- The Nifty has fallen for six consecutive sessions, closing near its 24,400 support level on Friday

- Key resistance levels to watch for recovery are 24,750 and 24,850 on technical charts

- Market remains range-bound with downside bias; trading strategies advised over long-term investing

The market was clobbered last week. The sell-off accelerated from Monday to Friday, culminating in a decisive bloodbath on Friday. It was a 'Humpty Dumpty all fall down' type of day. The slight cheer from earlier in the week—and the hope that came with it—was decimated. The worst part was that people were clueless as to why it had happened.

Of course, by Friday, the market's current nemesis, Donald Trump, was back at it again. Blame was placed on India for "funding" Russia's war in Ukraine at the UNGA, and then the pharmaceutical sector got shellacked. Perhaps, the market had some wind of this coming. In any case, the Nifty has, once again, posted a six-session fall in a row.

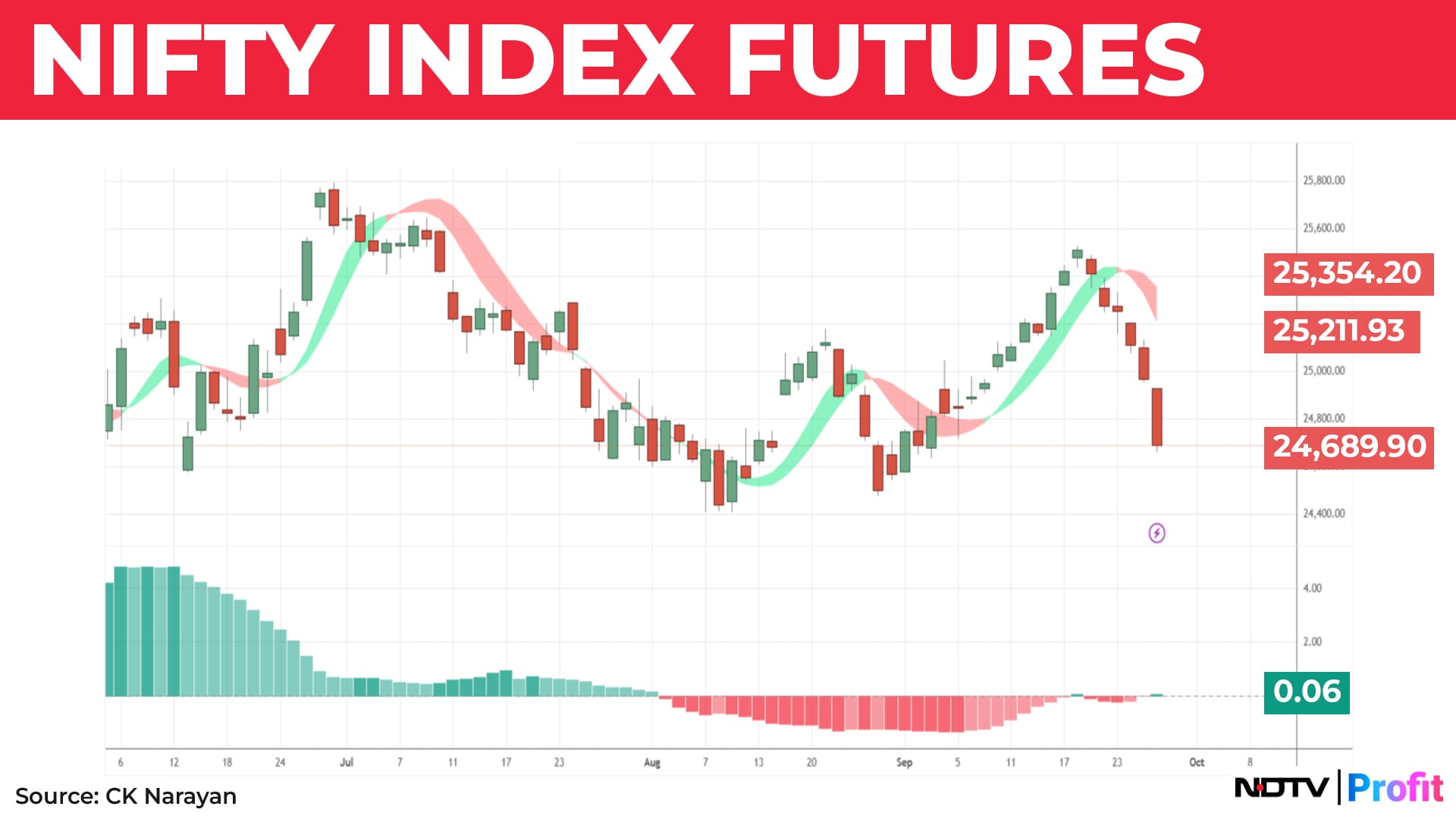

In the last week, I had indicated that there were some ”niggling signs of worry” and had outlined the rally running into a resistance (78.6% retracement and bearish candle stick pattern), and how that had torpedoed the last rally attempt (back in June). Well, it happened again. I had also featured the rising pitchfork tracking the fledgling uptrend, stating it would be broken if 25,150 is lost. It was. Decisively. But the hope was price declines would not break 25,000. That hope was dashed and we are now faced with the prices racing towards the recent swing lows near 24,400.

So, now, after an attempt to break the higher end of the range, are we looking to mount an attack at the lower end of the range? I don't think so. Not quite yet. But market needs to buck up to stop the bear.

First up, this pharma tariff thing. It is not on generics. So, we should be only marginally impacted – nothing that the industry or the markets cannot take in their stride. Second, Friday's long-range candle occurred in a week ruled by bears, who had trapped unsuspecting bulls since Monday.

Third, the momentum indicator on Chart 1 is showing a neutral reading. This means the situation is essentially balanced, despite the drubbing that long-term holders received. While it was undoubtedly painful for those holding long positions this week, being on the wrong side of a market that is adjusting within a range is not the same as a change in trend. It simply means you failed to catch the adjustment and paid the price for that lapse.

Chart 2 shows that the current situation is rather tenuous. It is the 60min chart of the NF, with Gann Angles overlaid. By Friday, we have come down almost to rest on the last of the angles for support.

Note the decisive role the modified moving average band played on prices, as no intraday rally could penetrate it. Furthermore, there were several long-range red candles during the decline.

So, the time to take a stance (for the bulls, that is) is "now". For this, they need to:

Stop declining any further next week.

Push the index above 24,750 levels where the MA bands are and get past 50% of last long body red candle.

Reclaim the territory above 24,850 i.e. above the next higher Gann angle.

Produce some touch of green in the momentum indicator in Chart 1, i.e. show some modicum of sustained bullish up cycle.

Get some leadership going among stocks and sectors – which will indicate that all the Kings' men are able to put Humpty Dumpty together again.

If all of these things happen, then, and then alone, the bears can be stopped from mauling the long-held support at 24,400 area.

But as ever, we also need to be prepared for the opposite. Well, that is relatively easy, one-step process only – just continue lower than last week levels with similar kind of wide breadth. That would be enough.

I think sentiment-wise, people are not still prepared for that to happen. So, chances of that are not ruled out. Market trend, sometimes, runs till it inflicts maximum pain on maximum number of people. So, if you haven't yet pulled the plug on your stoploss button, last week ‘s low would be a good point to set it.

Where to, if the fall continues? Next two numbers that show up on the Gann cycles are 24,300 and 24,000 areas. This is if 24,600 is decisively lost. So, check for that first. If the low of the recent range breaks, it is not the index level that you really want to worry about. We have bigger things to worry about.

Momentum is an important concept in technical analysis and its presence or absence tells us a lot of things. The RSI is one of the widest used momentum indicators across the world. Andrew Cardwell came through with improvements on the reading of the RSI, observing that if rallies (especially those that make it near to previous highs) are unable to move past the 60 levels on the RSI scale, then the instrument is in a bear or consolidation phase.

Applying this analysis to our market indices—and I have checked every variety of the Nifty indices—the bad news is that, with very few exceptions, the recent rally stalled at the 60 level. The number of charts confirming this is too large to feature here.

What this means is that the recent rally higher (or even the earlier one too) lacked bullish momentum to sustain and convert into a full-fledged uptrend. This is important in the light of a whole bunch of us waiting with bated breadth for an upside move to occur.

I have used the calculation on the weekly time frame for all indices and the only sectors or thematic or industry indices to escape this fate are Auto, Consumption, Metal, MNC, PSU Banks and some obscure ones like EV, Rural and Transport & Logistics. On the daily chart calculations, the data situation is even worse.

This reiterates that the entire market is still caught in the grip of ranging to declines and, therefore, we should not allow our micro focus on the Nifty and its levels cloud our judgement on what is happening on a broader front.

So, it is not just Trump and his latest salvos or any other stuff that is the major problem. There is a malady that has attached itself to the trends of the market for now and refusing to go away and, therefore, trying to find seeds or saplings or indeed even growing bushels of upward price action is to be avoided.

While it is nice to call for a turn that will take you to new highs and all that, and that often spreads the good cheer and all that, one has to be realistic too. Right now, this is a market that is very much caught in range with continued downside bias.

The only way to play it is to treat all rallies as just that, rallies. Don't go building large castles out of price moves, order flows (read Defence sector), full page ads (Read Real Estate), GST beneficiaries (many) etc. etc. Trade them. If you see some 15-30% gain in the short term, take your money off the table. Sure, you will miss some humdingers or the other. But hey, there is always some price to pay, right?

I know that may sound disappointing. However, this doesn't necessarily mean the market is going to crash significantly. We may continue in this ranging market, creating new boundaries, and rapidly moving between price levels, occasionally attempting a breakout or breakdown, some of which may even succeed. But the overall market trend needs to change for us to become long-term investors once again. Until then, trade it, momentum invest, short it, range trade it, etc. That's about all there is for the present. But don't long-term invest in it. Not unless you have significant financial reserves!"

Disclaimer: The views and opinions expressed by experts and investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.