The Big 2020 Yield-Curve Steepening Bet Stumbles Out of the Gate

It’s been a rough start to the year for the bearish bond trader.

(Bloomberg) -- It’s been a rough start to the year for the bearish bond trader, as an abrupt escalation in U.S.-Iran tensions has sent investors retreating to the safety of Treasuries.

Benchmark yields tumbled Friday, driving the curve flatter, as the market digested the potential ramifications of a U.S. airstrike that killed one of Iran’s top generals. Iran’s vow of retaliation, coming on top of North Korea’s Jan. 1 threat of “shocking” action to avenge American sanctions, puts geopolitical angst front and center even before many investors have returned from the New Year holidays. And those anticipating cheerier news on the economic front faced disappointment from the worst U.S. factories data since 2009.

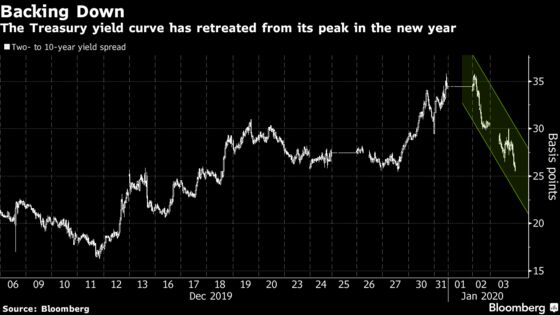

The defensive turn is a blow to one of the past year’s most tantalizing trades -- the curve steepener. Over the past month the move toward a wider curve looked in full swing as the U.S. 10-year yield rose to its highest point above the two-year in more than a year. Fans of the steepener have seized on improved global manufacturing data, headway on a U.S.-China trade deal and fledgling inflation pressures as the makings of a sustainable trend. That yield gap traded Friday around 26 basis points, a far cry from its inversion back in August, when recession fears gripped the market, but about 10 basis points flatter than its peak at year-end.

Friday’s manufacturing figure “was just flat out not a good number,” said Jim Bianco, president and founder of Bianco Research LLC. The curve can get “close to being inverted, and that’s predicated on two things: One is that I don’t think the data’s going to come through; and two, the trend in interest rates is lower.”

His call is for the curve to flatten back toward zero in the first half of this year, with the 10-year approaching its 2019 low around 1.43%, compared with about 1.8% now. That may well beckon a Federal Reserve rate cut in the first half of the year, in his view. Options positions betting on that sort of scenario have been popping up this week.

Developments related to Iran will probably keep markets on edge heading into the coming week. The U.S. is sending more troops to the region in the wake of the airstrike. But investors may also be distracted by what central bankers say this weekend at an American Economic Association conference in San Diego, which will include panels featuring former Fed Chair Janet Yellen and current New York Fed President John Williams, among a host of global financial officials. They may add a geopolitical angle to the risks noted in the Fed’s minutes from its December meeting -- released Friday -- which focused on uncertainty over international trade and weakness in economic growth abroad.

The best opportunity for yields to resume their climb may come early next week, should the latest reports on the U.S. services sector show continued expansion. The market may not have much to glean from Friday’s payrolls report -- which is expected to show a gain of around 160,000 jobs -- after last month’s surprisingly large increase only produced a modest sell-off.

What to Watch

- Traders will be on high alert for any Iranian response to the U.S. airstrike. But as far as domestic releases, the monthly jobs report and services-sector gauges are among the highlights of the coming week

- The 2020 data schedule gets in gear:

- Jan. 6: Markit services and composite PMIs

- Jan. 7: Trade balance; ISM non-manufacturing index; factory, durable goods and capital goods orders

- Jan. 8: MBA mortgage applications; ADP employment; consumer credit

- Jan. 9: Initial/continuing jobless claims; Bloomberg consumer comfort

- Jan. 10: Payrolls, unemployment and average hourly earnings; wholesale trade sales and inventories

- Much of next week’s Fedspeak is crammed into Thursday:

- Jan. 8: Governor Lael Brainard in Washington

- Jan. 9: Vice Chairman Richard Clarida speaks in New York; New York Fed’s John Williams at the Bank of England, Chicago Fed’s Charles Evans discusses the economic outlook in Milwaukee; St. Louis Fed’s James Bullard in Madison, Wisconsin

- It’s a full auction slate:

- Jan. 6: $42 billion of 13-week bills; $36 billion of 26-week bills

- Jan. 7: $38 billion of 3-year notes

- Jan. 8: $24 billion of 10-year notes

- Jan. 9: 4- and 8-week bills; $16 billion of 30-year bonds

To contact the reporter on this story: Emily Barrett in New York at ebarrett25@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Mark Tannenbaum, Nick Baker

©2020 Bloomberg L.P.