Brexit Deal Gives Absolutely Nothing to the City of London

If draft deal terms fail to survive divisions within U.K.’s government, parliament, the picture for London will be even grimmer.

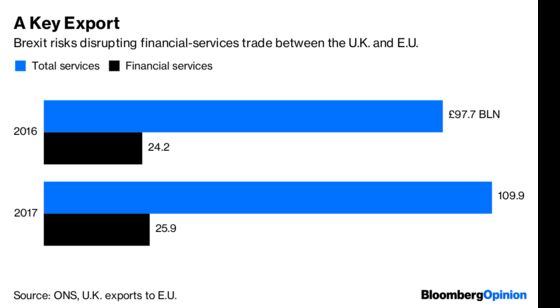

(Bloomberg Opinion) -- Whichever way you slice it, the draft Brexit deal unveiled by British Prime Minister Theresa May is no big win for financial services, despite being lauded as such in some quarters.

If she gets it past parliament, still a huge if, the accompanying transition period – which may well be extended – will give banks and other finance firms more time to shift jobs and assets to the continent. If not, we’re looking again at a no-deal Brexit that’s viewed universally as a probable catastrophe. It could have been worse, but not many bankers will be celebrating today.

The document setting out the terms of departure from the European Union and a broad outline of future trading arrangements – which will take many more months to be finalized – tries to put a positive gloss on post-Brexit EU market access for the City of London. It proposes access under the so-called “equivalence” regime, a system that lets firms from non-EU countries deemed to have similar financial regulations do business with the bloc.

While the three paragraphs of text on services are optimistic, they can’t be dressed up as a victory for London. The big problem with equivalence (known about for years) is that it’s entirely inferior to the U.K.’s current privileges as an EU member, which let British firms trade freely across the bloc. And neither will it deliver the regulatory “Singapore-on-Thames” freedoms dreamed of by the finance world’s Brexiters.

It’s available only for some parts of the finance industry such as securities trading, but not for wholesale and retail banking. Retail investment funds, payments and insurance brokers are excluded too. It is patchy, subject to change, and can be taken away by Brussels. Reports in the U.K. press indicate that Brussels has agreed to give several months’ notice rather than one before any withdrawal of equivalence, but this won’t make British finance bosses feel much more secure.

Indeed, there’s nothing here to deter banks and other diversified finance firms from setting up shop across the Channel, something they’re doing already. If you’re a big bank, your business will include stuff where equivalence applies and stuff where it doesn’t. Hardly straightforward. Perhaps pure-play brokers, or some markets infrastructure businesses, will find equivalence sufficient. But even then it will still require jumping through hoops, registering with EU regulators and time to implement.

In fairness, equivalence is certainly helpful for London’s critical role in the $400 trillion derivatives industry, as is the document's commitment to preserving financial stability and market integrity. But it doesn’t settle the burning question of how derivatives clearing will be regulated after Brexit, or whether the EU succeeds in grabbing control of global oversight of the industry – even if that risks provoking the ire of the U.S.

Probably the best thing to say for the deal is that the transition period allows firms more time to manage the expensive process of moving staff and assets abroad. It would be helpful, too, if the next wave of negotiations removed some of the conflict from financial-services regulation, and the sense that cities like Paris are using talks as a means to weaken the City. Binding London closer to Europe’s rules via equivalence is in Brussels’ interests, so it can afford a few modest concessions.

Still, no amount of smooth talking will bring back the financial passport for British firms, nor deliver what the pro-Brexit crowd thought London would gain from quitting the EU: Greater market share, preserved access to EU markets and more lucrative business with other hubs around the world. If these draft deal terms fail to survive divisions within the U.K.’s government and parliament, the picture for the City will be even grimmer.

To contact the editor responsible for this story: James Boxell at jboxell@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Lionel Laurent is a Bloomberg Opinion columnist covering finance and markets. He previously worked at Reuters and Forbes.

©2018 Bloomberg L.P.