Vedanta Shares Continue To Surge On Demerger Approval By NCLT

This marked the culmination of a two-year process that faced regulatory challenges, objections from the petroleum ministry, and multiple deadline extensions.

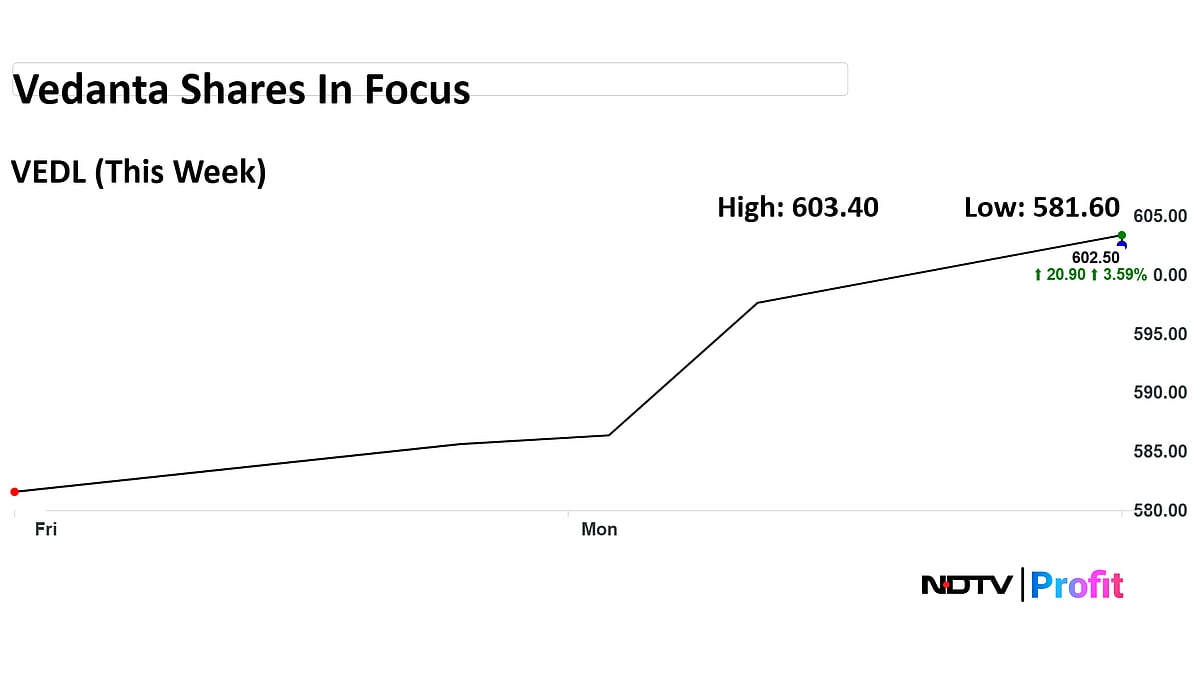

Vedanta Ltd's shares remain in focus, surging nearly 4% this week on the back of the demerger approval received last week. It has maintained a strong upward momentum, marking gains for 13 straight trading sessions.

During this period, the stock has delivered an impressive return of 18.1%, reaching a new 52-week high at Rs 607.65.

Last week, the National Company Law Tribunal (NCLT) gave its approval to Vedanta Limited’s long-awaited demerger proposal, clearing a major hurdle in the company’s restructuring journey.

Of the analysts tracked by Bloomberg with coverage on this stock, 10 have a 'Buy' call, and 4 have a 'Hold' rating.

Following the announcement, Vedanta shares surged to an all-time highs, and the momentum has sustained. This marked the culmination of a two-year process that faced regulatory challenges, objections from the petroleum ministry, and multiple deadline extensions.

The plan, spearheaded by billionaire Anil Agarwal, aims to split the metals-to-energy conglomerate into five independently listed entities — namely, Vedanta Aluminium, Vedanta Oil & Gas, Vedanta Power, Vedanta Iron & Steel, and a restructured Vedanta Limited.

Under the approved scheme, shareholders will receive one share in each of the four new companies for every Vedanta share held, while the parent entity will continue to retain its stake in Hindustan Zinc.

This move is expected to unlock value across Vedanta’s diverse businesses, improve operational focus, and attract sector-specific investors as the group transitions into a multi-entity structure.

Additionally, Vedanta Group Chairman Anil Agarwal remains optimistic about silver, despite some analysts warning of a possible correction following its record rally in 2025. Agarwal believes silver will retain its appeal even amid short-term price fluctuations.

Agarwal also revealed that Vedanta is setting up a green aluminium facility with a planned capacity of 3 million tonnes, driven by rising domestic demand and the government’s infrastructure push.

He further noted recent regulatory reforms in oil and gas exploration, adding that Vedanta aims to deploy 25 rigs to achieve an initial production target of up to 500,000 barrels per day.