Shares of Vodafone Idea Ltd. fell nearly 2% on Thursday as investors began profit booking. This comes after the shares rose nearly 26% on Tuesday and hit over one-month high.

On Tuesday, the stock had risen after the government announced it would pick up more stake in the debt-laden telecom operator, in lieu of spectrum auction dues. Vodafone Idea has been directed to issue 3,695 crore equity shares of face value Rs 10 apiece, at par within 30 days of regulatory approvals, according to an exchange filing on Sunday. The total amount to be converted into equity shares is Rs 36,950 crore.

This isn't the first time the government has stepped in. Back in 2023, they converted Rs 16,133 crore of Vodafone Idea's debt into equity at Rs 10 per share.

Government's debt conversation is not about numbers, but is for keeping Vodafone Idea Ltd. going, said Sanjay Kapoor, former chief executive officer of Bharti Airtel Ltd.

"With this respite that they get, their outflows required for their immediate future are less and therefore they can borrow more money from the market to pump into their capex," Kapoor told NDTV Profit.

EY India's Prashant Singhal echoed the sentiment, and highlighted that government is making it clear that they are keen on operating Vodafone Idea and increase their shareholding. "Very few companies globally would be sitting on 200 million subscribers," he said.

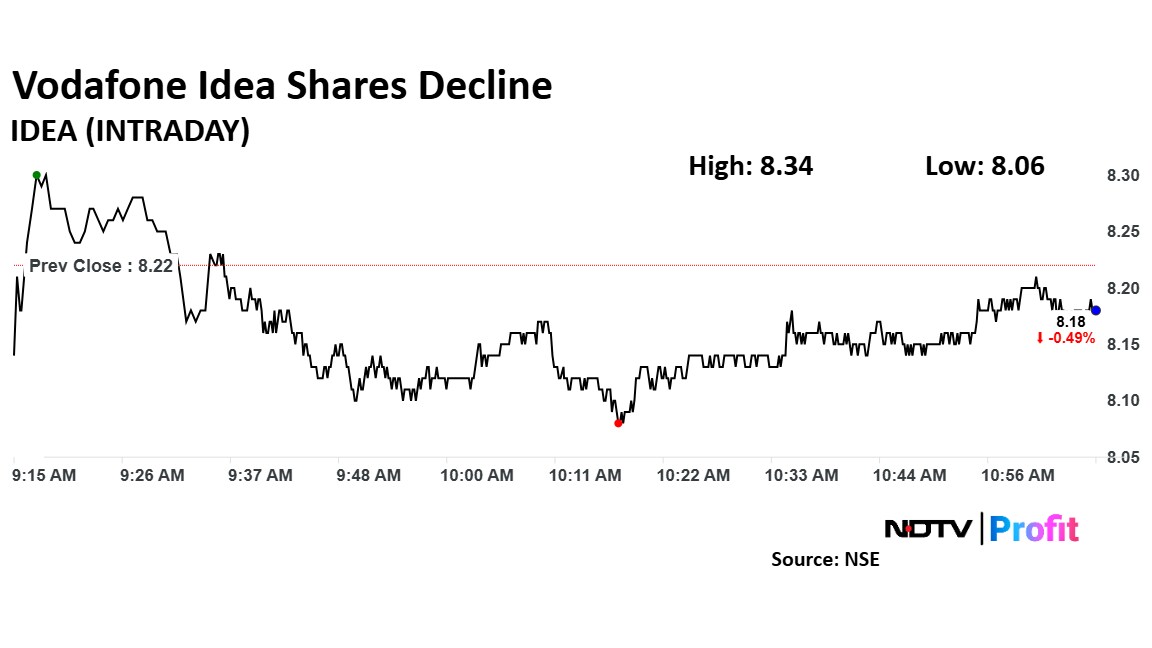

Vodafone Idea Share Price Decline

The scrip fell as much as 1.95% to Rs 8.34 apiece, the lowest level since April 2. It pared losses to trade 0.73% lower at Rs 8.16 apiece, as of 11:01 a.m. This compares to a 0.21% decline in the NSE Nifty 50.

It has fallen 38.95% in the last 12 months and risen 1.87% year-to-date. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 59.

Out of 21 analysts tracking the company, five maintain a 'buy' rating, five recommend a 'hold' and 11 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 3.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.