- US stocks rose after the Fed's third consecutive interest-rate cut

- S&P 500 hit session high, Nasdaq and Russell 2000 also gained amid cautious optimism

- Fed cut rates by 0.25%, signaling a data-dependent, meeting-by-meeting policy approach

Stocks rose to a session high as the head of the Federal Reserve spoke following the third consecutive interest-rate cut at a policy meeting Wednesday. Bond yields and the dollar fell.

The S&P 500 rose as much as 0.8%, putting the benchmark on track for a record close, after Fed Chair Jerome Powell pointed to downside risks for labor. The Nasdaq 100 turned positive while the Russell 2000 gauge of small-caps jumped 1.8% to a record high.

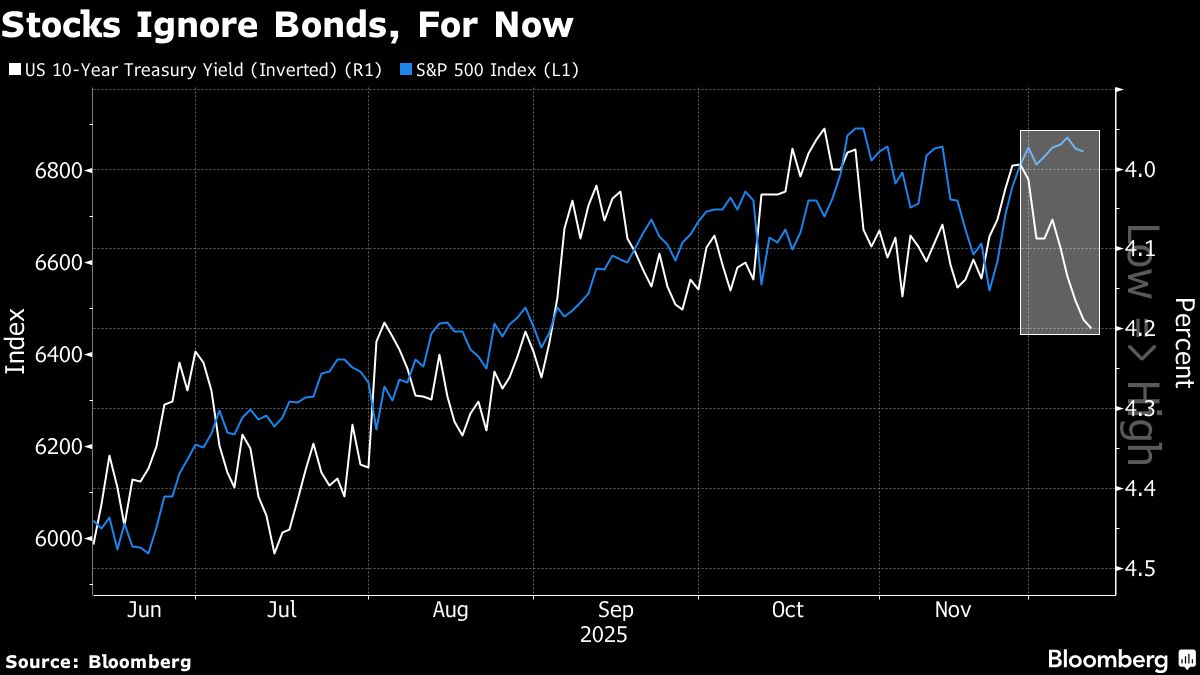

The rally in US stocks had stalled this week after traders pulled big bets off the table, with mixed economic signals and divisions among Fed policymakers clouding the outlook for rates into next year.

Nine out of 12 voters supported the decision to lower rates. The cut and the Fed's tone matched Wall Street expectations for a “hawkish cut,” while officials left intact their outlook for a single cut in 2026.

“Overall, a moderately hawkish cut not a max hawkish cut,” according to Evercore ISI's Krishna Guha.

Powell underscored the importance of upcoming economic reports while advising caution on assessing household jobs readouts, given technical distortions after a government shutdown caused a data blackout.

“The Fed emphasized that future moves will be data-dependent, shifting firmly to a meeting-by-meeting approach,” said Daniel Siluk, a portfolio manager at Janus Henderson Investors. “Chair Powell reinforced this stance in his press conference, noting that the Committee sees today's cut as a ‘prudent adjustment' rather than the start of a new cycle.”

US bond yields were lower. The 10-year rate hit 4.14% after reaching the highest since the first week of September in the morning session. Swaps traders are still pricing in two more cuts over the next year.

Traders may be disregarding Powell and FOMC bears' outlook given the imminent change in leadership, noted Jeff Schulze, head of economic and market strategy at ClearBridge Investments.

“The Fed's one rate cut outlook continues to be at odds with pre-meeting futures market pricing of two rate cuts in 2026,” Schulze said. “While we agree with the Fed that the need for further monetary support is limited, we caution investors to put less weight than normal on the dots since a new Fed chair will be at the helm starting in May.”

Chris Brigati, chief investment officer at SWBC, had expected the Fed to telegraph only one cut for next year, given the potential for consumer pricing pressures to reignite.

“The Fed is divided on how to proceed with rate cuts in 2026 given the delicate balance between job market weakness and still elevated inflation,” Brigati said. “There is also uncertainty about the new Fed chair, and that may also add to the central bank's reluctance to make any major rate moves in the months leading up to Chair Powell's term ending.”

To Brad Conger, chief investment officer at Hirtle Callaghan, investors should “remain long duration.”

“Neither Powell's comments nor the Dot Plot should matter for markets. Our view is that the job market is slowing,” he wrote. “The labor weakness will pressure inflation lower (slowly) and justify further cuts. It's likely that Mr. Hassett will inherit a Fed Funds at 3%.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.