HSBC Global Research has initiated coverage on Ventive Hospitality with a "Buy" rating and a target price of Rs 854 per share.

The brokerage highlights Ventive's strong balance sheet and healthy free cash flow as key strengths, despite the company's recent underperformance compared to its peers.

Ventive Hospitality owns 11 hotels across India and the Maldives, along with four annuity assets, including office buildings and shopping malls in Pune. The company's primary markets, Pune and the Maldives, generate nearly 90% of its revenue. Notably, its top four hotels—the JW Marriott and Ritz Carlton in Pune, and Anantara and Conrad in the Maldives—contribute 80% of its hotel revenues.

The Indian hospitality industry is currently experiencing a robust upcycle, with record-high occupancies and average room rates. Factors such as urbanisation, improved infrastructure, and increased holiday spending are driving demand, which is expected to grow in the low double digits over the next four to five years, the brokerage noted.

However, capacity growth is lagging at 6-8% per annum, with much of the new capacity coming from conversions of non-branded to branded hotels.

While most hotel operators have reported occupancy levels of 78-79%, Ventive's occupancy was lower at 60.7% in the last quarter. Additionally, Ventive has only 367 rooms in the pipeline, significantly fewer than its peers. However, management expects occupancy levels to rise, particularly in Pune and the Maldives, as airport infrastructure improves in both locations.

Pune's new terminal and the expansion of the Maldives airport are anticipated to boost tourism and corporate events.

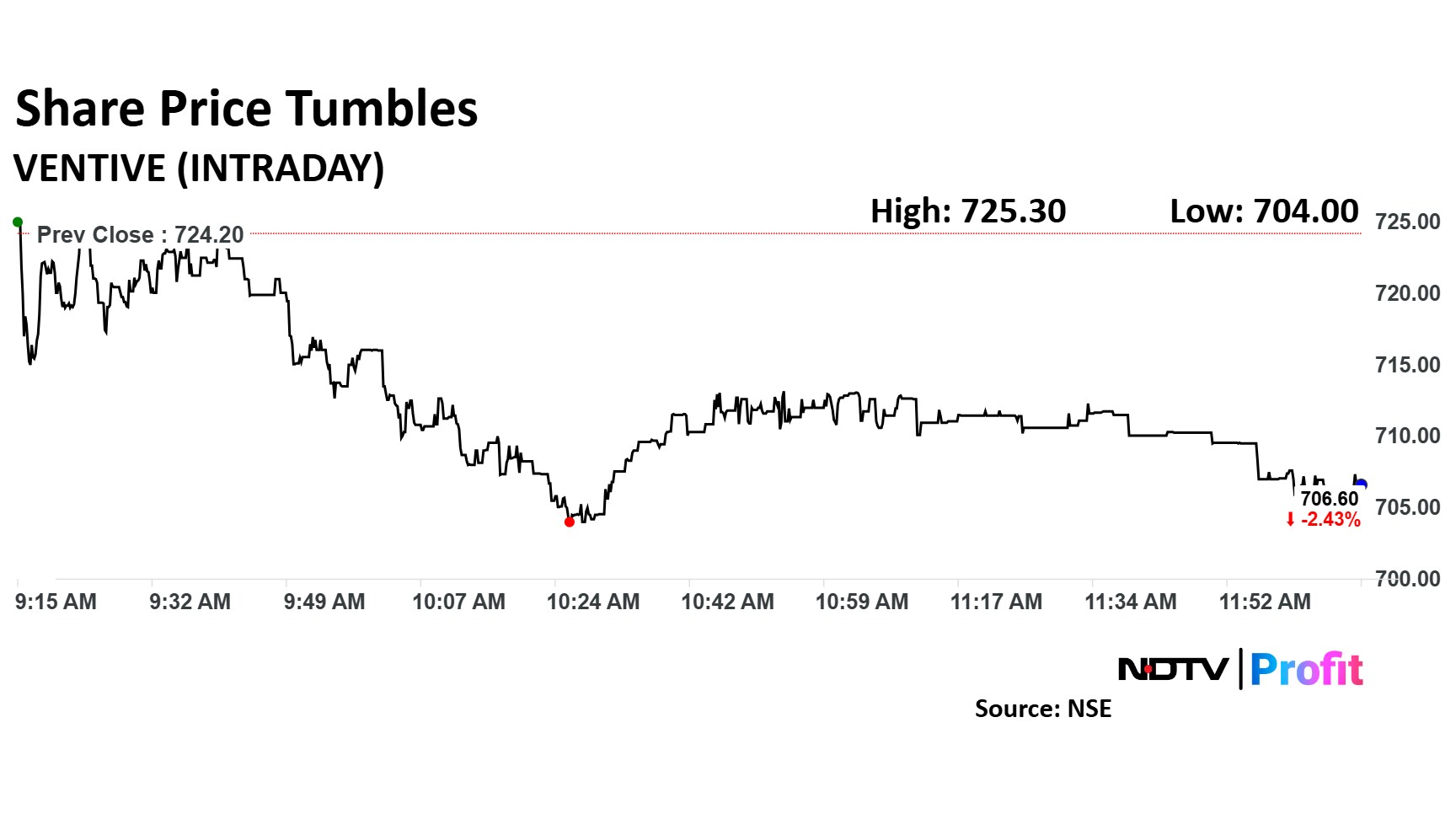

The scrip fell as much as 2.79% to Rs 704 apiece. It pared losses to trade 2.56% lower at Rs 706 apiece, as of 12:06 p.m. This compares to a 1.29% decline in the NSE Nifty 50 Index.

It has risen 0.29% in the last 12 months. Total traded volume so far in the day stood at 0.7 times its 30-day average. The relative strength index was at 48.

One analyst tracking the company maintains a 'buy' rating on the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.