- Vijay Kedia holds an 18.20% stake in Atul Auto as of November 2025

- Atul Auto's Q2 net profit surged 80.9% to Rs 8.27 crore in FY26

- Three-wheeler sales rose 4.49% to Rs 92.48 crore in the quarter

Ace investor Vijay Kedia's portfolio is in focus as one of the stocks in Kedia's portfolio, Atul Auto, surged over 14% in intraday trade over the last two sessions, after the company reported an 80% jump in its July–September quarter net profit for the financial year 2025-26.

As per data available on the BSE website, Vijay Kedia holds an 18.20% stake, equivalent to 50,50,505 public equity shares of Atul Auto as of Tuesday, 11 November 2025.

In addition to his personal holding, his investment firm, Kedia Securities Pvt. Ltd, owns a 2.71% stake, or 7,51,512 equity shares, in the commercial vehicle manufacturer as of the same date.

Atul Auto released its July–September quarterly results for FY26 on Tuesday, reporting an 80.9% increase in net profit to Rs 8.27 crore, compared with Rs 4.57 crore in the corresponding period last year.

According to the consolidated financial results, three-wheeler sales for the quarter rose 4.49% to Rs 92.48 crore, up from Rs 88.50 crore in the year-ago period.

The company also reported that total revenue from core operations grew 10% to Rs 200.17 crore, compared to Rs 181.65 crore in the same quarter of the previous financial year.

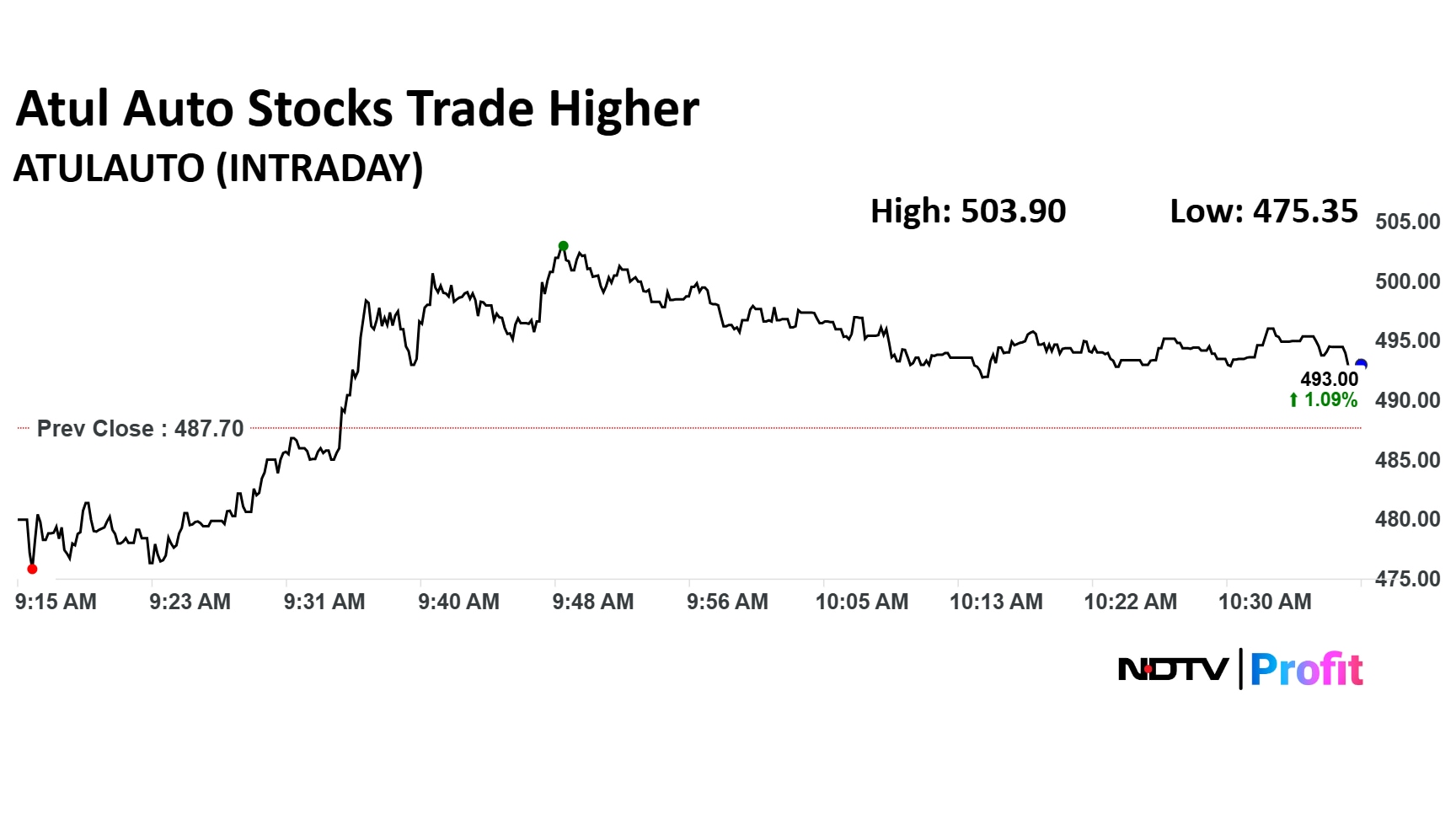

Atul Auto Share Price Details

The scrip rose as much as 3.32% to Rs 503.90 apiece. It pared gains to trade 0.94% higher at Rs 492.30 apiece, as of 11:20 a.m. This compares to a 0.62% advance in the NSE Nifty 50 Index.

Over the last five years, Atul Auto shares have delivered more than 209% returns to investors. However, the stock has fallen over 13% in the past year. On a year-to-date basis, it is down 15.64% in 2025, and is down 3% in the last one month.

No analysts are currently tracking the stock, as per Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.