(2).jpeg?downsize=773:435)

Vedanta Ltd.'s share price declined over 1% but later recovered to trade 0.10% higher following the release of its fourth-quarter financial results. The company's revenue increased by 1.65% to Rs 40,455 crore, compared to Rs 39,795 crore in the previous quarter, slightly exceeding the estimated Rs 39,593 crore.

Despite the revenue growth, earnings before interest, tax, depreciation and amortisation fell by 2.7% to Rs 11,466 crore from Rs 11,784 crore, missing the estimated Rs 12,356 crore. This decline in Ebitda indicates increased operational costs and other financial pressures.

The Ebitda margin also contracted 28.34% from 29.61%, below the estimated 31.2%.

Additionally, net profit decreased by 1.8% to Rs 3,483 crore, down from Rs 3,547 crore, though it slightly exceeded the estimated Rs 3,456 crore.

Vedanta's India operations in zinc, lead, and silver experienced a quarter-on-quarter revenue growth ranging from 4% to 15%. The international zinc segment reported a 6% increase in revenues, while the oil and gas segment remained stable at Rs 2,658 crore.

The power, copper, and aluminium segments saw sales rise between 4% and 11%. However, the copper segment negatively impacted overall revenue growth, with sales declining by 6% quarter-on-quarter to Rs 6,138 crore.

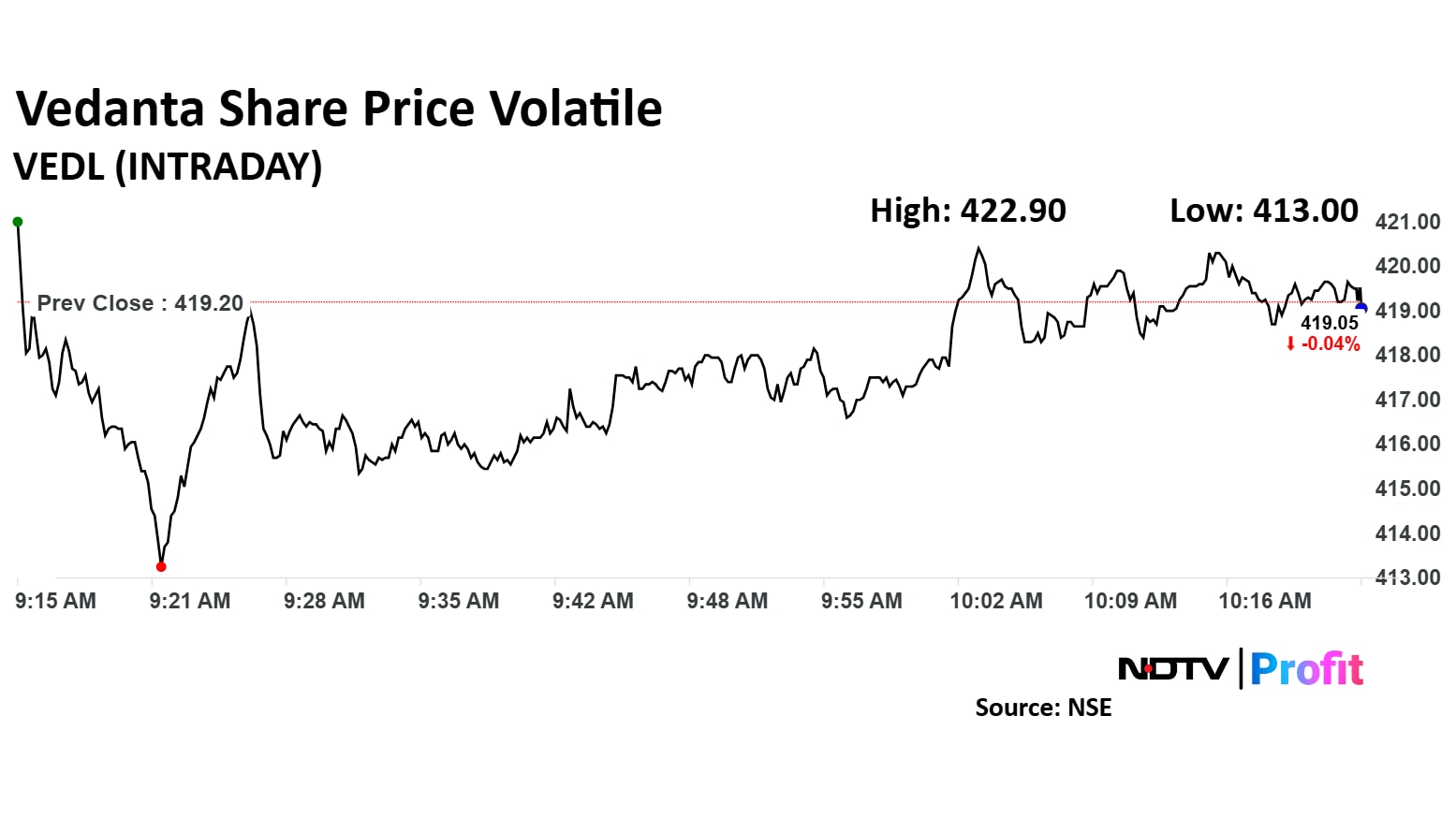

The scrip fell as much as 1.48% to Rs 413 apiece. It later recovered the losses to trade 0.10% higher at Rs 419.60 apiece, as of 10:26 a.m. This compares to a 0.86% advance in the NSE Nifty 50 Index.

It has risen 2.14% in the last 12 months. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 49.

Out of 15 analysts tracking the company, 10 maintain a 'buy' rating, four recommend a 'hold', and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.