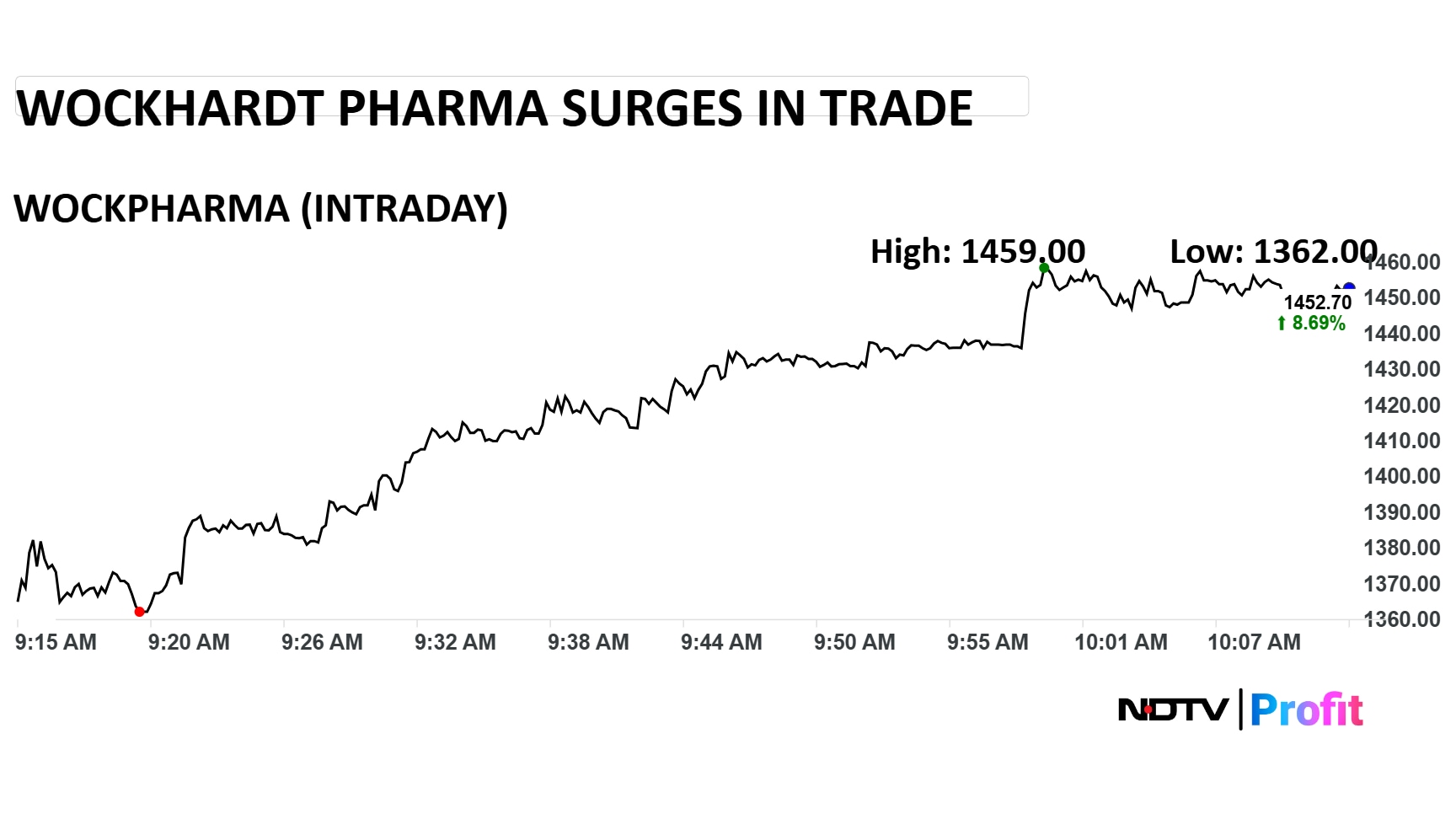

Shares of Wockhardt Ltd. has surged in trade on Monday, registering gains of more than 9% following positive cues on the tariff front. The shares reached an intraday high of Rs 1,458. The stock had declined 10.2% on Friday.

The stock was currently trading at Rs 1,456 compared to Friday's closing price of Rs 1,336 as of 10:22 p.m. and over a 12-month period, Wockhardt Pharma shares have risen almost 50%.

Wockhardt's rally on Monday comes on the back of a recent clarification from the White House, which suggested that countries which have an existing trade deal with the US will be exempted from the pharma tariff.

This is a major positive for the European Union and Japan, as both entities have an existing trade deals, in which only 15% tariff will be charged as opposed to the 100% tariff on foreign-made branded drugs which Trump announced last week.

Wockhardt Pharma was one of the worst hit pharma stocks in India following Trump's announcement, falling more than 9% in two trading sessions.

(Photo: NDTV Profit)

What Does Wockhardt Gain From This?

This development is a major positive for Wockhardt as the company's flagship drug Zaynich will be produced in Europe.

This implies that Zaynich's launch economics will remain intact and would, therefore, avoid the risk of punitive duties that had alarmed the investors.

Zaynich (WCK 5222) is Wockhardt's flagship antibiotic. In a global Phase 3 cUTI study it achieved at least 20% superior composite cure vs. meropenem, with more than 90% efficacy in a resistant‑organism study and as many as 51 compassionate‑use lives saved, as per the company.

Wockhardt eyes $7 billion market in the US and Europe and has a Rs 17,000 crore addressable market in India, offering the company a high-margin branded revenue stream.

The product not being affected by tariffs, therefore, is vital for the company and it has been evident given the way the stock is reacting on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.