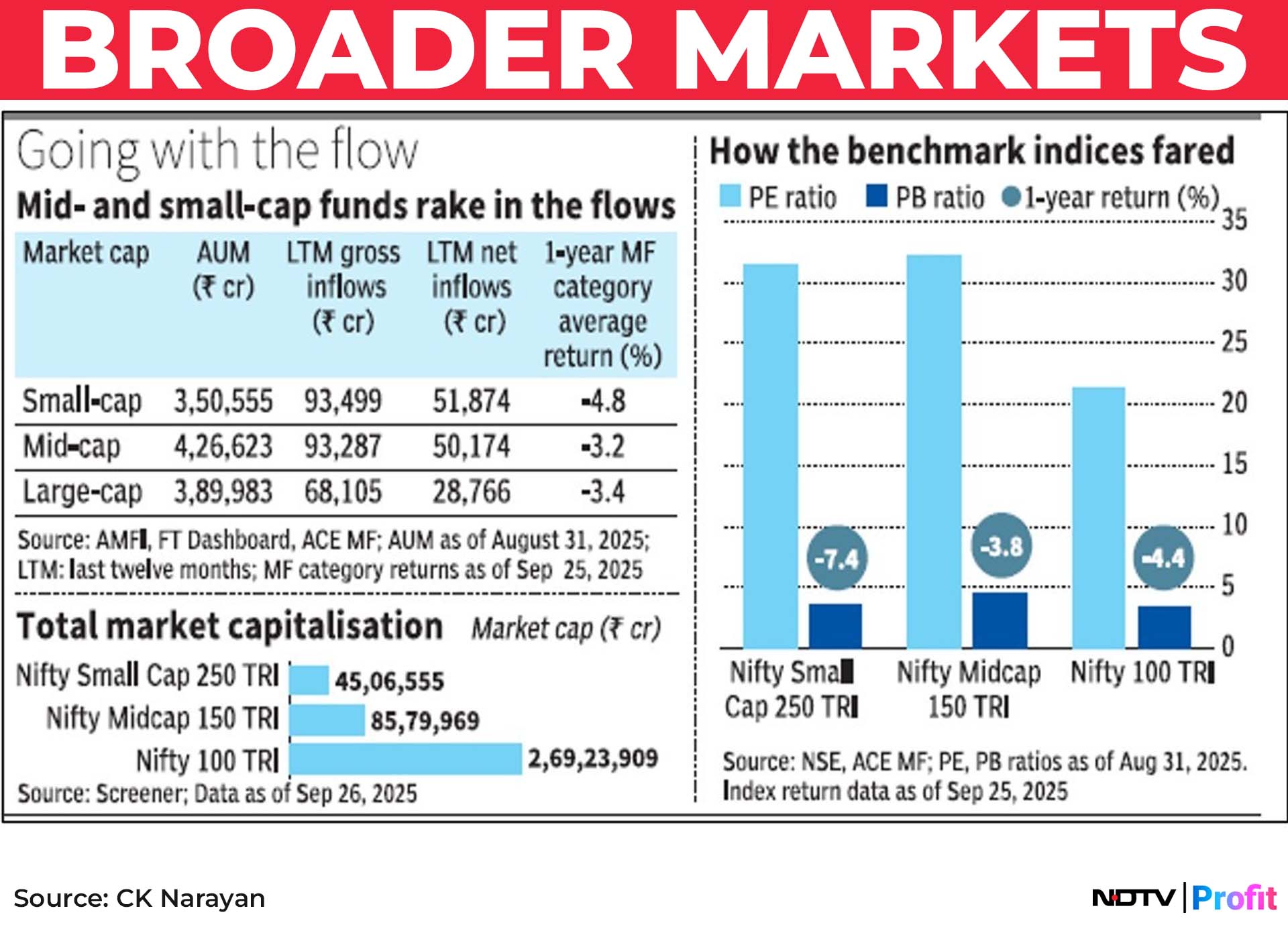

The data would suggest so. Recent MF inflow data showed that both small and midcap schemes attracted about 50,000 crore of net new flows compared to around 28,000 crore for large caps. So, the domestic funds are buying into small and midcap stocks while the FIIs are pummelling large caps? After all, that is what they hold, right? Since the bought stocks are not in Index (and sold stocks are), there is a continued negative impact.

Broader Markets

The interesting aspect here is that this inflow is happening despite high valuation for the Small and Midcap indices (31-32x) compared to large cap (21x). So, despite everything, is risk-on still the dominant sentiment? Maybe that is why the larger time frame charts are not turning bearish?

The government is doing its thing once again-the RBI governor's statements indicated so yet again. Will the private sector step up? We wait to see. The FM keeps exhorting industrialists to move ahead without fear. Will they? Q2 will start flowing a week from now. Is there any build up by way of expectation? I don't see anything much.

Best way to track this is to check of onset of momentum on sector charts and various indices charts. And there, we come up miserably short. Barring very few index charts, almost all the others are seeing a weak momentum in their weekly charts (RSI <60 or unable to cross 60). When this signal is widespread among a range of sector charts and bigger indices too, then it is a sign of a malady, an illness that has struck the stocks of the market.

The market may be trying to recover from it every now and then but so far has failed to do so. Now, with Q2 results about to come through, can we look for some deliverance? I don't know. I can only hope. The lack of build up ahead of the results flow tells me that the market also has low hopes of this happening.

The Trump tariffs only made that job even more difficult. So, my take is that the market may take its time to see where the chips land before deciding its next play. Hence it is better not to expect any major action across the coming week or two?

Let's leave it there for now. Summing up, we play the range, alternating our plays based on which side of the 25,000 the Nifty lies. All trades are short term oriented. As suggested, look at plays beyond the index and these shall be on a case-to-case basis.

The flow of Q2 results shall decide those cases. No positional trade expectations for now and certainly no big investment expectations either. If you get some 20-30% in a play (and yes, there are such plays still, in stocks) pocket it and begone.

Disclaimer: The views and opinions expressed by experts and investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.