Varun Beverages Ltd.'s share price rose over 1% on Thursday, after more than 21 lakh shares changed hands in four block deals.

Shares amounting to Rs 111 crore were sold in a block deal. The stock pared gains to trade 0.41% lower at Rs 508 apiece as of 2:00 p.m. on Thursday.

Varun Beverages Q1 Performance

The Pepsi bottler follows a January-December period to report its quarterly results and released results for the first quarter on April 30, 2025.

It reported a 35% year-on-year rise in net profit compared to Rs 537.27 crore in the same quarter of the previous fiscal, according to its stock exchange notification. This was above Bloomberg's estimates of Rs 741 crore.

Along with this, both its Ebitda and revenue were up 28% to Rs 1,263.96 crore and 29.2% to Rs 5,566.94, respectively.

The company's sales volume saw growth, with consolidated figures up 30.1%. This growth was driven by a 15.5% organic volume increase in India and a 13% rise in South Africa. Its South African operations achieved 141 million cases over the trailing four quarters, indicating successful integration of the territory.

However, this strong volume performance was accompanied by margin compression from 22.9% to 22.7%. Varun Beverages had declared an interim dividend of Rs 0.50 per share, with a record date of May 7.

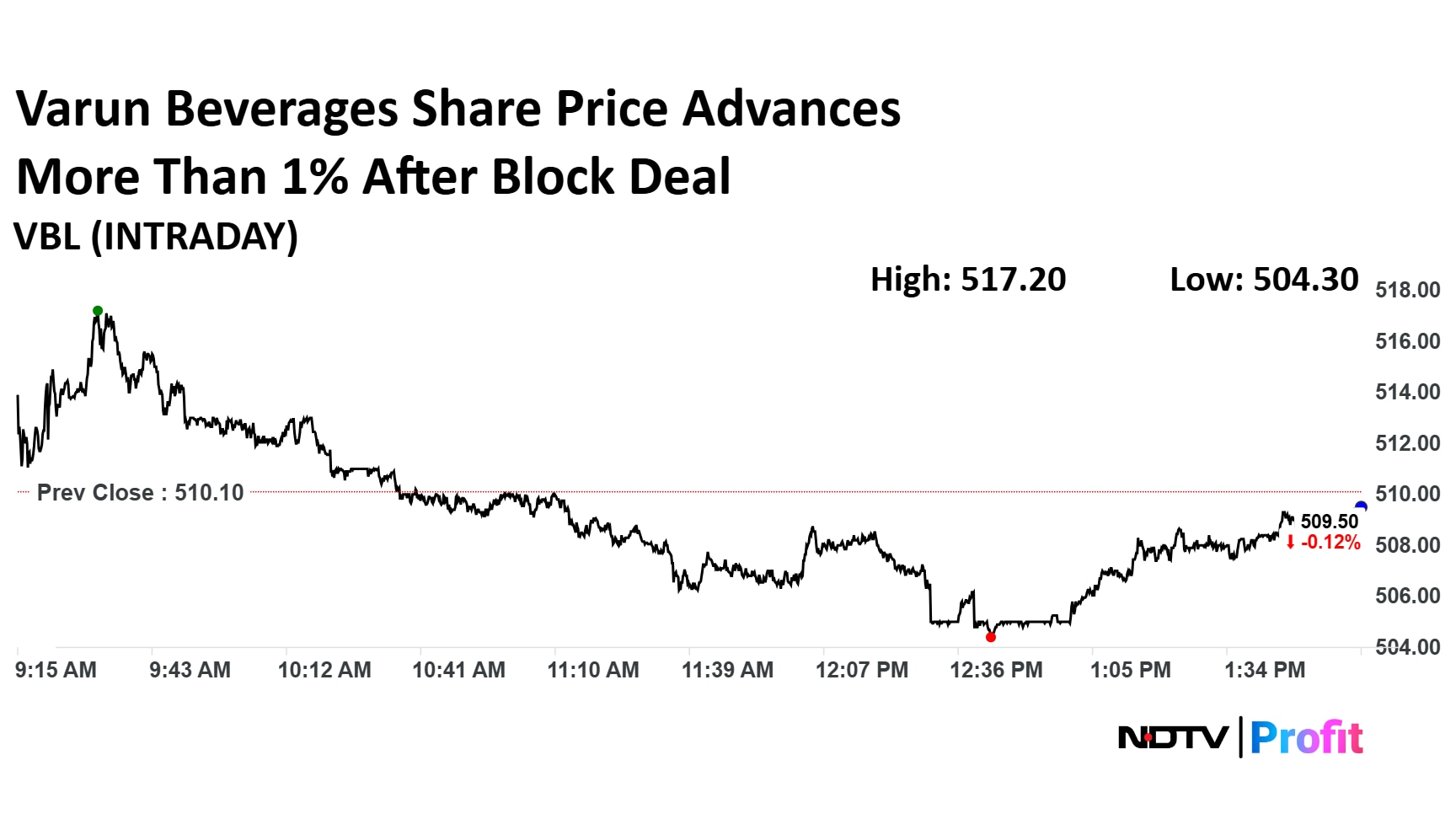

Varun Beverages Share Price

The scrip rose as much as 1.39% to Rs 517.20 apiece, the highest level since May 13, 2025. It pared gains to trade 0.41% lower at Rs 508 apiece, as of 2:00 p.m. This compares to a 1.71% advance in the NSE Nifty 50.

The stock has fallen 20.28% on a year-to-date basis, and is down 15.13% in the last 12 months. Total traded volume so far in the day stood at 0.98 times its 30-day average. The relative strength index was at 43.64.

Out of 27 analysts tracking the company, 25 maintain a 'buy' rating and two recommend a 'hold' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 23.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.