US stocks pared early-morning declines as investors assessed Treasury Secretary Scott Bessent's positive trade remarks and the latest batch of earnings results.

The S&P 500 Index fell 0.3% at 11:26 a.m. in New York after declining as much as 1.1% earlier. The Nasdaq 100 came off session lows to trade down 0.6%. Palantir Technologies Inc. slumped 12% after its results failed to live up to lofty expectations, while Constellation Energy Corp. rose 9.3% as analysts noted the company is nearing a long-term nuclear power deal.

Some “very good” offers have been made to the US in negotiations with trading partners, Bessent said in answering questions at a House Appropriations Committee hearing on Tuesday, while reiteraring that a deal could be announced as soon as this week.

US stocks are still on track for a second consecutive day of losses as investors assess the impact of trade tensions on corporate results and look ahead to Wednesday's Federal Reserve interest-rate announcement.

“Investors are in wait and see ahead of the FOMC and actual trade deal announcements, and markets still need to price in below trend GDP growth,” said Kevin Brocks, director of 22V Research.

Utilities stocks, which are often seen as a defensive play, outperformed Tuesday, followed by gains in energy as oil prices rose after technical measures suggested a recent plunge may have been overstretched.

Among single stock movers, DoorDash Inc. fell 6.9% after announcing two multibillion-dollar acquisitions that stand to turn what is already the largest food-delivery service in the US into a formidable global player. Hims & Hers Health Inc. jumped 12% after the telehealth company posted better-than expected first-quarter results, which TD Cowen views as “impressive.”

At the Milken Institute Global Conference in Los Angeles, financial leaders said they could live with tariffs and trade reforms, but called for an end to the uncertainty.

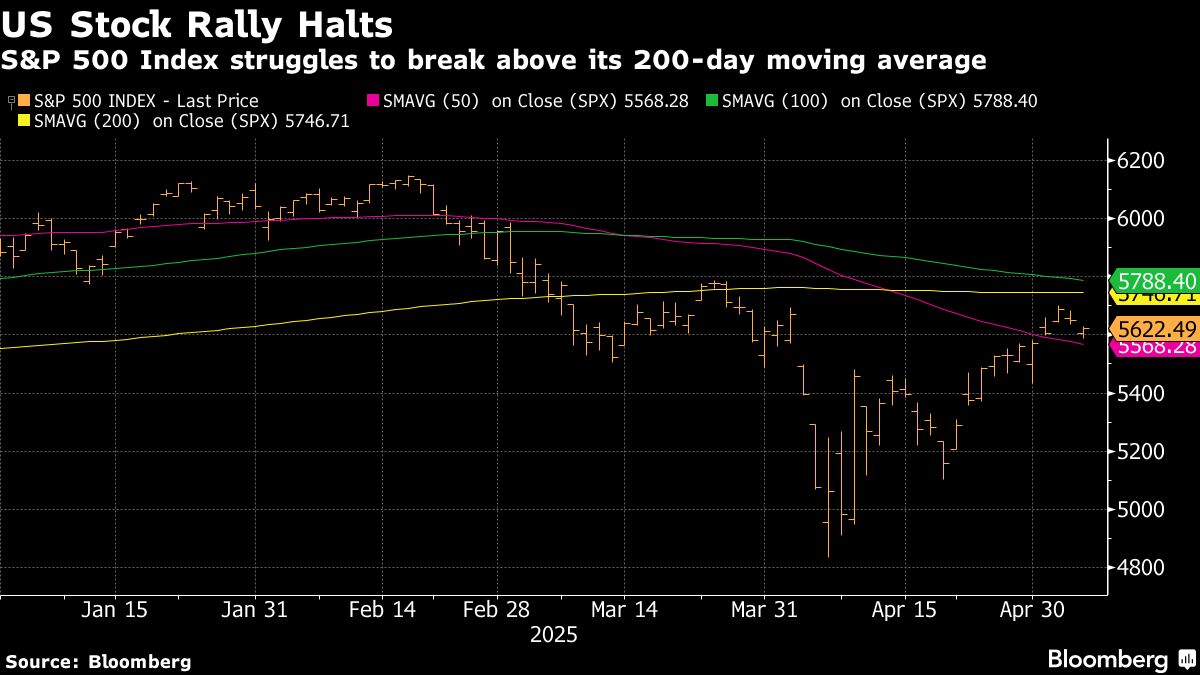

Goldman Sachs strategists warned that current stock valuations leave little room for the recent rally to continue, after the S&P 500 ended its longest winning streak in nearly two decades on Monday. JPMorgan Chase & Co. strategists say US assets are “not a good place to hide.”

Options markets reflected the shift in mood, with investors hedging against another downturn rather than betting on more gains.

Meanwhile, billionaire investor Paul Tudor Jones said he expects US President Donald Trump to dial back China tariffs by 50%, calling the levies “the largest tax increase since the ‘60s.” He said that unless the US Federal Reserve suddenly starts cutting rates, “you're probably going to new lows.”

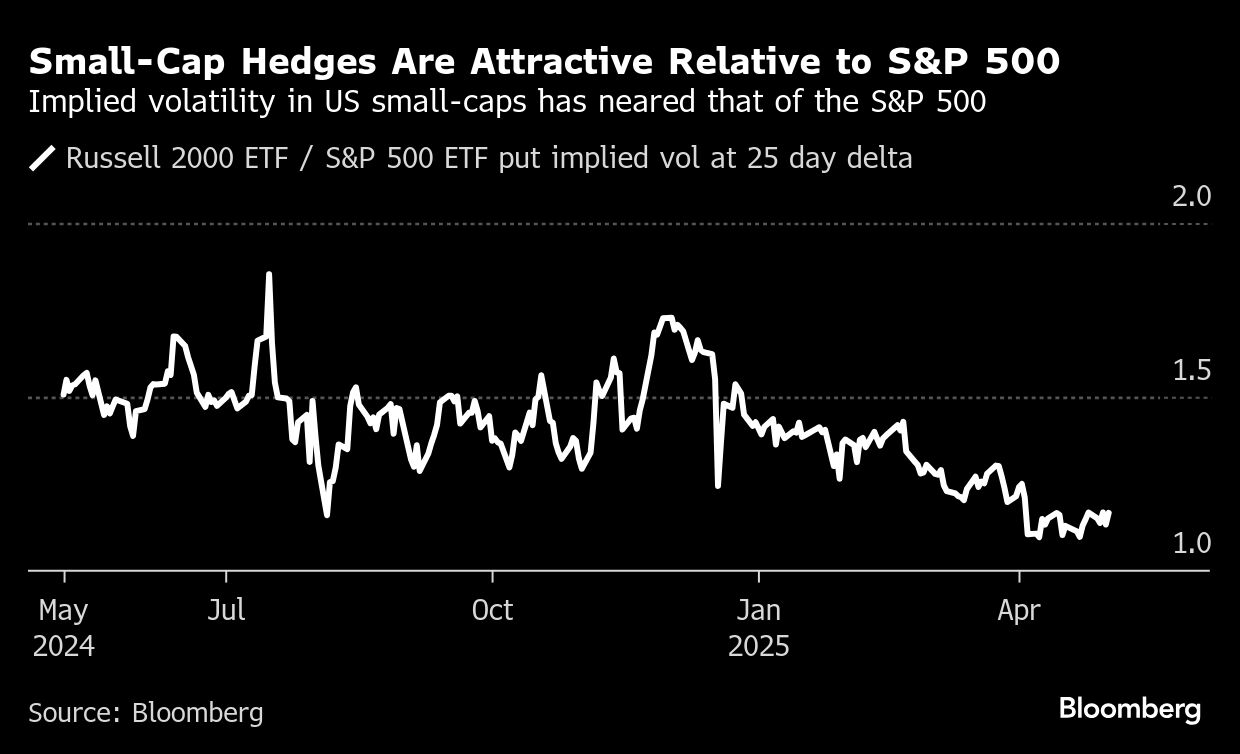

To BNP Paribas' Greg Boutle, it's a good time to protect against a slide in small-cap names. He suggests traders buy puts — a bet on stocks fall to a certain level — on the small-cap focused Russell 2000 Index, and buying options expiring in July to capture two volatility-inducing events: Wednesday's Federal Reserve rate decision and the expiration of the pause on President Donald Trump's reciprocal tariffs.

Meanwhile, demand from retail traders remains strong. Bank of America Corp.'s individual-investor clients snapped up stocks for 21 consecutive weeks through last Friday, the longest buying streak in the firm's data history going back to 2008, strategists led by Jill Carey Hall say Tuesday in a research note.

Tesla Inc. fell 1.57% as sales kept sliding across Europe's biggest electric-car markets in April, despite the company rolling out an updated version of its most popular vehicle. The carmaker registered only 512 new vehicles last month in the UK, down 62% from a year earlier.

In the consumer space, WK Kellogg Co shares fell 3.00% after the packaged-food company's organic sales declined more than expected.

Investors now turn their attention to Wednesday's FOMC meeting with traders dialing back bets on Federal Reserve interest-rate cuts on strong economic data in recent days.

“Doing nothing and saying less is probably a welcome option for the FOMC when there is so much uncertainty on fiscal and tariff policies and their ultimate economic and asset-market consequences,” wrote Steven Englander, head of global G10 FX research and North America macro strategy at Standard Chartered Bank.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.