The number of women who have systematic-investment-plan accounts have surged nearly fourfold in the last four years, with the growth driven by such investors in smaller cities.

Women investors' SIP accounts have grown 269.8% from 71.1 lakh in December 2020 to 2.63 crore in December 2024, according to a report by the Association of Mutual Funds in India and credit ratings agency Crisil.

The growth rate in the SIPs has been higher in beyond the top 30 cities with a 331% increase for the period ended December 2024. The top 30 cities saw a 226.1% jump during the same period, the report stated.

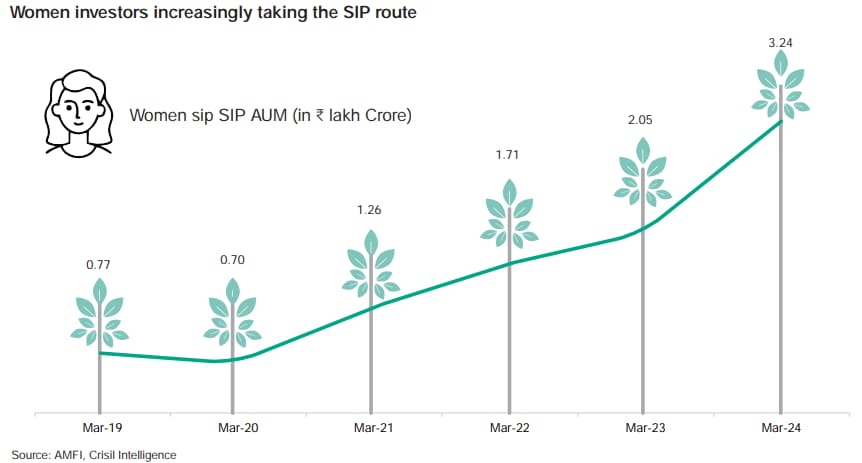

The assets under management of women SIPs grew about 250% from Rs 1.2 lakh crore in December 2020 to Rs 4.3 lakh crore in December 2024, with the growth rate in top and smaller cities being in line with the overall trend, according to findings.

Women's SIP AUM accounted for over 30.5% of the total in March 2024. It grew 319.3% between March 2019 and March 2024, which shows that women are increasingly adopting SIPs as a disciplined investment approach.

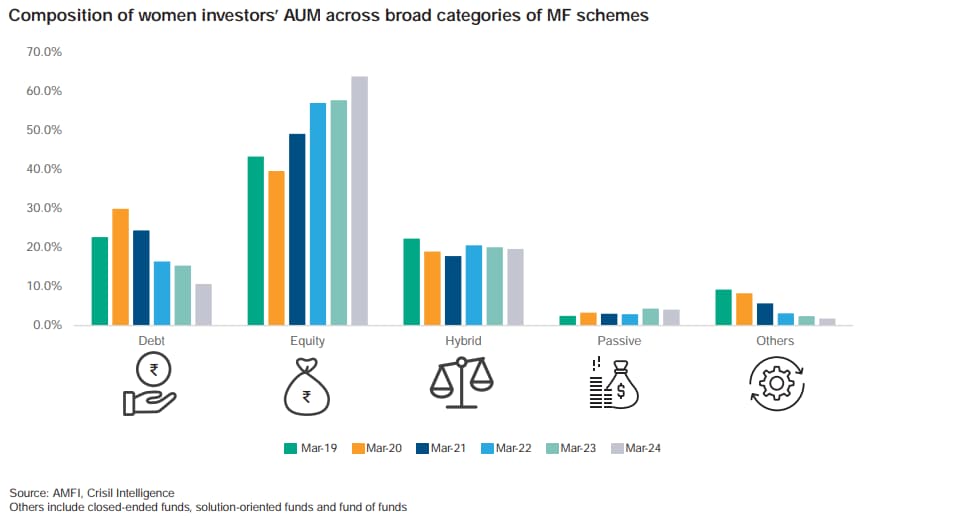

The allocation of women investors' AUM across various categories has undergone a significant shift over the past five years. The share of equity AUM in women's overall AUM increased substantially from 43.3% in March 2019 to 63.7% in March 2024, indicating a growing affinity among women investors for equity as an investment avenue, according to the report.

Women participation in debt funds declined consistently from 22.6% of women's total AUM in March 2019 to 10.7% in March 2024. This trend was seen across all age groups of women.

The allocation to hybrid categories has remained relatively stable around the 20% mark over the years. The allocation to hybrid investments increases with age — from 13.7% for the below 25 age group to 26.6% for the above 58 age group — which shows that older women investors seek more balanced or diversified investment options.

Women's allocation to passive investment strategies surged from 2.5% in March 2019 to 4.1% in March 2024. Further, passive gold schemes, which includes gold ETFs, made up 5.2% of women investors' AUM in March 2019 and increased to 24.9% in March 2024, indicating a strengthening commitment to passive investing and preference for the electronic modes of investing in gold. The allocation to passive MF schemes is relatively stable across all age groups, between 4% and 5% of the total AUM of each age category of women.

Over the past five years, women investors are showing a preference for long-term holdings. The AUM of women investors, with a holding period of over five years, has increased from 8.8% of the total women investors' AUM in March 2019 to 21.3% in March 2024, which shows that women are becoming increasingly patient and committed to long-term wealth creation, according to the report.

State-Wise Participation

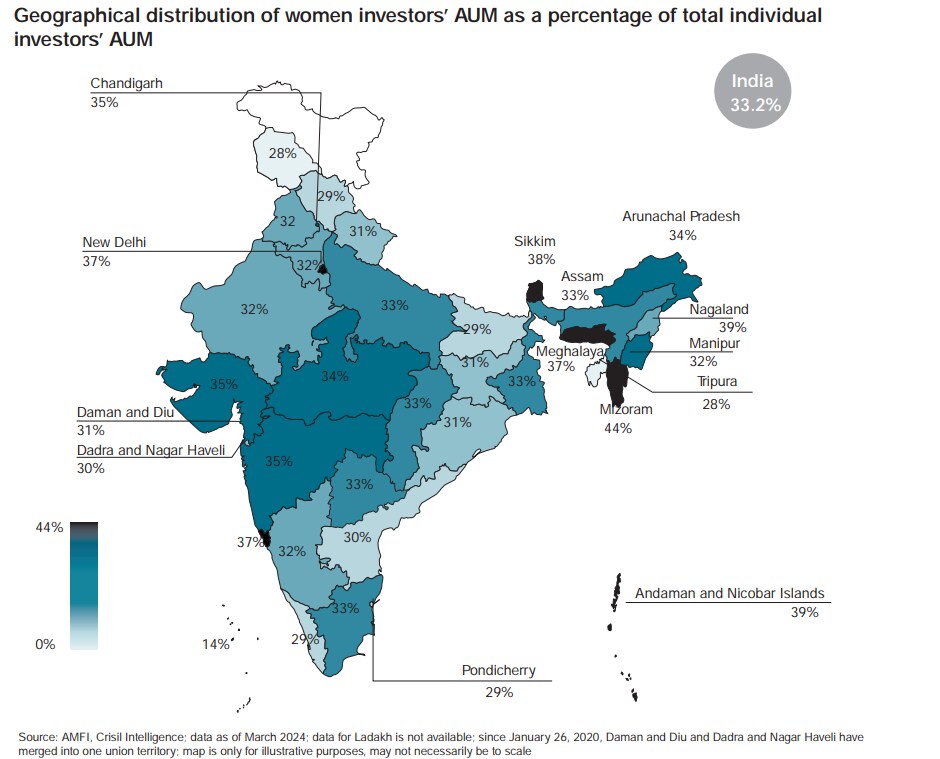

The national participation rate of women in mutual funds is 25.1% in terms of unique investors and 33.2% in terms of women investors' AUM as a percentage of individual investors' AUM. The participation rate based on the AUM is higher than the unique investor-based participation rate, indicating that women investors tend to invest larger amounts than men.

Thirteen states and union territories have exceeded the national average in the AUM contribution — these are Mizoram (44.1%), Nagaland (39.1%), Andaman & Nicobar Islands (38.6%), Sikkim (37.9%), Goa (37.2%), New Delhi (36.8%), Meghalaya (36.5%), Maharashtra (35.4%), Gujarat (34.7%), Chandigarh (34.7%), Madhya Pradesh (33.8%), Arunachal Pradesh (33.7%) and West Bengal (33.3%).

Women's participation rates in these geographies range from 33.3% to 44.1%. Several northeastern states are on this list due to the region's matrilineal societies and strong women-centric cultural norms. This empowers women to take active roles in financial decision-making, thereby increasing their share in retail AUM.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.