Some of the best ideas for investing often come during conversations over chai at a tapri (tea at a roadside stall). About fifteen months ago, a successful fund manager and I were chatting about stocks in the brokerage space, and from the way he put it, they seemed like great investment ideas.

Run the clock fifteen months forward, and these stocks have been some of the best wealth creators. The question many have is – is it too late to catch the trend? I don't have answers to that, but a cursory look at these companies' businesses reveals trends that are not only interesting but have remained steady.

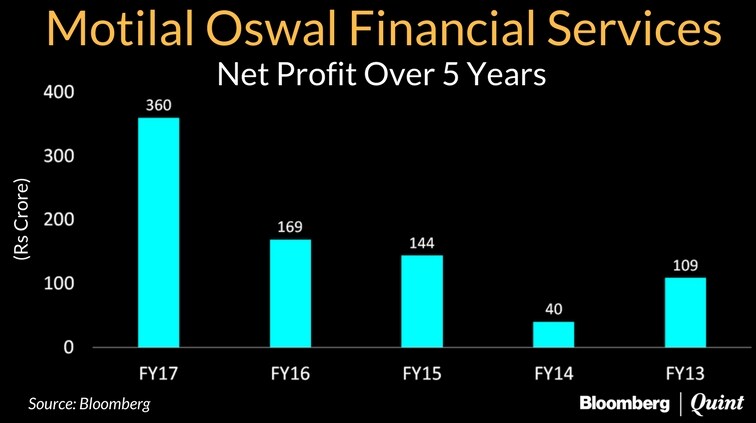

Let's take Motilal Oswal Financial Services Ltd. for starters. Broking and distribution revenues may be thinner contributors in the future, but the company has put in place a base for steady, long-term revenue growth in the asset management business as well as the home finance business. The company overall has clocked in a 35 percent compounded growth in earnings over the last four years, and analysts don't see dramatic risks to these numbers.

Another known story is IIFL Holdings Ltd.'s performance over the last three years. The company now has just a small fraction of its revenue coming from the broking business. The big kicker for IIFL comes from its wealth management subsidiary, where assets under management (AUM) have been growing at a rapid pace. If I recall correctly, the AUM grew to Rs 1.25 lakh crore by April 2017, nearly doubling from Rs 65,000 crore three years ago. The Street sees these as enormous earnings kickers which are likely to stay, as a greater share of household savings move into financial products.

Edelweiss Financial Services Ltd. is not far behind. The company has moved toward a diversified credit book and has one of the largest asset reconstruction businesses in India. A potential transition into the banking space could be a future trigger.

The list goes on, as some of the other names have their own strengths. JM Financial Ltd. has a robust investment banking business, and Centrum Capital Ltd. has recently seen capital infusion from promoters.

However, it may be useful to study the price run-up and get a sense of the valuations. Both IIFL and Edelweiss trade at about 22-24 times Bloomberg estimate earnings per share (EPS) for the financial year 2017-18 (FY18e) and about 2.8-3 times FY18e price-to-adjusted book value (P/ABV). The outlier here is Motilal Oswal which trades at over 30 times FY18E EPS and over 5 times FY18E P/ABV – valuations that aren't seen as cheap.

Hence, the assessment that I hear in conversations with most experts is to be very picky. These experts believe the earnings growth justifies the rise, and that the nature of the AUM for a lot of these players suggests that there is unlikely to be a dramatic drop in earnings growth anytime soon. However, in card game parlance, don't play blind here. See your cards carefully and then place your bets.

Niraj Shah is Markets Editor at BloombergQuint.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.