Insider trading activity in September revealed contrasting patterns compared to year-to-date trends. While there was a notable surge in selling by key company personnel, insider purchases in specific sectors like telecom and finance took the spotlight.

Overall, the market was dominated by significant insider sales, indicating a cautious stance from corporate leaders.

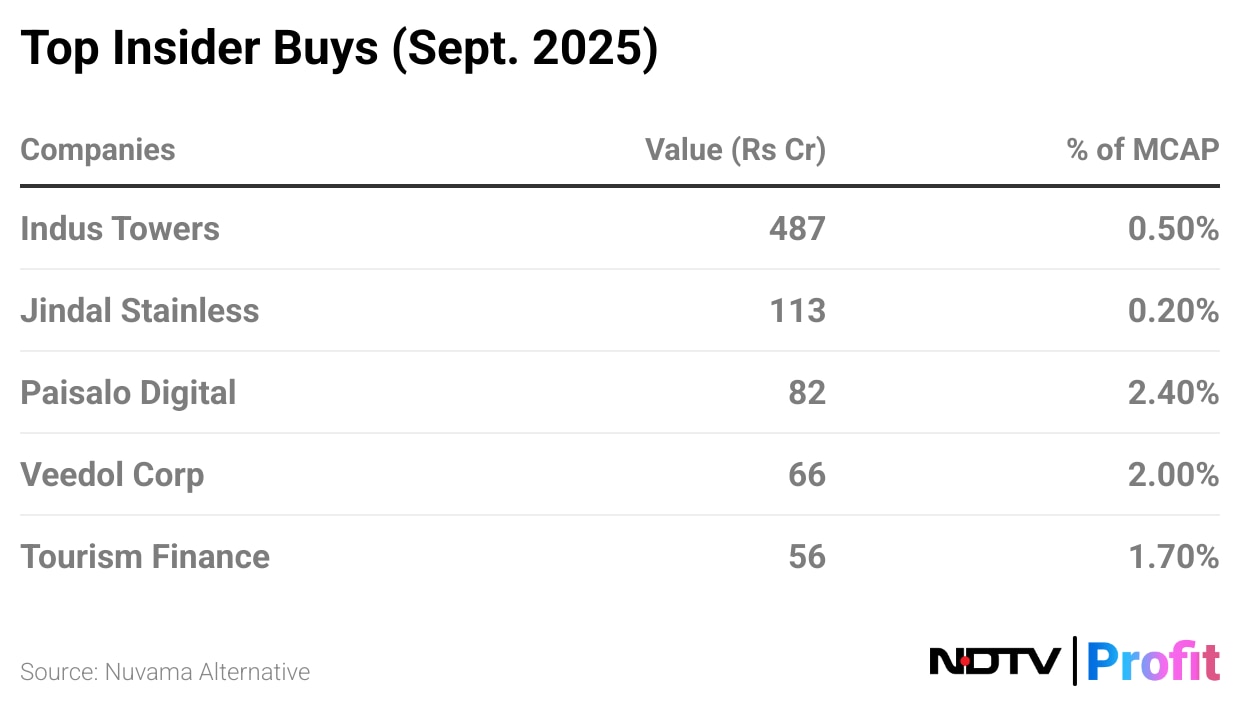

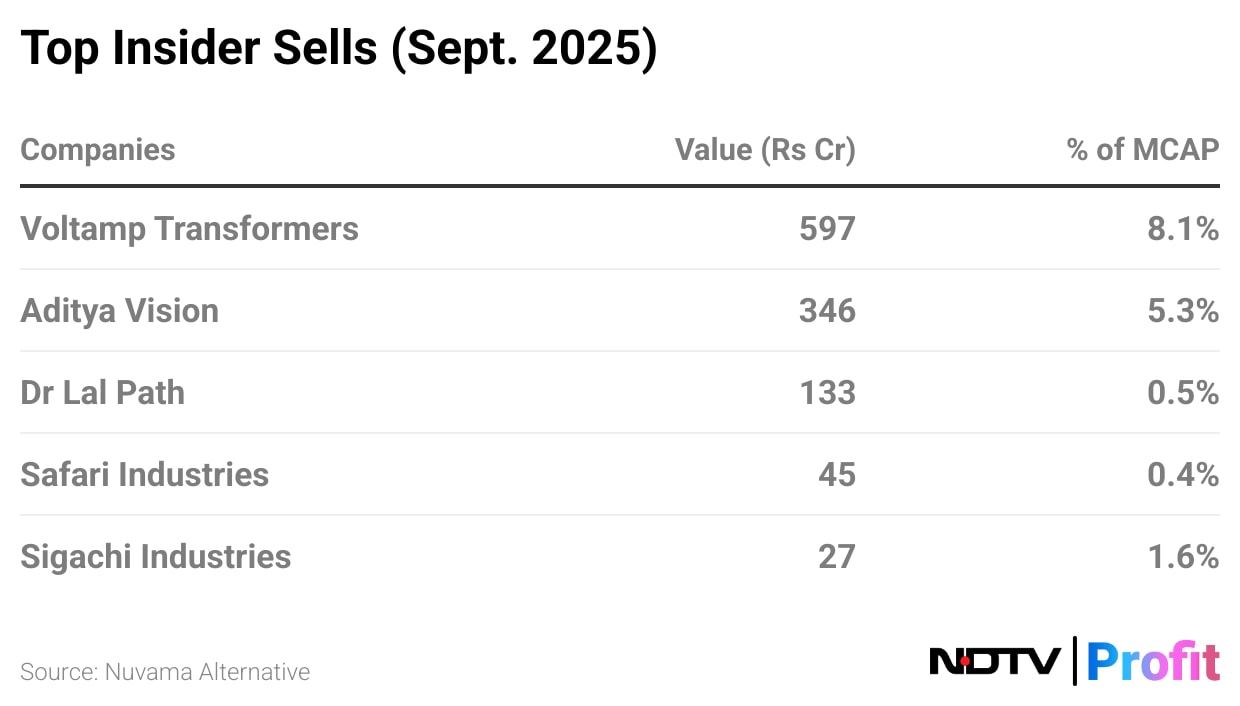

Buy And Sell Trends In September 2025

According to data from Nuvama Alternative, September saw a total of Rs 487 crore in insider buys for Indus Towers, and Paisalo Digital had a substantial purchase valued at Rs 82 crore, representing 2.4% of its market capitalisation.

Other key purchases took place in Jindal Stainless, Veedol Corp, and Tourism Finance. On the other hand, the month was marked by substantial insider sales, with a total value of Rs 597 crore for Voltamp Transformers alone, amounting to 8.1% of its market capitalisation.

Aditya Vision and Dr. Lal PathLabs also saw significant sales, valued at Rs 346 crore and Rs 133 crore, respectively.

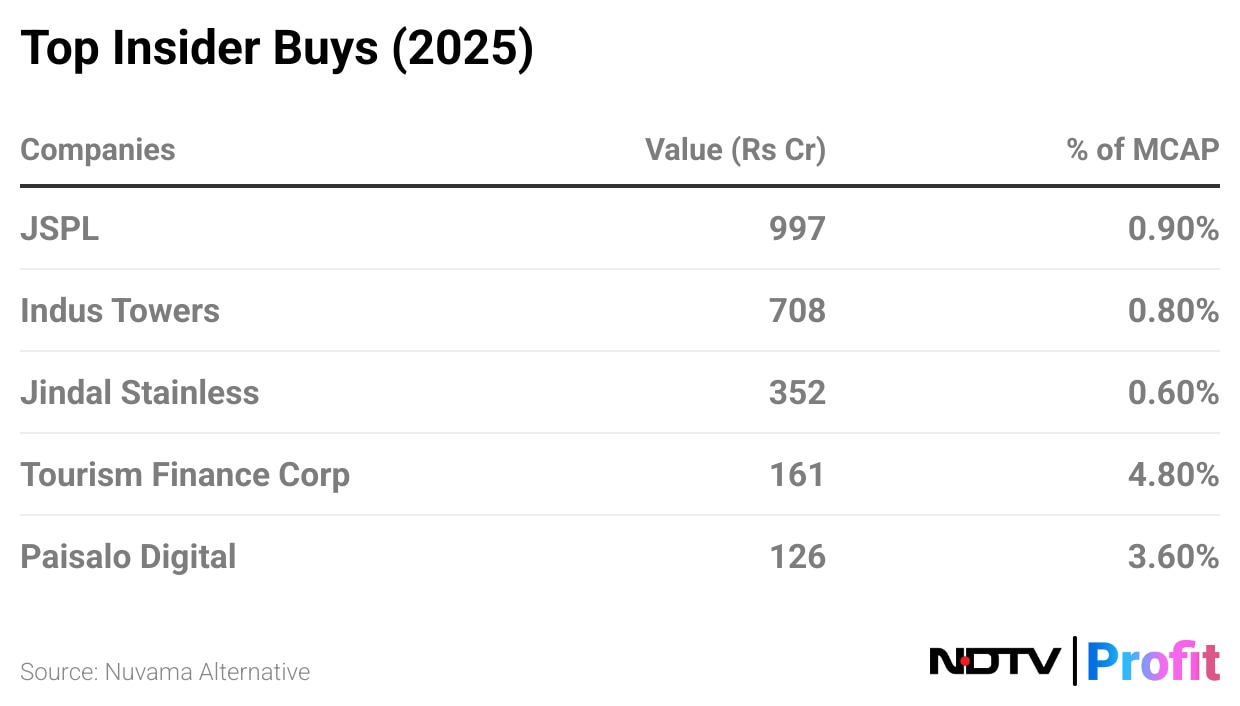

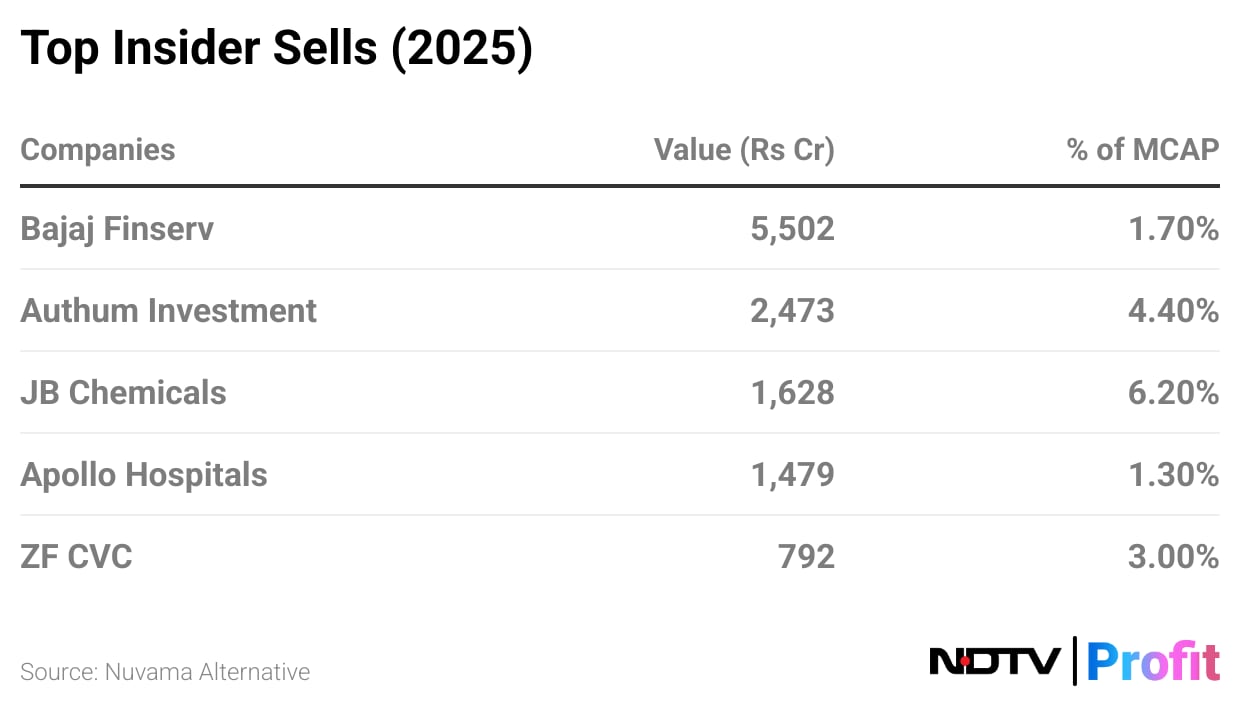

Buys And Selling Through 2025

When analysing trends for 2025, high-value insider selling stands out as particularly significant. Net insider sales for the year amounted to Rs 25,500 crore, against net purchases of Rs 3,860 crore. This suggests a broad move by insiders to liquidate their holdings despite individual company-specific purchases.

Top insider buys for the year were led by JSPL and Indus Towers, with values of Rs 997 crore and Rs 708 crore, respectively. Jindal Stainless, Tourism Finance, and Paisalo Digital also appeared on the annual buy list, mirroring their presence in the monthly data.

However, the top sales list for 2025 was led by major corporations like Bajaj Finserv with Rs 5,502 crore in sales, followed by Authum Investment and JB Chemicals.

This divergence between monthly and annual figures, coupled with the sharp imbalance between buying and selling, suggests that while some insiders remain confident in their companies' prospects, the broader trend points to cashing out.

The higher volume of selling, particularly from key players in the finance and healthcare sectors, could signal cautious outlook on market stability or a move to diversify personal portfolios.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.