Waaree Energies share price jumped to a record high in Thursday's session. The stock has been rallying for three sessions in a row. CEO and Whole-time Director of Waaree Energies Amit Paithankar said that GST rate cuts are overall good for the renewable energy sector.

GST rate cuts can "materially change" the landscape for India's solar industry by significantly boosting demand and reducing project costs, according to Amit Paithankar, CEO and Whole-time Director of Waaree Energies.

The project cost and input costs will go down by 5%. End consumers will likely benefit. For instance, consumers in the PM Surya Ghar Yojana have a direct benefit of GST, he told NDTV Profit in an interview last Friday.

Waaree Energies intimated exchanges about receiving no objection for the reclassification of promoter group Metafin Cleantech Finance Pvt. Ltd. After the no objection certificate, the promoter group is classified as public.

Waaree Energies's management will meet investors on Friday at the manufacturing plant in Chikhli, Navsari, Gujarat, the company said to the exchanges on Monday. The discussions will not include any publicly unavailable information or unpublished price-sensitive information relating to the company.

The company reported a rise of 89% in consolidated net profit to Rs 745 crore, compared to Rs 394 crore in the corresponding period last year.

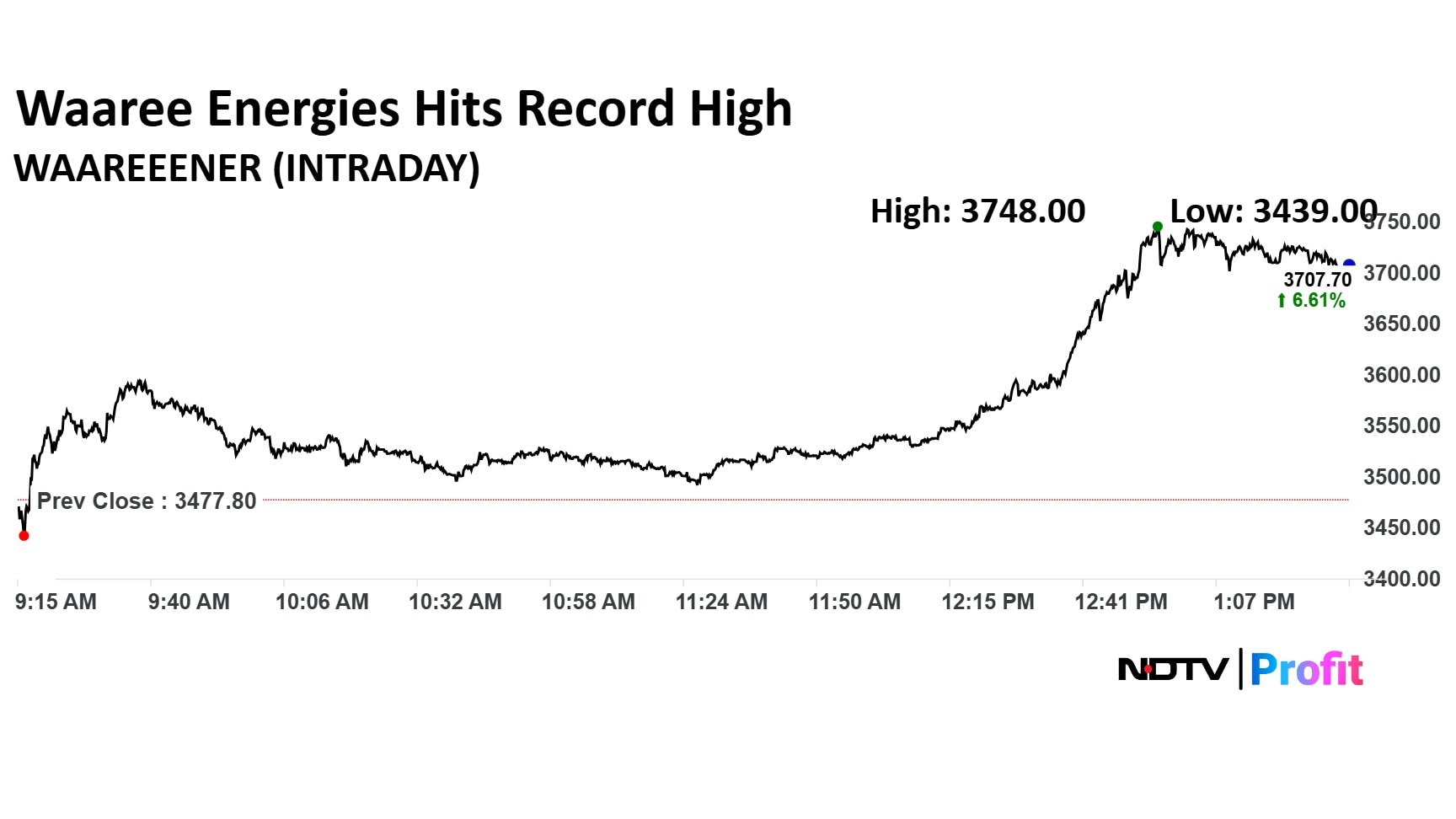

Waaree Energies share price jumped 7.77% to a record high of Rs 3,748 apiece. The stock was trading 6.10% higher at Rs 3,687.5 apiece as of 1:39 p.m., compared to 0.14% advance in the NSE Nifty 50 index.

The stock advanced 57.7% in 12 months, and 29% on year-to-date basis. Total traded volume so far in the day stood at 4 times its 30-day average. The relative strength index was at 70.51.

Out of five analysts tracking the company, four maintain a 'buy' rating, and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 13%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.