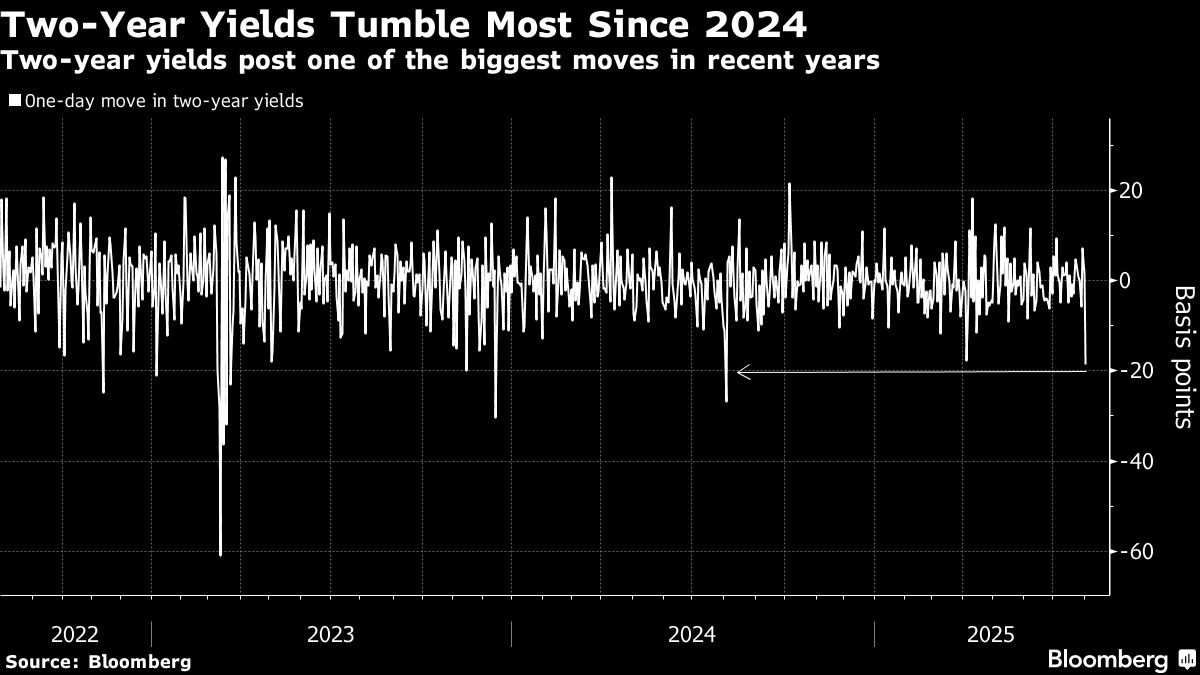

Treasuries rallied, with short-term yields posting their biggest drop in a year, after softer US jobs data prompted traders to boost bets that the Federal Reserve will lower interest rates as soon as next month.

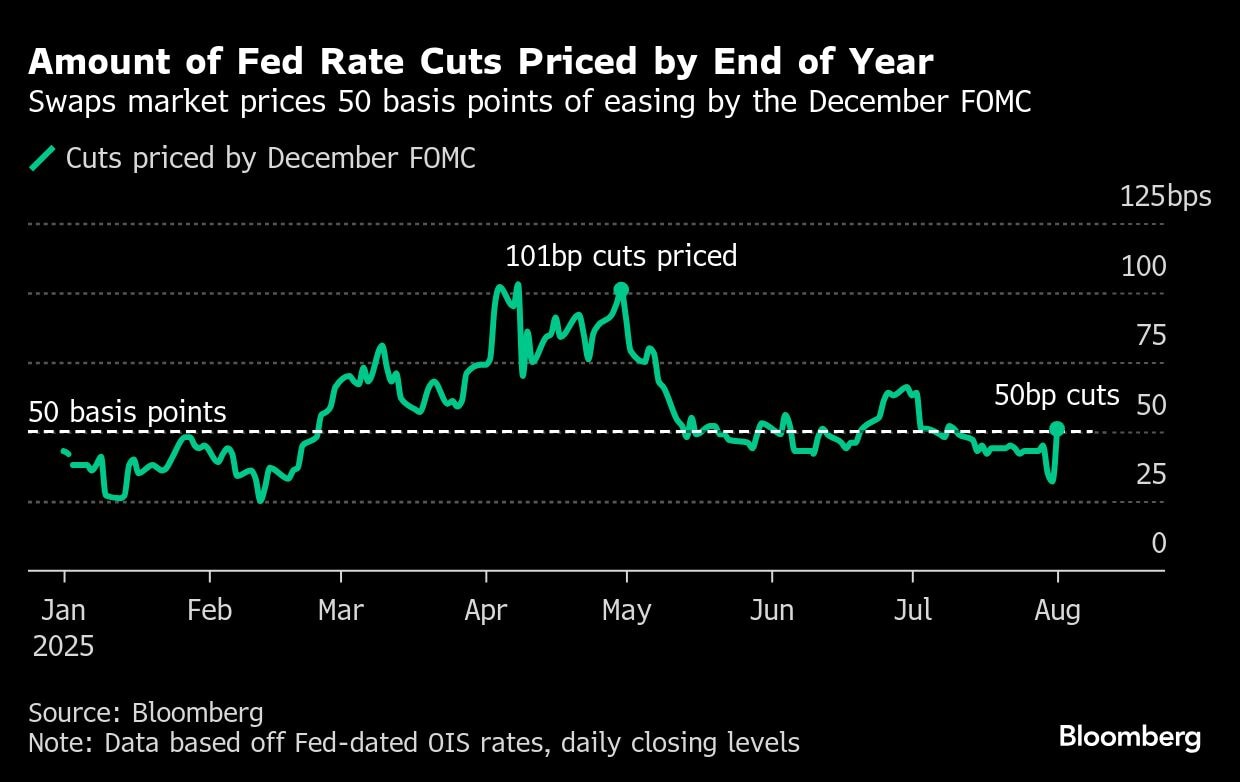

Yields on two-year notes tumbled 21 basis points to 3.74%, setting up the biggest drop since last August. Traders fully priced in two rate cuts this year, with an 80% chance of a reduction in September.

The move weighed on the dollar and stocks, sending an index of the greenback's strength down as much as 1% and the S&P 500 nearly 2% lower.

The yield moves reflected a dramatic shift in sentiment around the monetary policy outlook, shaped in part by President Donald Trump's relentless pressure on Fed Chair Jerome Powell to cut rates despite elevated inflation expectations.

“We would look for the Fed to begin lowering rates in September,” said Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities. “It's somewhat amazing how you can have a sitting Fed Chair intimate the strength in labor one day and receive these numbers a few days later.”

Expectations for rate cuts collapsed on Wednesday after Powell's latest comments on the outlook, less than an hour after Trump said it was his understanding the Fed would cut in September. Friday's rebound — a seeming validation of Trump's view and those of two Fed governors he appointed, who dissented from the July 30 decision not to cut rates — may prove historic.

The moves were sparked by a report on US labor that showed payrolls increased 73,000 in July. Figures for the prior two months were revised down by nearly 260,000. The jobless rate ticked up to 4.2%, from 4.1%.

While the pace of hiring has been slowing since April, Powell said low unemployment indicated the jobs market was “in balance” when explaining why policymakers remain on the sidelines.

On Friday, Fed Governors Christopher Waller and Michelle Bowman expressed concerns that policymakers' hesitance to lower rates could risk damaging the labor market. The two policymakers voted against the Fed's decision this week, opting for a quarter-point reduction.

The jobs report suggests Waller's camp “may hold sway or convince more people to come on his side of the argument. And maybe they missed the opportunity in July but it raises the odds you get it in September,” said Jeffrey Rosenberg, portfolio manager at BlackRock Inc., said on Bloomberg Television. “That is why you are seeing the big move on the front end of the curve.”

Friday's rally reversed Treasuries' 0.4% loss last month, only the second monthly decline this year. The market is still up 3.4% for the year.

“It's a big beautiful bond market,” said Michael Collins, portfolio manager at PGIM Fixed Income, said on Bloomberg Television.

He prefers the two- to 10-year part of the curve where “you don't have to take a lot of interest-rate risk to get a lot of benefit.”

The magnitude of the shift Friday was reflected in high trading volumes in Treasury futures. Some of that activity involved scrapping wagers on shrinking gaps between short- and long-term Treasury yields, which became losers in the rally unleashed by the jobs data, in which those gaps widened as two- to five-year yields saw the biggest declines.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.