Shares of Vodafone Idea Ltd. fell over 12% in trade on Monday, after the Supreme Court dismissed the telecom operators' petition on adjusted gross revenue dues waiver, calling them 'misconceived.' This follows the government's plea rejection for relief earlier in the day.

The court acknowledged that the companies can explore other remedies. However, it clarified that they can't pursue the same through the Supreme Court in this manner. “Don't make us a party”, said the Supreme Court, essentially refusing to mediate or interfere in what it considers a matter for the executive or government to decide.

Vi counsel pointed out that the company has already paid Rs 50,000 crore and that the government now owns nearly 50% of the company, to which the court responded that if the government wishes to help, it's free to do so, but the judiciary won't compel it.

Long-Standing AGR Woes

The Department of Telecommunications, in a letter dated April 29, said the request for further concessions on AGR liabilities “cannot be considered” due to the apex court's 2020 ruling in the case. The ministry noted that Vodafone Idea had already sought and received partial support when the government converted spectrum-related dues worth Rs 36,950 crore into equity, increasing its stake in the company to 49%.

This marks the latest chapter in a long-running dispute over the definition and calculation of AGR, which began with a 2019 ruling. In 2020, the top court fixed a 10-year timeline for telcos to clear dues. The DoT had earlier urged the court to extend the repayment window to 20 years, but the court did not accept the proposal.

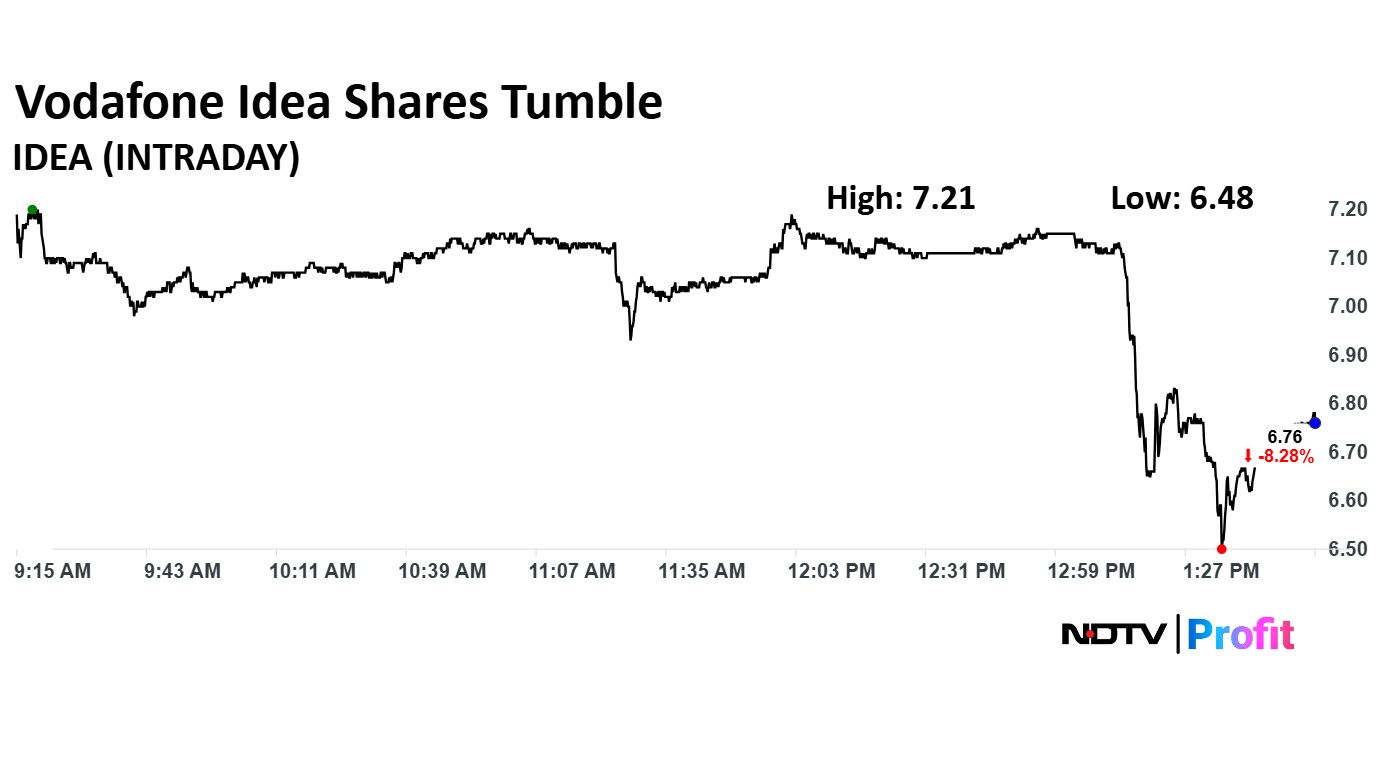

Vodafone Idea Share Price Today

The scrip fell as much as 12.08% to Rs 6.48 apiece, the lowest level since May 9. It pared losses to trade 8% lower at Rs 6.78 apiece, as of 2:02 p.m. This compares to a 0.21% decline in the NSE Nifty 50 Index.

It has fallen 14.99% on a year-to-date basis, and 49.21% in the last 12 months. Total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 47.50.

Out of 21 analysts tracking the company, five maintain a 'buy' rating, four recommend a 'hold,' and 12 suggest 'sell,' according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.