The Indian stock market is currently experiencing a rally due to a confluence of positive factors. After a brief panic-driven selloff last week amid the escalating India-Pakistan tensions, bulls are back in charge on the Dalal Street. The optimism is driven by both domestic and international factors.

India-US Trade Deal

Reports of easing trade tensions and even potential zero-tariff trade deals between India and the United States have boosted investor sentiment. President Donald Trump's administration has said the two countries are close to signing a trade deal.

Commerce Minister Piyush Goyal will be visiting Washington later this week to iron out the details.

A trade deal between India and the world's largest economy will follow the pact with the UK.

Bluechip Buying

There's significant buying interest in quality stocks, particularly large-cap names such as Reliance Industries Ltd., HDFC Bank Ltd., and ICICI Bank Ltd., which have all seen gains.

Bharti Airtel Ltd. and Infosys Ltd. have also contributed to the market's upward momentum, along with buying activity in Tata Motors Ltd., HCLTech Ltd., Adani Ports and SEZ Ltd., and Maruti Suzuki Ltd.

Both foreign and domestic institutional investors have been net buyers in seven of the nine sessions in May.

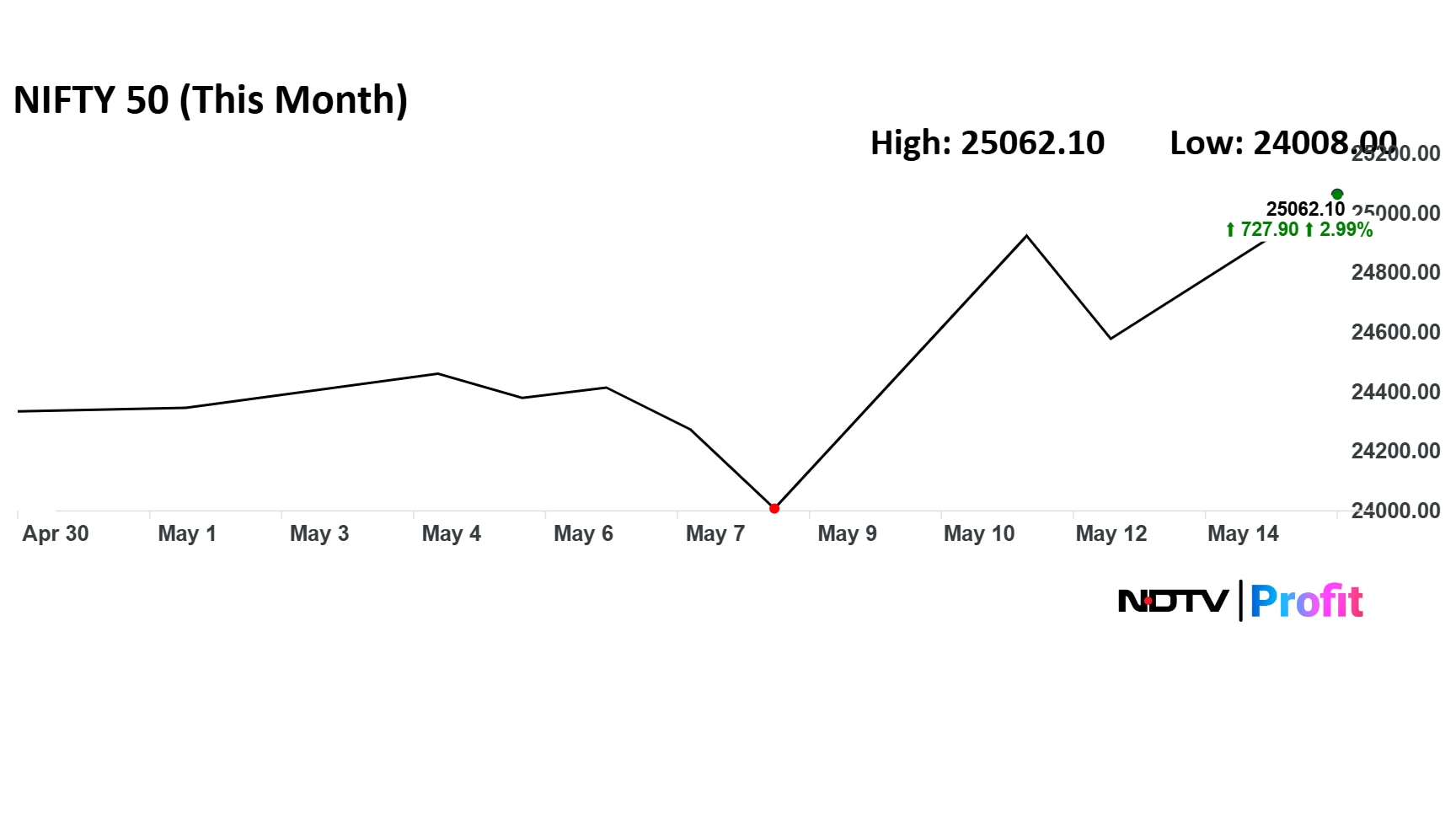

The benchmark Nifty 50 has gained 4.4% so far this week.

Defence Stocks

A strong surge in defence stocks has provided substantial support to the market, with companies like Cochin Shipyard Ltd., Mazagon Dock Shipbuilders Ltd., and Garden Reach Shipbuilders witnessing remarkable gains.

These follow their fourth-quarter and full-year financial results, along with a sentimental boost after the recent tensions with Pakistan showcased India's military edge and capabilities.

Cooling Inflation

Easing inflationary pressures, as indicated by a decline in both retail and wholesale inflation, have raised expectations of potential interest rate cuts in the future.

India's retail inflation eased to 3.16% year-on-year in April 2025, its lowest in nearly six years, driven by a broad-based decline in food prices. Wholesale price inflation eased to the lowest in over a year at 0.85% in April, compared to 2.05% in March.

Analysts expect this downward trend to continue into May, with estimates ranging from 2.8% to 3.3%, strengthening the case for further rate cuts by the Reserve Bank of India.

Cheaper Oil Prices

Finally, the recent softening of crude oil prices, with a 5% drop in the past two days and Brent crude falling below $64 per barrel intraday, is viewed positively as it will likely reduce India's import bill, which is beneficial for the overall economy.

The reason behind falling oil prices has to do with the US and Iran working on a deal that may lift sanctions on Iranian oil in exchange for Tehran limiting its nuclear activities.

The oil market is also seen to be oversupplied, with OPEC+ countries set to increase their flows.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.