Shares of Yes Bank Ltd. rose to over two-month high after its fourth quarter profit rose 63% year-on-year to Rs 738 crore. On a sequential basis the bottom line rose 20.55%.

A rise in other income also aided the bank's profit after tax. It rose 11% on the year to Rs 1,739 crore.

Provisions and contingencies fell over 32% year-on-year and 23% sequentially to Rs 318.07 crore. Net interest income rose 5.7% year-on-year to Rs 2,276 crore, pushing net interest margins up by 10 basis points, both sequentially and annually to 2.5%.

Asset quality remained stable, with the gross non-performing asset ratio steady at 1.6% quarter-on-quarter. Net NPA improved to 0.3% from 0.5% in the previous quarter.

Retail slippages stood at Rs 1,101 crore, slightly lower than Rs 1,174 crore in the December quarter, but higher than Rs 977 crore a year ago. Overall gross slippages declined to Rs 1,223 crore from Rs 1,348 crore in third quarter and Rs 1,356 crore in the year-ago period.

Net advances grew over 8% year-on-year to Rs 2.46 lakh crore. Retail advances were Rs 1.01 lakh crore—up from Rs 99,805 crore in third quarter but down from Rs 1.05 lakh crore last year.

Total deposits rose nearly 7% year-on-year to Rs 2.84 lakh crore. The CASA ratio improved to 34.3% from 33.1% in the previous quarter and 30.9% a year ago.

The bank's credit-deposit ratio stood at 86.5%, down from 88.3% in third quarter but up from 85.5% a year earlier.

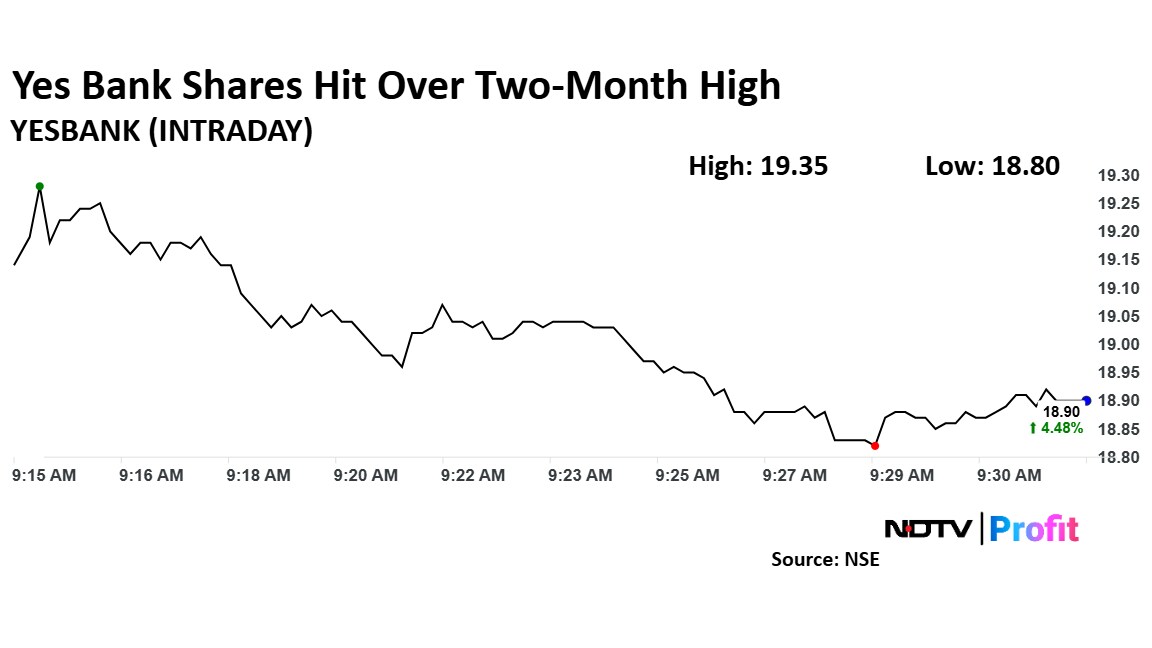

Yes Bank Share Price Rises

Shares of Yes Bank rose as much as 5.80% to Rs 19.14 apiece, the highest level since Feb. 7. It pared gains to trade 4.48% higher at Rs 18.89 apiece, as of 9:45 a.m. This compares to a 0.70% advance in the NSE Nifty 50.

The stock has fallen 21.13% in the last 12 months and 3.57% year-to-date. Total traded volume so far in the day stood at 6.2 times its 30-day average. The relative strength index was at 55.68.

Out of 12 analysts tracking the company, two recommend a 'hold' and 10 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 12.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.