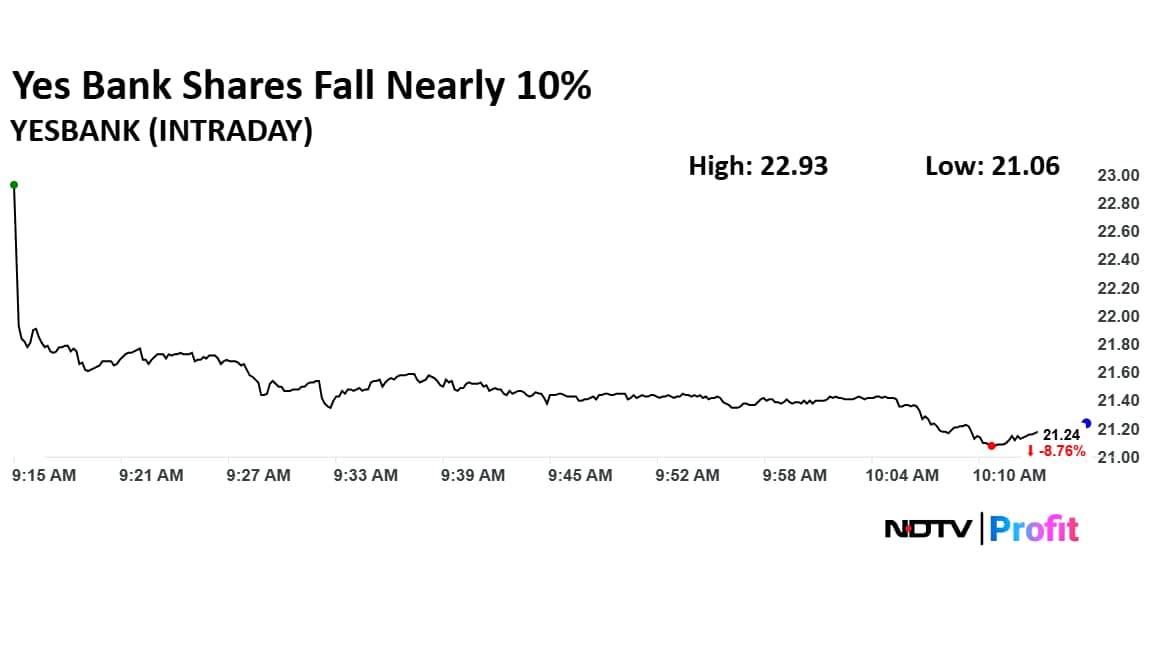

Shares of Yes Bank Ltd. fell over 8% on Tuesday following multiple large trades. About 3% equity changed hands in 52 large trades.

This comes ahead of its board meeting to consider fundraising through issuance of equity shares or debt securities through private placement and is subject to requisite approvals.

According to an investor presentation in May, only one State Bank of India-nominated director will remain on the board of Yes Bank, following its acquisition by Sumitomo Mitsui Banking Corp. Another SBI-nominated director will be resigning immediately once the transaction is closed, it added.

On May 9, Yes Bank had announced that SMBC would acquire the 20% stake from its shareholders, including SBI and several Indian lenders such as HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank, IDFC First Bank, Federal Bank and Bandhan Bank. These lenders had participated in the private lender's restructuring plan in 2020.

SBI will divest its 13.19% stake in the private lender for nearly Rs 8,890 crore and other lenders will cumulatively sell 6.81% stake in Yes Bank to SMBC, taking the latter's stake to 20%.

This takes the total investment to be made by SMBC in Yes Bank to around Rs 13,484 crore.

With this deal, SMBC can nominate two non-executive directors to Yes Bank's board to support its governance and strategy with a 20% stake.

Yes Bank Shares Decline

Shares of Yes Bank fell as much as 9.54% to Rs 21.06 apiece, the lowest level since May 30. They pared gains to trade 8.59% lower at Rs 21.28 apiece, as of 10:17 a.m. This compares to a 0.21% decline in the NSE Nifty 50.

The stock has fallen 9.77% in the last 12 months but risen 8.47% year-to-date. Total traded volume so far in the day stood at 51 times its 30-day average. The relative strength index was at 59.76.

Out of 17 analysts tracking the company, 14 maintain a 'buy' rating, one recommends a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 26.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.