Vodafone Idea Shares Hit Lower Circuit After Cabinet Decision — Here's Why

The stock last traded at Rs 10.25 on the NSE, compared to Tuesday's closing price of Rs 12.11.

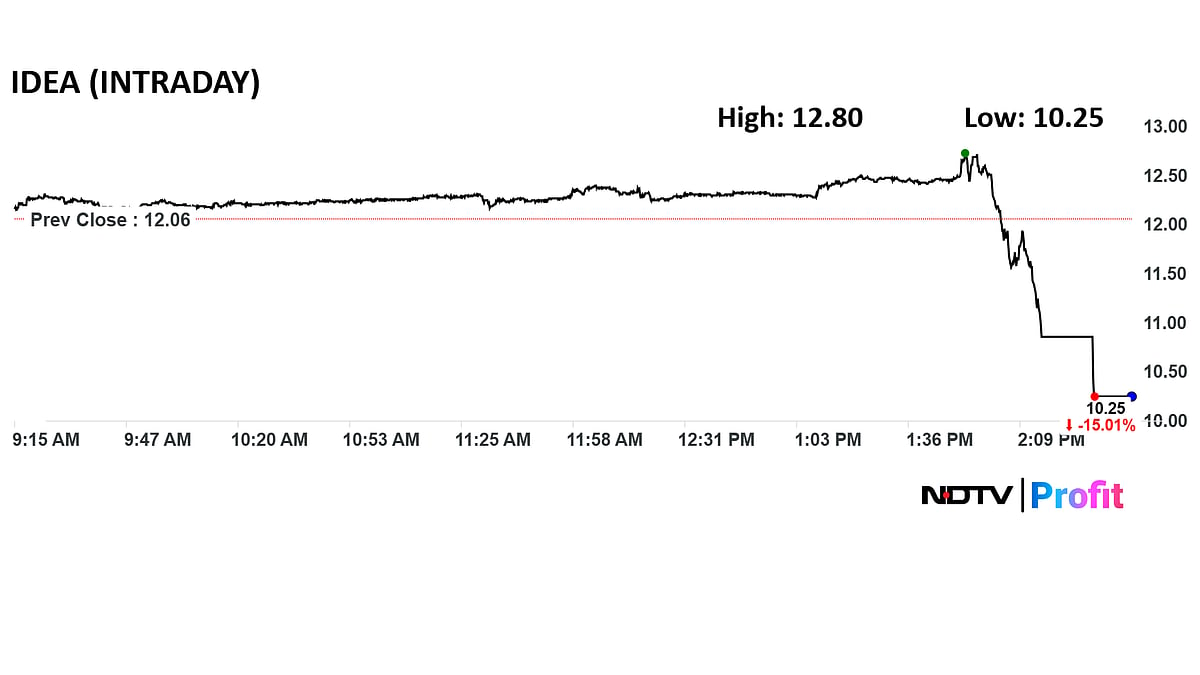

Shares of Vodafone Idea Ltd., after reaching a 52-week high earlier, hit the lower circuit of 15% on Wednesday. The stock last traded at Rs 10.25 on the NSE, compared to Tuesday's closing price of Rs 12.11.

The downturn came after the Union Cabinet decided to freeze the AGR dues of VIL as on Dec. 31, 2025 at Rs 87,695 crore instead of a waiver. The payment of this amount is being rescheduled over financial year 2031-32 to 2040-41, government sources told NDTV Profit.

The AGR dues frozen shall also be reassessed by the Department of Telecom based on Deduction Verification Guidelines and audit reports. The outcome will be decided by a committee appointed by the government and that shall be binding on both parties, sources said.

In addition, the AGR dues pertaining to FY18 and FY19, that were already finalised by a Supreme Court order in September 2020, will be payable by Vodafone Idea over the period FY26 to FY31 without any change, sources said.

The government's decision comes against the backdrop of the street expecting an AGR waiver of at least 50%, which could have had major positive implications on cash strapped Vodafone Idea's long-term prospects.

However, sources said that the Department of Telecommunications is likely to form a committee to look into reassessment of AGR dues, in about six to eight months.

The central government owns 49% equity in VIL, which has over 20 crore customers in India.

The company has not yet released any statement on the Cabinet's decision.

The Vodafone Idea share price is up 38% this year. Out of 22 analysts tracking the company, five maintain a 'buy' rating on VIL stock, seven recommend a 'hold,' and ten suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target is Rs 8.96.