Vishal Mega Mart Ltd.'s shares rose as much as 2.97% in early trade on Friday but reversed gains to trade 2.72% lower, following a strong run-up. The stock had surged nearly 7% to hit its highest level in nearly three months after the retailer posted robust fourth-quarter results for financial year 2024–25 on Tuesday.

Net profit for the March quarter jumped 88% year-on-year to Rs 115.11 crore, compared to Rs 61.22 crore in the same period last year, according to the company's exchange filing. Revenue rose 23% to Rs 2,547.89 crore from Rs 2,068.93 crore a year ago.

Earnings before interest, taxes, depreciation, and amortisation increased 42.5% to Rs 357 crore. Ebitda margin improved to 14% from 12% in the year-ago period.

Brokerage View

Brokerages attributed the company's strong performance to festive-driven demand, improved store productivity, and an increasing contribution from its private-label brands. Same-store sales growth stood at over 13% in the March quarter—a key positive, according to analysts, given muted consumption trends across other retail names.

Jefferies and JPMorgan both maintained their bullish views. Jefferies raised its target price to Rs 142 from Rs 125 and retained a ‘buy' rating. JPMorgan also lifted its target to Rs 133 from Rs 125, maintaining an ‘overweight' stance. The brokerages pointed to Vishal's expanding footprint in states like Kerala, Maharashtra, and Gujarat, and highlighted the rising share of own brands, which now account for more than 73% of total sales.

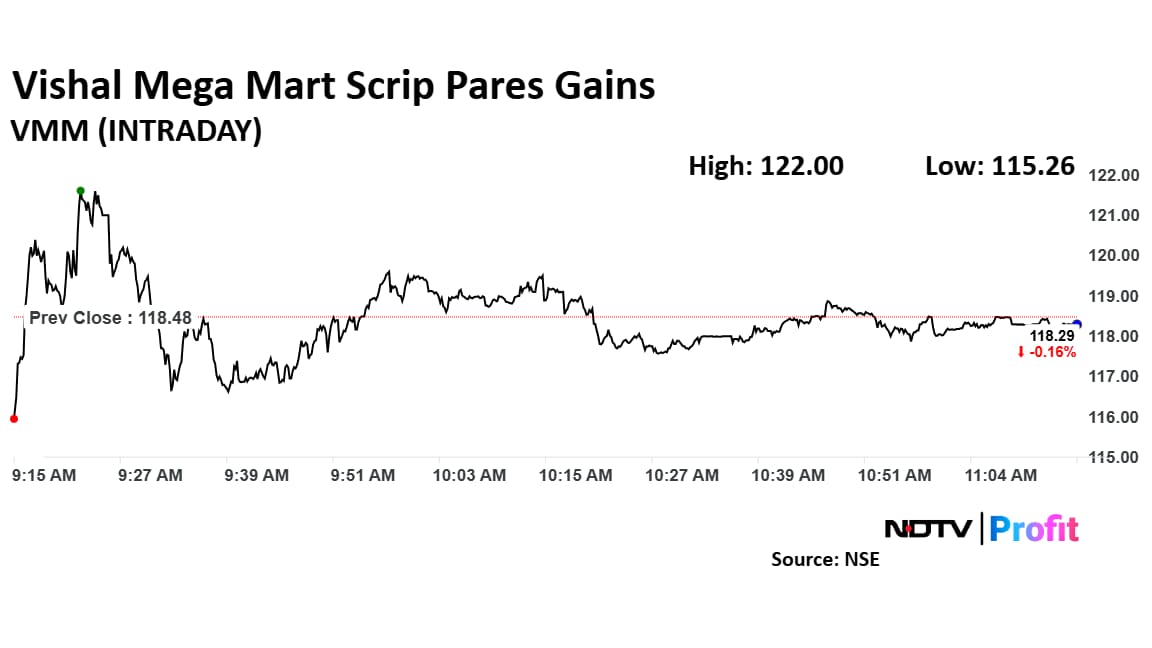

Vishal Mega Mart Share Price Today

Vishal Mega Mart stock rose as much as 2.97% during the day to Rs 122 apiece on the NSE and then pared losses to decline 2.72% to Rs 115.26 apiece. It was trading 0.36% lower at Rs 118.05 apiece, compared to a 0.36% advance in the benchmark Nifty 50 as of 11:14 a.m.

It has risen 5.67% in the last 12 months and 11.15% on a year-to-date basis. The total traded volume so far in the day stood at 4.5 times its 30-day average. The relative strength index was at 68.

Seven out of the nine analysts tracking the retailer have a ‘buy' rating on the stock, one recommends a ‘hold' and one suggests a ‘sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 131.89, implying an upside of 11.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.