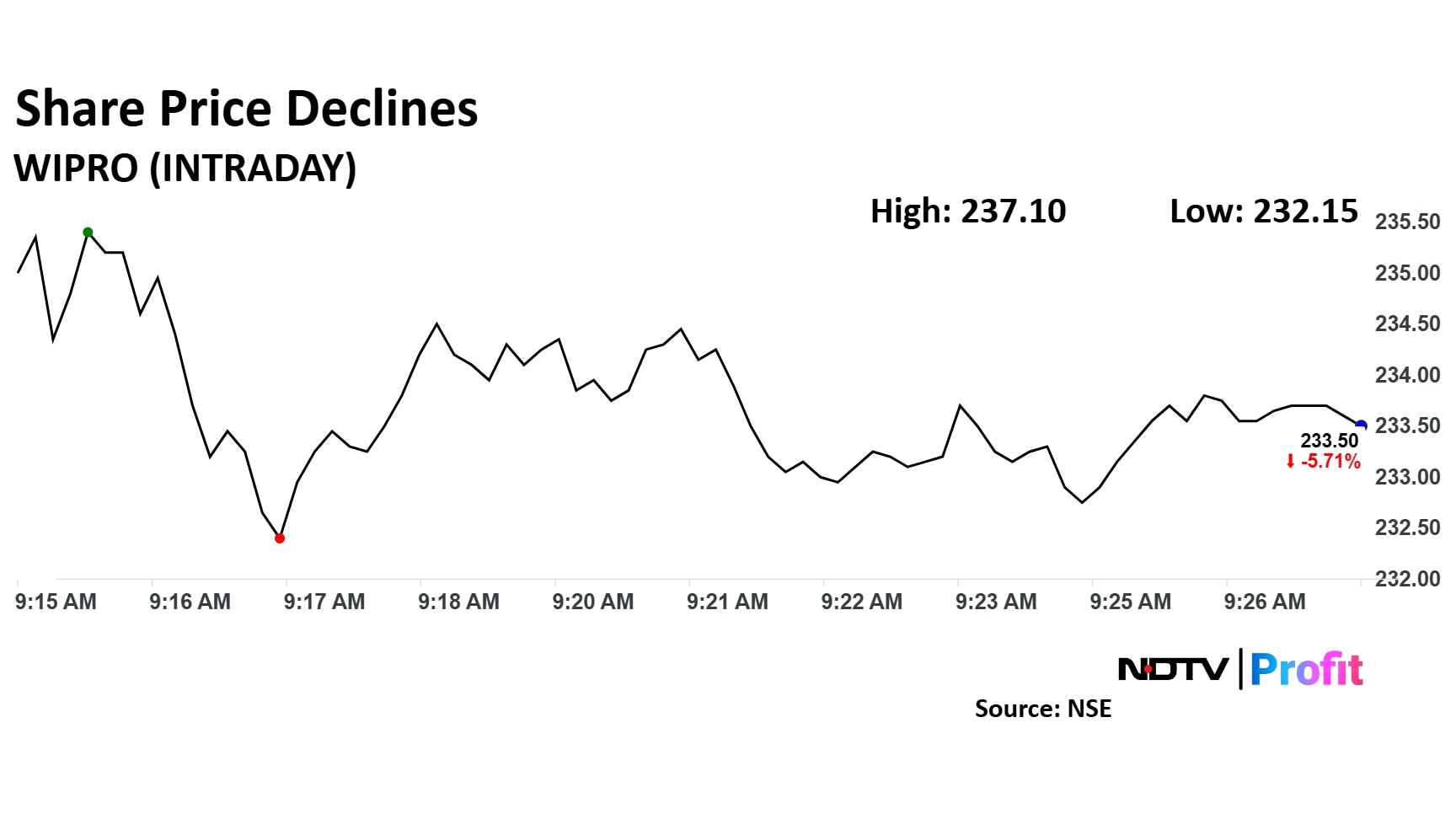

Wipro Ltd.'s share price declined over 6% on Thursday, after the company lowered its revenue guidance following the announcement of its fourth quarter results.

The IT major's outlook for the June quarter remained muted amid an uncertain macro environment, as the company guided for a degrowth of -3.5% to -1.5%.

Consolidated revenue in the fourth quarter of the last financial year rose 0.8% sequentially to Rs 22,504.2 crore. This compares with the Rs 22,684-crore consensus estimate of analysts tracked by Bloomberg.

The information technology major's net profit increased 6.6% sequentially to Rs 3,588 crore, beating the consensus estimate of Rs 3,364 crore. The company's EBIT increased 1% to Rs 3,902 crore, compared to Rs 3,923 crore estimates.

Notably, Wipro's American Depositary Receipts sank to close 3.20% lower at $2.73 in New York on Wednesday. ADRs are securities issued by a US bank that represent ownership in shares of a foreign company, denominated in dollars and traded in US markets.

Noting muted fourth-quarter earnings, brokerages have issued bearish commentary on Wipro's future performance and cut the target price on the stock.

Citi maintained its 'sell' rating on Wipro and cut the target price to Rs 215 from Rs 240. The brokerage noted that Wipro's Q1 guidance is well below expectations.

Meanwhile, BofA maintained its 'underperform' rating on Wipro and reduced the target price to Rs 225 from Rs 260.

Investec has retained its 'hold' rating on Wipro and cut the target price to Rs 250 from Rs 260. The brokerage expects FY26 to be another year of revenue decline, weaker than consensus estimates.

The script fell as much as 6.26% to a piece. It pared losses to trade 5.75% lower at Rs 233.40 apiece, as of 09:24 a.m. This compares to a 0.50% decline in the NSE Nifty 50 Index.

It has risen 5.14% in the past 12 months. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 31.

Out of 45 analysts tracking the company, 10 maintain a 'buy' rating, 14 recommend a 'hold', and 21 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside/upside of 8.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.