As a bountiful Samvat 2077 draws to a close, a key advice is to stay invested and take advantage of the inevitable corrections that the markets will face.

“Equities are for optimists. If one stays invested and believes in human ingenuity, markets will deliver,” Aashish Somaiyaa, chief executive officer at White Oak Capital Management, said on the special Diwali edition of BloombergQuint's The Mutual Fund Show. “One has to stay invested, but be judicious and see where growth is coming in. Last few days have been a sea of red, but corrections are inevitable. One will be tempted to bail out many times in the next Samvat but one should stick by for returns.”

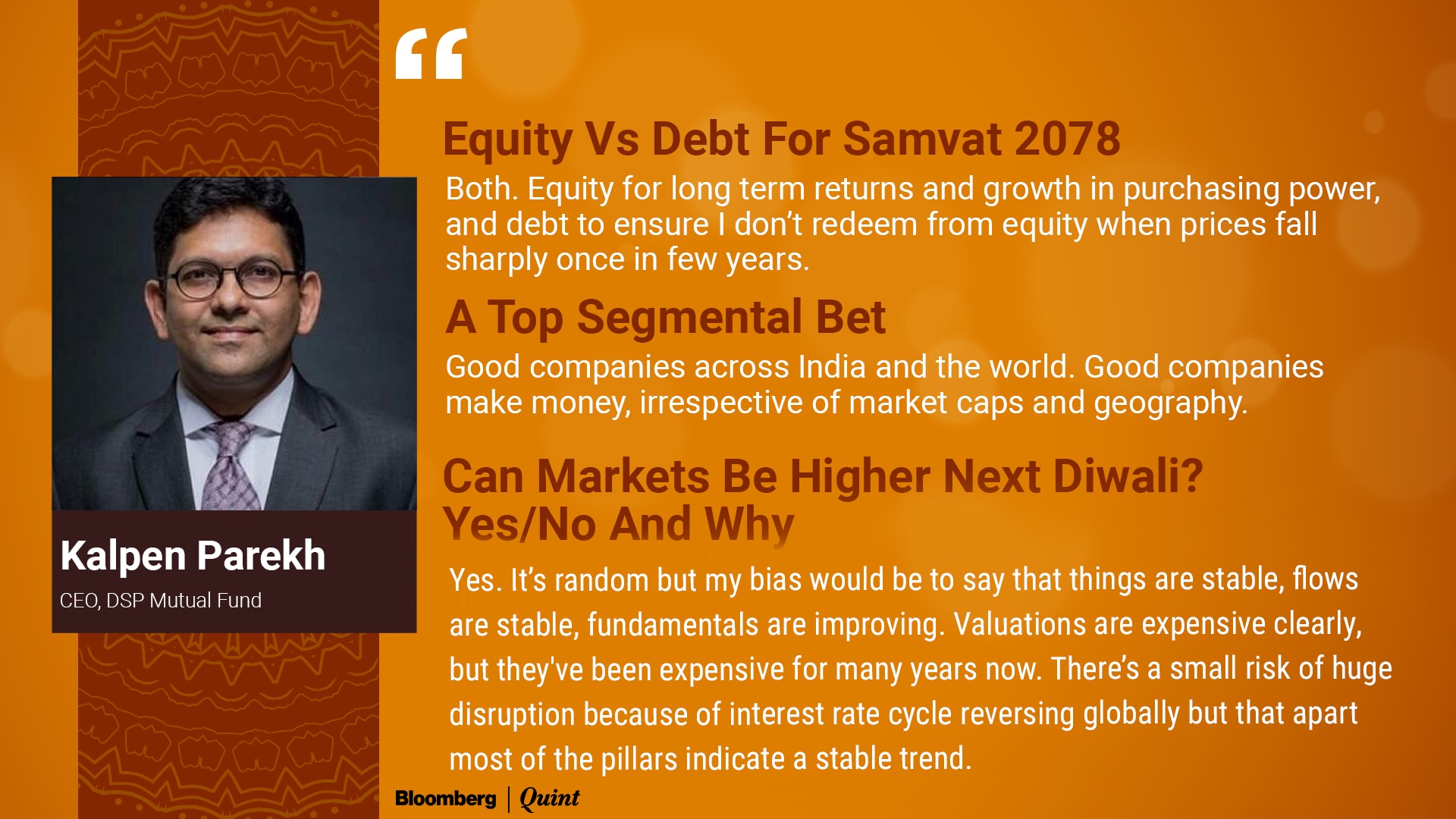

Kalpen Parekh, CEO at DSP Mutual Fund, agreed. “Markets fluctuate. One must take advantage of them, instead of getting penalised by them. If we know the drivers and turning points, we can take advantage of them,” he said on the same show.

“Investing in markets is not a game of T20 cricket, but rather a Test match. It's very important to survive. And in investing, what helps is diversification across asset classes. That's been the big learning,” he said. “Stay away from watching prices every day.”

The Biggest Surprise

For Parekh, the biggest surprise in Samvat 2077 was the “massive resilience” that corporate India displayed. “The way we saw companies realigning business models, cutting expenses and doing whatever it takes to continue to grow, was great. Investors at large didn't lose their goal and kept faith in their asset classes.”

According to Somaiyaa, it was the boom in retail participation.

“Ironically, those who haven't ever been in the markets did well compared to those who have been here for two-three cycles or even decades," he said. "For them, some of the past bad experiences were of long-drawn bear cycles. If you're really informed or coloured by some of your past experiences, I think that worked out to being a bit of a disadvantage.”

Besides, acceleration in digital adoption with respect to capital markets and otherwise was significant, Somaiyaa said. “A lot of these things have changed forever. We aren't going back to pre-Covid versions of them. They also got accelerated due to the pandemic.”

Watch The Diwali Special Mutual Fund Show here:

Here are the edited excerpts from the interview:

Aashish, the most important learning for you from the Samvat gone by, and why?

AASHISH SOMAIYAA: I think that the last one year in fact I read it somewhere that equities are for optimists. I think that was one of the biggest things which one realised because 2020 usually in fact I wrote it somewhere, that generally speaking when you talk to analysts or portfolio managers they tell you that there is a bear case, there is a bull case and there is the base case, but somewhere in 2020 it was only that ‘the world will come to an end' case or ‘the world will not come to an end' case. So, at one point in time the market started believing that human beings are the next dinosaurs. So, I think if you really think that the world is going to come to an end, and then I don't think this is the right place for you. I think equities are for optimists that is what is the key learning that if you stay invested, and if you believe in human ingenuity, I think eventually you will come through.

Kalpen, what was your most important learning?

KALPEN PAREKH: I will make a statement which we actually use very extensively in all our marketing campaigns and we had come up with very large voting campaigns also. My learning for the last year was markets fluctuate and as investors, we should take advantage of them rather than getting penalised by these fluctuations. So, ups and downs are a part of the game, they are the rules of the game and if we know them well, if we know what the drivers and turning points are we can take appropriate advantage of these fluctuations.

Kalpen, in the Samvat gone by, what was the thing that surprised you the most?

KALPEN PAREKH: think it was not so very easy to remain optimistic in March and April last year, looking at how the health crisis was unfolding and mapping into an economic crisis, and what really positively surprised me was the massive resilience of good companies and corporate India because ultimately that matters to us when we are putting our money to work. The way we saw over the course of the year companies responded with a smart realignment of business models, bringing down expenses and doing whatever it takes to continue to grow and find solutions to do that. It was something which was an extremely positive surprise. With our own business, we had made a certain budget estimate in the June board meeting and by the time we hit December, the numbers are very different and much higher than the estimates. So, I think the world is coming back and more importantly companies are responding to that very positively was a strong surprise. The second thing was, it was very encouraging that investors at large did not lose their cool. So we all were nervous, unanimously investors around the country were nervous about likely to happen, what will happen, a personal cash flow issues, market volatility, yet I think a large part of investors kept faith in the asset class, and continued to invest. Some of them who were smarter enough added more taking advantage of this fluctuations, but net-net we saw the continuity in investment plans, a continuity in SIPs, we saw more money coming in disciplined products like asset allocation and I think to me that was a very strong reinforcement that a lot of our investors are maturing and taking advantage of these fluctuations to fulfil their long-term goals.

Aashish, I believe you thought as well that the retail participants surprise you the most?

AASHISH SOMAIYAA: Frankly, it is quite ironic but I observed that people who have been in the market for two, three cycles, and maybe two, three decades even, I think for them you know some of the past bad experiences have long-drawn bear cycles, I think, if you're really informed or coloured by some of your past experiences, I think that worked out to being a bit of a disadvantage. Whereas for a lot of the people for whom it was uncharted territory, I think they kind of did it slightly better. So that was one of the key things. The second thing is that clearly, everything we keep looking at, we think what was pre-Covid and what is post-Covid. We start thinking that these are cycles and in many aspects we will go back to pre-Covid etc. but I think with digital adaption and as digital adaption it applies to capital markets, capital market adaption in general, I think a lot of these things have changed forever. I don't think we are going to go back to a pre-Covid kind of a scenario when it comes to these things. It was a long trend, it got significantly accelerated. If we look around ourselves even my mom is 70 but I think she's got to ordering these food deliveries and the books and stuff. We see youngsters all of them adapting to capital markets because of digital interfaces. I think some of these things have changed, it is now forever it's a significant change. I don't think we are going back on this.

Aashish, what is the biggest do and don't for the upcoming Samvat?

AASHISH SOMAIYAA: Easy returns are out of the way, very clearly. In the hindsight now we know that we got a vaccine in six months as opposed to the thinking that vaccines take 5 to 10 years, and we have vaccinated 1 crore people. Thankfully, and as of yet no sign of a real third wave in India, I hope I haven't spoken too soon but what I would say is that the easy money is out of the way, very clearly. We are not in any undervalued or kind of screaming by a kind of scenario. Now it's more about being judicious and seeing where the growth is coming in and how companies and businesses are doing from here on. But that said, I think one has to stay invested, because recently somebody put out very interesting data that even if you think that economically and cyclically you are up for a good phase, still the best of market conditions have multiple corrections. Like you know the point in time when we are talking about this, the last few days have been a sea of red as far as small and mid-caps are concerned. I think these are things which will happen even amidst a bull market, there'll be many temptations to bail out in the next year or so, but I would still say that people who stay invested, are likely to fare much better than people who have this urge to react to every market development.

Kalpen, the biggest do and don't?

KALPEN PAREKH: My big learning, always, and more so got reinforced in 2020 is that investing is not 20-20, investing is a test match. So, it's very important to survive. It's very important to last long and what really helps survival is diversification across asset classes, asset classes which don't move together in the same direction, every time. So, diversification across asset classes is a very important learning that I would keep for life, and I will give you a live example. On March 23, last year when stocks were tanking and were down 40% from their peak, knowing that you have 20, 30-40% in fixed income, gives you the comfort to say that even if this correction were to last for longer, I don't have to dip into this asset pool because I have my fixed income goals which will live through the next two or three years. So even if there is a long run bear market, there is a fixed income component to take care of that. So, to me, asset allocation and diversification is a very strong do. From a don't perspective, again, I would say that the more we get digital, the more we are used to constantly touching our gadgets and looking at our portfolio values. The quality of UI, UX provokes us to sometimes press buttons very quickly, move money, switch money, redeem money and stuff like that. I think staying away, having done your investments, knowing that this is a long-term investment journey, stay away from watching asset classes every day. Stay away from watching prices every day. I myself do it very often and try to curb that instinct. I end up sleeping looking at markets outside India, wake up and after some time start looking at Nifty, but at times you realise how does it matter? 20 years from now it wouldn't matter, that what the price in 2021 was. So, stay away from frequency of activity and just bring stillness to your portfolios, it will help a long way in earning superior risk-adjusted returns.

Diversify across asset classes Kalpen, it has also got relevance from an international perspective as well. You look at international markets a lot. You believe people should do that as well increasingly?

KALPEN PAREKH: Absolutely. My take on this is, there are enough companies in the world who are similar or better than Indian companies, in terms of quality, in terms of scale, in terms of the profit pools that they cater to and in terms of the innovation. Finally from an operating matrix, if you sort companies around the world based on ROE and ROCE, earnings growth or valuations, there are easily 50 to 100 companies available outside as well. So, what happens is many times, in short cycles, India will do well and these global companies will not do well, or vice versa. So, this moderately low correlation also helps in better stability of NAV. So if you noticed, last full year, international stocks did relatively better than India and emerging markets. This year so far, I was just seeing since the time we launched the fund which had an international slice, since then, the international slice has underperformed India by 24%. So, India has done well but will I be able to predict, every year, which is going to do well or vice versa? No. So, having a nice blend is very important and I strongly believe that when you map profit pools, there are very large profit pools outside. Today every conversation we do are on products sold by global companies, so why not benefit from our own expenses? We are spending money on a lot of these global products. So how do we convert our expenses which are their profits back into our investment returns? I think global diversification definitely makes sense, at the right time, not because the last 10 years global stocks have done well or U.S. stocks have done well but by very thoughtfully putting a portfolio together. It's very easy to just say internationally diversify but where and which components to what vehicles becomes very important. I have noticed last year, a huge trend towards purchasing past returns of international funds but that can be harmful again. It has to be very thoughtfully done but clearly global diversification is very important, I personally have around 30% of my portfolio in international funds. So that's something where I'm saying what I actually believe in.

Aashish, would you believe in an ideal percentage for international funds?

AASHISH SOMAIYAA: I actually agree with what Kalpen said, more like 20-30% is a pretty good number to have. I can provide a testimonial for what Kalpen mentioned because I keep exchanging notes with him quite frequently. A year back, he told me that you should invest outside the country with stuff like say energy stocks or metals and DSP of course has some of the best products in that space, like the World Gold Fund or the Energy Fund etc. So, he in fact did tell me that this is what he's thinking about and this is what should be there in people's portfolios and everybody knows that, that has what has worked out very well. So I think clearly I think Charlie Munger, actually, maybe it's attributed to him, but he said that, if you tell me where I'm going to die, I will never go there. So, that basically talks about human beings' inability to predict which means there's no such thing as just in time investing or there's no such thing as right place, right time. You have to be in every place all the time, I think that's the only choice.

Aashish, in a period over the next 12 months, do you think that compared to normal returns that each of the asset classes individually give, can equity give better returns than its standard returns that it does or do you think debt can give better returns than the standard returns that it does?

AASHISH SOMAIYAA: I would say that I expect equity to outperform, I think you already put in all the disclaimers there on our behalf, so I won't bore you with that but I would still stick my neck out and I expect equity to do better purely because of whatever I believe about the economic cycle. The most important thing, what we should keep in mind is that pre-Covid, the global economic cycle, versus India's economic cycle was asynchronous. So pre-Covid, the West was booming, the world economic growth was 3.5-4%, U.S. was 3.5% and we were at 4%. So that created a situation where we had no elbow room to prime our economy. If you remember in 2019, we had 4% GDP growth and 3.5% deficit and we were talking about cutting the deficit, which means growth should have gone even further lower and eventually deficit would have gone up even further. After Covid, if you see 2021, we said deficit is going to be 7.5%. Forget so we're in downgrade people are giving us more money and the rupee is stable. So what has changed between 2019 and 2021? The only thing which has changed is that global economic cycles have been forced into synchronicity. That's why the world is giving us enough elbow room to prime ourselves. So, to cut a long story short, I would still weigh in favour of equity. Of course, you cannot wish away fixed income in your portfolio but even within fixed income, given the view on the economic cycle, you see for example what is happening there are alternatives to fixed income. Like there is commercial real estate, there are real estate investment trusts. These are trading at great yields. So, not saying you should not do fixed income but even in fixed income, you can express yourself differently.

Kalpen, what about you, equity versus debt?

KALPEN PAREKH: If you force me to choose any one asset class, I would equity because knowing my past statistical track records, around 60% of times, equity annually has earned better than fixed income at large. So, the odds are 60-40, and the only disclaimer I'll add is, generally after a very high cycle, a very fast move upwards, there is a phase of consolidation and I'm not trying to map it to history but if you look at 2010 to 2013, we had periods of the four years of consolidation, but this time the economic cycle like Aashish mentioned is extremely strong. So, keeping that in mind I would say equity should do better than fixed income. If your question is, equity give more than the normal returns? Here I would say probably not, again getting into the zone of astrology which I'm not good at, but what are normal returns generally? When we do data crunching from all sides, long-term returns converge closer to our average return on equities, and on average return on equity varies from 10% to 20%. In a downcycle, we are at 10, in an upcycle we are at 20. We are somewhere at 14-15% right now, but the market knows it, you and I know it, everyone knows it, so it is also in the price. So, now a lot of good news a lot of turning points are also captured in the price. Hence, I would be happy if I get even the regular returns of equity, I would not be expecting or be greedy that I will get more. Like Aashish started by saying that for a lot of good returns, 2021 was the year for that, maybe 2022 will test all the new money which has come in and all the new investors which have come in and will test the real patience whether we are really long-term investors or are we just using last year returns.

Aashish, did you want to make a point?

AASHISH SOMAIYAA: I was just saying that, people say that consensus is generally wrong. It's not true. It's not necessarily that consensus should always be wrong. Not making recommendations but if you take a recent example, ICICI Bank's performance is the best example that it's not necessarily that consensus will be wrong. So, I hope that the Indian market in general does just like that bank.

Kalpen, between the different market capitalisation segments, large, mid, small caps, which one do you think would outperform and why?

KALPEN PAREKH: My take is, generally I do believe in reversion to mean, and in the long run Aashish and I used to drive together 20 years back to work from the suburbs in Borivali all the way to Ballard Pier and we used to drive because the idea was to keep changing lanes, if this lane was a little empty then lets go in the other lane and then this lane would go ahead. So, the big learning is ultimately you will take the same two hours that you normally take and trying to switch lanes has never really worked. I feel that a swings have happened in small and mid caps, and they've run up a lot and like I said last year was a year of great surprise because companies improved profitability, they improved margins, their costs were lower but as we normalise, a lot of these operating numbers could disappoint. While we talk also, we are hearing about margin pressure, we are hearing about dominant companies saying that our margins are coming under squeeze. So, on one hand, most of the good news and most of the good companies are priced to perfection. So, any small disappointment can lead to significant price fluctuations. I would be more biased for diversified portfolios independent of market caps, where the fund manager chooses whatever he feels is right. If there are three good companies, irrespective of them coming from small caps so be it and if they are four good companies coming from large caps, so be it. These are times to be more conscious of the fact that don't polarise capital to any one idea. Be with all and continue the journey of compounding without sharp fluctuations. So diversification, again, in market caps rather than any single market cap.

Into crypto as well, Kalpen?

KALPEN PAREKH: Yesterday, for the first time I met someone who asked, what is crypto? Teach me too, because there is a feeling of being left out and not being aware of what's happening. To be honest, I still am not able to figure out what the driver of that return is. Like in equities, I can see ROEs and multiple expansion or contraction and dividend yields are the broad drivers of returns over a full cycle. In fixed income, your starting interest rates are your drivers of return. In crypto, I still don't know. So, I'm the wrong person to really comment on this, I really have no clue. I am a student I've just entered junior kindergarten and with some more reading maybe in the next Samvat discussion, I may have some answers.

Aashish, mid, small, large caps, crypto — where do you believe the larger allocation should be?

AASHISH SOMAIYAA: I'm with Kalpen on this one because it is best to leave it to the portfolio manager. Clearly, as I said earlier also that now we've got to be with the GDP growth and with the corporate growth. So the easy money is out of the way and that really needs some discerning kind of decision making and active management. So multi cap is probably the way to go, no doubt about it. As far as Crypto is concerned, again, I think we're not in the right place to really make too much of a commentary on it. Only thing I've learned is that blockchain technology itself, I think that is something which one must really work hard on, and invest into it. Crypto as an application of that technology, I'm not sure how far it can really go. I'm more keen to understand about the technology and figure out if there are ways to invest in the technology itself, but not so much in the current application that we are seeing.

You think you guys will come out with some innovative things as a new house on the block through the mutual fund route?

AASHISH SOMAIYAA: So I would say that, first of all, I'm not very aware of how many investing opportunities per se into the technology itself are there, but I think any technology company or any digital technology company, I think you should be able to express it through your multi-cap funds or whatever gives you that opportunity. I'm not a big fan of getting into any corners or cracks or crevices of the market. Like say sector, for example because whenever you operate in any corner crack or crevice of the market to generate outperformance generally the market takes it back from you. So, it is a huge outperformance usually followed by huge underperformance. So, even if you believe that this is a technology that you should find in your portfolio, then, still it should go the multi-sector, multi-cap kind of way.

Kalpen, you guys have come out in the past with some very innovative products as a house. I mean, DSP BlackRock and then DSP as well. Do you get tempted or involved into conversations, which might mean that Indian money gets invested in a fund which is using or investing in blockchain technology/crypto assets abroad because that's where it's largely prevailing, so to say?

KALPEN PAREKH: Currently, Indian money can get invested only under the framework of regulations that SEBI allows. So, whether in India or even when we transfer money outside in some fund of funds, so even those funds have to be governed by the SEBI regulations of what we are allowed to invest. It has to be only listed equities and listed funds. So, there are many interesting funds outside. So, we are discussing about an idea which is driven around a global innovation and how technology is transforming, creating and enabling value for all industries. So, technology is not just software companies or tech companies but even in healthcare, there is robotics or gene sequencing and DNA testing and so on and so forth. So, there are many applications of technology, and we are trying to curate a portfolio of four or five underlying themes and funds coming together, which we will talk more about once we file for an approval with SEBI. It could be around a month away and some part of it will have some of these disruptive technologies what Aashish mentioned about companies which are involved in how blockchain can make an impact in terms of overall processes, companies which have set up exchanges. So, like I said, for crypto understanding where the cash flows coming from may be a challenge for us to understand because we are very naive in that but there are opportunities in that space where there are companies generating cash flows, which are involved. So, some work we are doing on that, maybe a month or two from now and once we are better prepared, we'll be talking to you back on that.

Kalpen, what's happening in the next Samvat? Will the Sensex or will the Nifty be higher than where we are this Samvat?

KALPEN PAREKH: Yes. I thought I'll surprise you for a change because anyways it is random but my bias would be to say that things are stable, flows are stable, fundamentals are improving, valuations are expensive clearly but they've been expensive for many years now. There is a small risk of huge disruption because of interest rate cycle reversing globally but that apart most of the pillars indicate a stable trend and hence I said yes so quickly.

Aashish, what about you, what do you believe? Do you reckon significantly higher, higher, or just about it?

AASHISH SOMAIYAA: I would say, higher. Significantly higher would be like 2021, I don't think we're going to see a repeat. So, I would say higher than where we are, that's the expectation.

One key health tip before we wrap up. Aashish, to you first?

AASHISH SOMAIYAA: I'm trying not to eat after 6 p.m. No terminology to it, just avoid eating late in the evening. That's it.

Kalpen, one key health tip?

KALPEN PAREKH: I think, half an hour of yoga, half an hour of walk, these two things every day. It is simple just like daily SIP and wealth.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.