Relief that Donald Trump will hold off from imposing China-specific tariffs on his first day in office propelled US equity futures higher on Monday. The dollar slumped.

The incoming administration has pivoted toward starting his second term with potential engagement with Beijing rather than another trade war, according to people familiar with the plans.

Trump plans to issue a broad memorandum that directs federal agencies to study existing trade policies and relationships with China, Canada and Mexico, the Wall Street Journal reported earlier Monday. The memo stops short of calling for new tariffs on the three biggest US trading partners.

That suggests a more deliberative approach, coming as a relief to investors who were expecting a barrage of executive orders after Trump's inauguration on Monday. It also gave a foretaste of the uncertainty and volatility to come, according to Michael Green, chief strategist at Simplify Asset Management.

“The challenge becomes are you protecting against the risk of tariffs, or the risk that expected tariffs are not going to be put on?” Green said in an interview with Bloomberg TV. “It becomes a really challenging environment, one that likely translates to higher implied volatility.”

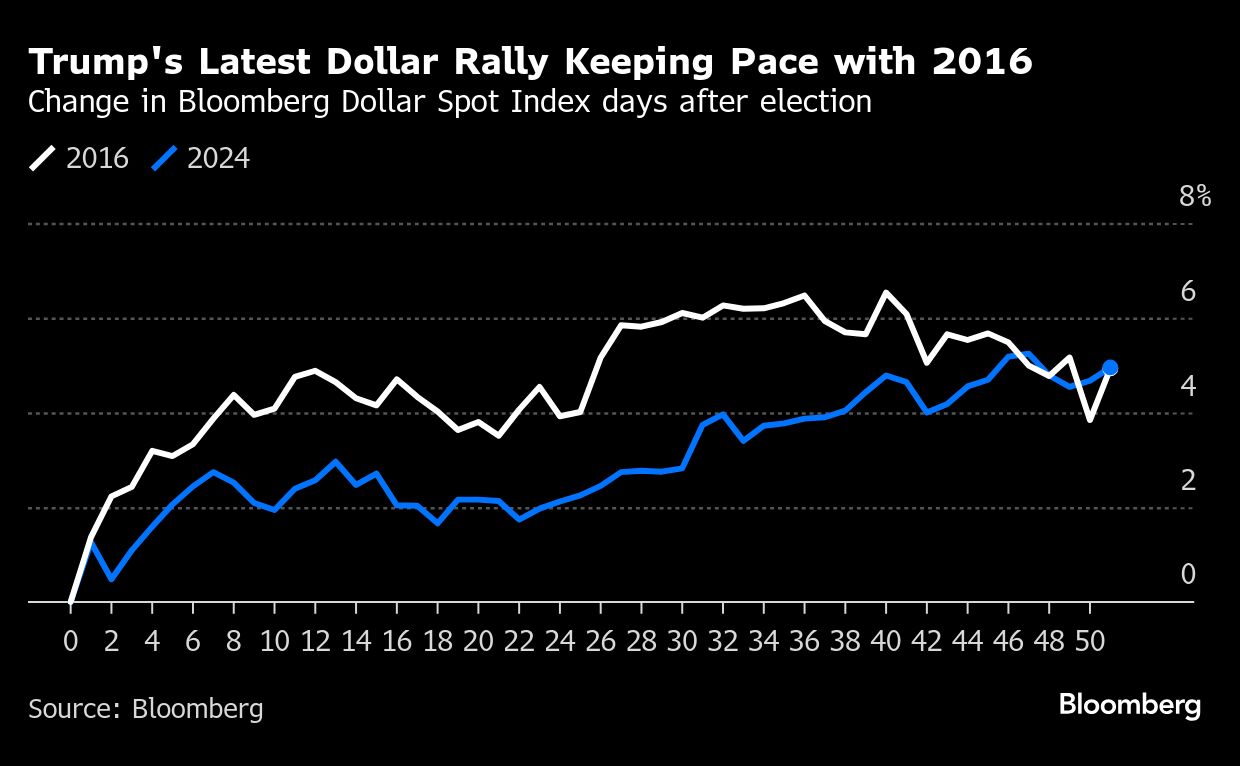

A gauge of the dollar dropped as much as 1.1%, extending a retreat from the 13-month high it reached earlier in January. Contracts on the S&P 500 rose 0.4% with Wall Street closed Monday for a holiday.

Trump's plan to invoke emergency powers in order to boost domestic energy production, while shifting away from renewable sources, sparked declines in Siemens Energy AG, Enel SpA and Vestas Wind Systems A/S. Crude oil fell.

Bitcoin climbed to a fresh record after the president-elect and his wife Melania unveiled their own memecoins over the weekend. Trump's conversation with China's leader Xi Jinping — which he described as “very good” — boosted Asian stocks on Monday.

Read More: Bitcoin Traders Latch on to Any Driver to Sustain Confused Rally

The decision not to immediately target Beijing reflects a shift by the incoming president into a negotiating mode and an eagerness to cut another deal with Xi, one of the people familiar with his plans said Monday.

Trump's inflationary domestic agenda, from tax cuts to fiscal spending, may keep the dollar strong and Treasury yields elevated. For one, Nomura Holdings Inc. has joined T. Rowe Price in seeing a chance of 10-year Treasury yields rising to 6% this year, while a small group of bond traders believe the Federal Reserve's next move on interest rates will be to increase them, contrary to the majority view that rates will be cut.

“Any further stimulus that sparks a growth and inflation shock could lead to a Fed rate hiking cycle, for which markets are largely unprepared,” Iain Stealey, international CIO for fixed income at J.P. Morgan Asset Management, wrote in a note to clients.

Key events this week:

The annual World Economic Forum in Davos begins, Monday

Donald Trump to be sworn in as 47th president of US, Monday

UK jobless claims, unemployment, Tuesday

Canada CPI, Tuesday

New Zealand CPI, Wednesday

Malaysia CPI, rate decision, Wednesday

South Africa retail sales, CPI, Wednesday

ECB President Christine Lagarde and other officials speak at Davos, Wednesday

South Korea GDP, Thursday

Eurozone consumer confidence, Thursday

Turkey rate decision, Thursday

Norway rate decision, Thursday

Canada retail sales, Thursday

Trump will join the World Economic Forum for an online “dialogue”

Japan CPI, rate decision, Friday

India, euro area, UK PMIs, Friday

ECB President Christine Lagarde and BlackRock CEO Larry Fink speak at Davos, Friday

And here are the main market moves:

Stocks

S&P 500 futures rose 0.4% as of 11:34 a.m. New York time

Futures on the Dow Jones Industrial Average rose 0.4%

The Stoxx Europe 600 was little changed

The MSCI World Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index fell 1%

The euro rose 1.3% to $1.0404

The British pound rose 1.1% to $1.2304

The Japanese yen rose 0.4% to 155.65 per dollar

Cryptocurrencies

Bitcoin rose 1.6% to $105,233.79

Ether rose 3.5% to $3,343.66

Bonds

The yield on 10-year Treasuries was little changed at 4.63%

Germany's 10-year yield declined one basis point to 2.52%

Britain's 10-year yield was little changed at 4.65%

Commodities

West Texas Intermediate crude fell 1.7% to $76.57 a barrel

Spot gold rose 0.2% to $2,707.39 an ounce

This story was produced with the assistance of Bloomberg Automation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.