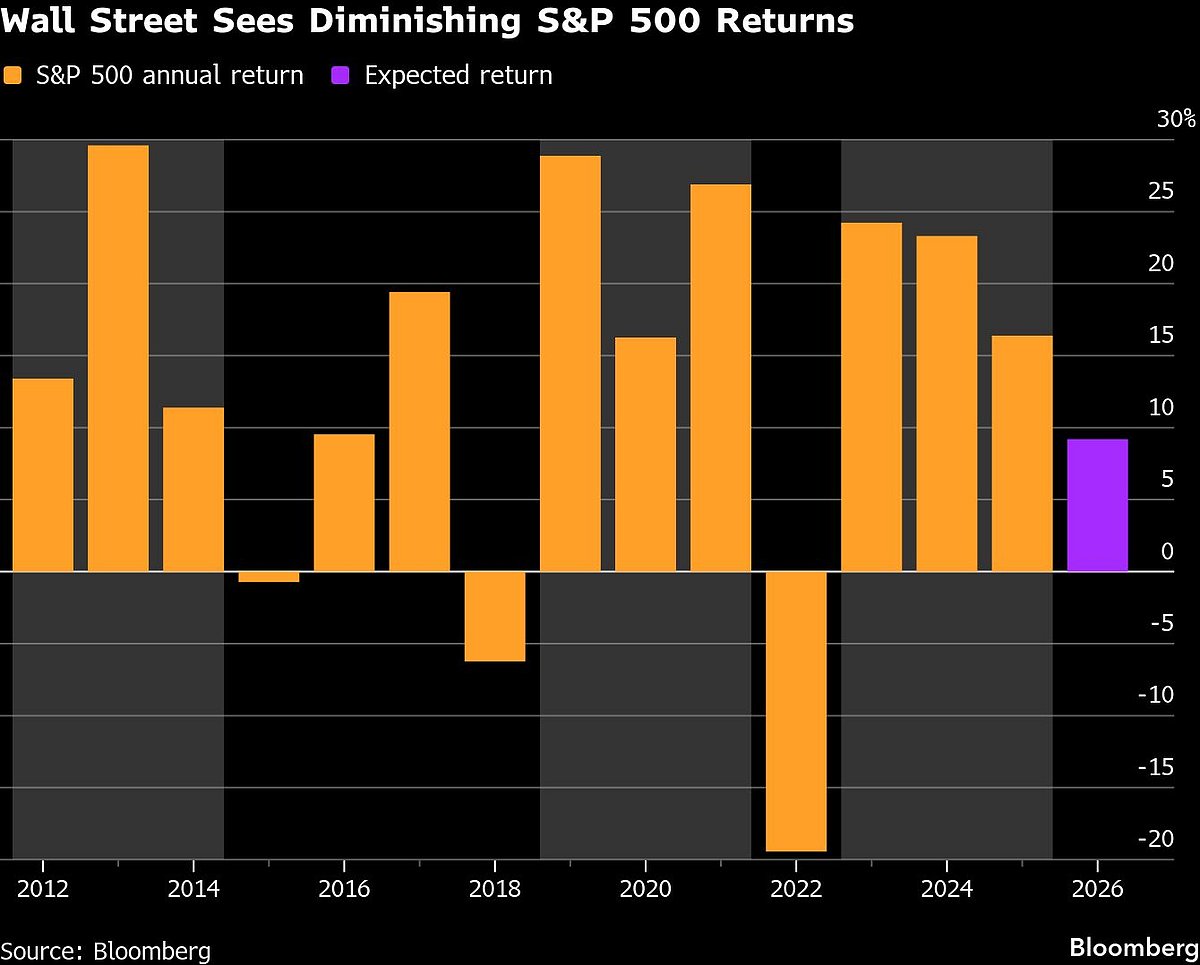

Wall Street Bulls Eye Milder Gains In 2026 After 3-Year Surge

Strategists surveyed by Bloomberg expect the S&P 500 to advance 9.2% this year, roughly in line with the average total return this century.

An eye-popping three-year run that added 78% to US equities isn’t deterring Wall Street’s persistently bullish prognosticators. But this year’s optimism comes with a dose of caution.

“Adjust your sights slightly lower,” Sam Stovall, chief investment strategist at CFRA, said by phone Friday. “It’s OK to remain a bull but spell it with a lower-case B because we’re also bumping up against a historically challenging mid-term election year.”

Strategists surveyed by Bloomberg expect the S&P 500 to advance 9.2% this year, roughly in line with the average total return this century. But that would trail the prior three years, when the index churned out rallies of 24%, 23% and 16%.

The average gain expected by strategists also equals the historical average for performance in the fourth year after three straight double-digit rallies, according to Stovall. Recent history is less rosy. The last two stretches of back-to-back-to-back gains of at least 10% were followed by annual declines, in both 2020 and 2015. If the S&P 500 did gain 10% this year, it would mark the best four-year stretch for the index since 1999.

The bull case is predicated on expectations that the US economy will pick up steam in the first half, with tax cuts and regulatory easing adding to an ongoing boost from the artificial intelligence buildout. The tempering of expectations comes from continued worries that valuations remain high and capital spending plans could start to weigh on profits.

“Growing capital-intensity of big tech spenders that make up an outsized share of the index, elevated multiples, plus cracks in the labor market” contribute to the case for “a more cautious stance,” BofA Securities strategists Victoria Roloff and Savita Subramanian wrote in a Friday research note.

The pair see the S&P 500 adding a pedestrian 4% this year.

History also provides reasons to be cautious heading into 2026. In mid-term election years, the market’s average advance is just 3.8% and rises just 55% of the time. “That’s not much better than a coin toss,” Stovall said.

Sevens Report founder Tom Essaye wrote Friday that “a three-year stock market like the one that just concluded more often than not occurs in late-cycle market environments leading into cyclical bear markets.”

This is especially “ominous” when looking at the negative five-year forward returns for the S&P 500 after such a three-year run, he said, adding that signals of a bear market are “emerging.” He pointed, for example, to concerns about a bubble in AI-linked stocks and the benchmark’s recent drops to test support levels.

Of course warnings about lofty valuations and unsustainable share-price gains have been overcome with ease lately as corporate profits continue to swell. Earnings growth is actually seen accelerating in 2026 to nearly 14% compared to 12% in 2025, which could provide a tailwind to the market’s performance.

“This has been an earnings driven bull market,” Keith Lerner, chief investment officer and chief market strategist at Truist Advisory Services Inc., said by phone. “You’ve had a modest increase in valuations but the bulk of it was earnings.”

While Lerner said he does still expect earnings to drive the market’s performance, it is reasonable to expect a lower pace of appreciation given that stocks are trading at historically elevated multiples.

“After three years of gains, you could see some modestly lower returns but still positive over the next year,” Lerner said.