Sign up for NDTV Profit's 'In This Economy...' newsletter and our other daily and weekly newsletters here.

Happy Tuesday! Welcome back to the third instalment of In This Economy…

At NDTV Profit we are gearing up for a day of insights, conversations and exciting discussions. The inaugural NDTV Profit Conclave 2025 will be held in Mumbai today. Some of our most exciting guests include Union Commerce Minister Piyush Goyal, State Bank of India Chairman CS Setty, Morgan Stanley's Ridham Desai, NSE's Ashishkumar Chauhan, Dinesh Thakkar of Angel One, Microsoft's Puneet Chandok, Ronnie Screwvala, among other dignitaries.

These guests will talk to NDTV Profit's editorial team to discuss India's dream of becoming a developed nation by 2047. Where do we stand? Where do we need to get? What can get us there? All of these questions and more will be answered. Do make sure to tune into NDTV Profit on your television screens and the channel's YouTube page to get timely updates.

Now, on to our newsletter for the week!

The Big Idea

Trump's Tariff Temper Tantrums

Last week, US President Donald Trump announced reciprocal tariffs against India, and other countries trading with the US. On top of this, Trump's announcement included a bombshell. The reciprocal tariffs would not just take into account the actual tariffs levied by other economies, but also non-tariff barriers they employ to strengthen their own trade. These barriers include things like export subsidies, lack of intellectual property protections, anti-dumping measures, among other things.

The timing of the announcement was also curious, as Prime Minister Narendra Modi was officially visiting the US then.

An assessment by Nomura analysts suggests that India and China employ the highest number of non-tariff barriers. As analysts tried to figure the economic impact of the reciprocal tariff announcement, they expressed that it is very challenging to ascertain how non-tariff barriers will impact the game.

As the news starting spreading, the already battered Indian stocks took a turn for the worse. On Friday, Nifty 50 and Sensex lost about 2.5%, their worst in the year so far. Analysts estimate that apart from agricultural exports from India to the US, sectors such as textiles, chemicals and footwear will be hurt the most owing to the reciprocal tariffs.

To be sure, India is currently reviewing and changing tariff structures. In her budget speech on Feb. 1, Union Finance Minister Nirmala Sitharaman announced customs duty cuts on certain specific products.

"We are building to be an investor friendly country and as a result, the duty cuts and rationalisation we have announced… continuing process, and we will keep doing that,” Sitharaman said on Monday.

For now, bilateral conversations between India and the US have started and hopefully will conclude before the reciprocal tariffs become effective in April.

Can Trump's tariff temper tantrum prevail over India's diplomatic efforts? Guess we will find out in April.

Feature Five

1. Charu Singh writes here about how SEBI plans to verify return claims by algo providers.

2. Agnidev Bhattacharya has this story about the sea of allegations at industry body Assocham, and how that ties to a flat in South Delhi.

3. RBI put another cooperative bank from Mumbai into moratorium this past week and it reminded some of the rush at Punjab & Maharashtra Cooperative Bank over five years ago.

4. The first edition of this newsletter highlighted the story of LS Industries and its mystically high market valuation. It seems SEBI took note of it.

5. Abakkus Asset Manager's Sunil Singhania told NDTV Profit's Niraj Shah that in the current equity market, the best strategy is to stay put.

Chart Of The Day

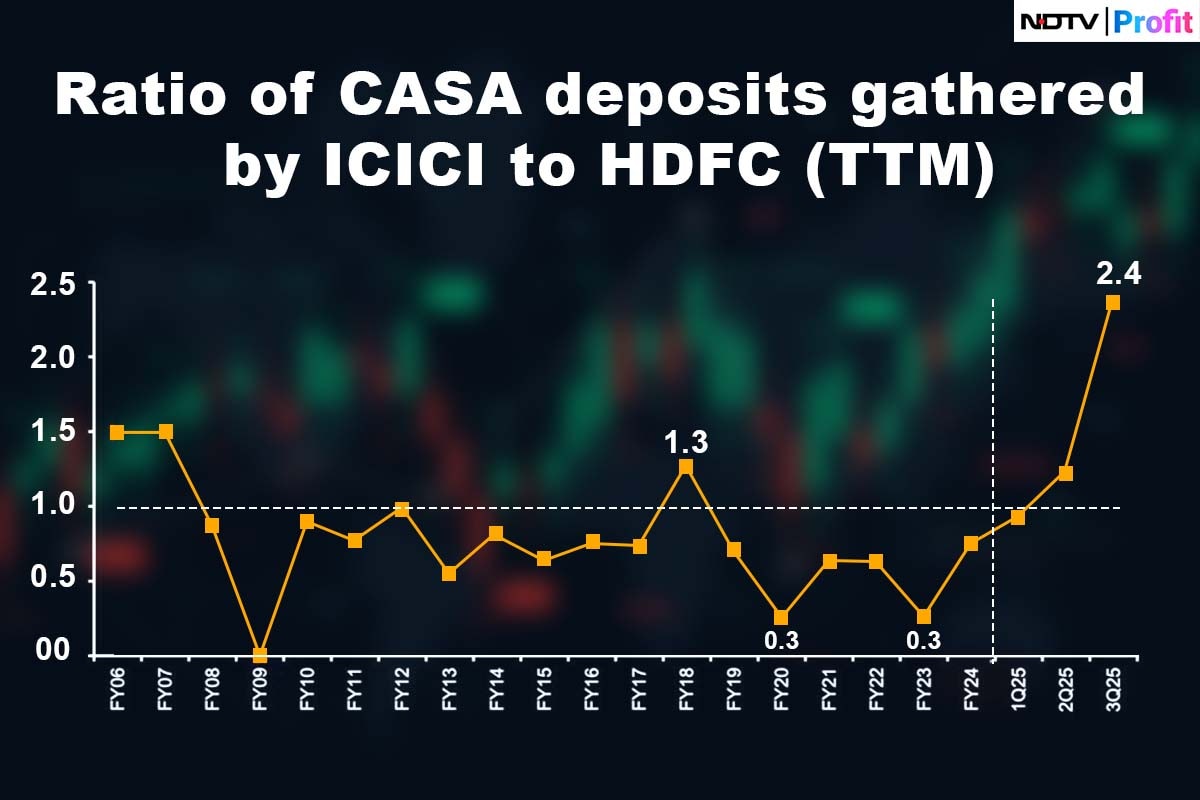

In this chart, Bernstein's Pranav Gundlapalle notes that ICICI Bank is quickly emerging as a well-oiled CASA machine. The chart shows how ICICI Bank has been able to garner 2.4 times more CASA deposits than HDFC Bank between December 2023 and 2024.

Caught My Eye

There are return-to-office mandates and then there are Return-To-Office mandates. And once the second one is passed, you don't go about trying to oppose it. JPMorgan's Nicolas Welch found this out the hard way, according to a report by Fortune. At a recent town hall, Welch told JP Morgan CEO Jamie Dimon that a work from office mandate was not relevant for someone like him, whose entire team works across time zones. Dimon was quick to dismiss any opposition to his mandate. But what was surprising was that Welch was called in by his superiors and let go of. Even more surprising? By the same evening he was given his job back. Read the absolutely bizarre story here.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.