US stock funds suffered the biggest outflows in almost three months, according to data published by Bank of America Corp., adding to signs that the equity market rally is stalling.

About $9.8 billion was redeemed from US stocks in the week through Wednesday, the most in 11 weeks, according to EPFR Global data cited by the bank. Even European funds, which have been popular with investors this year, suffered their first outflows in nine weeks at $600 million.

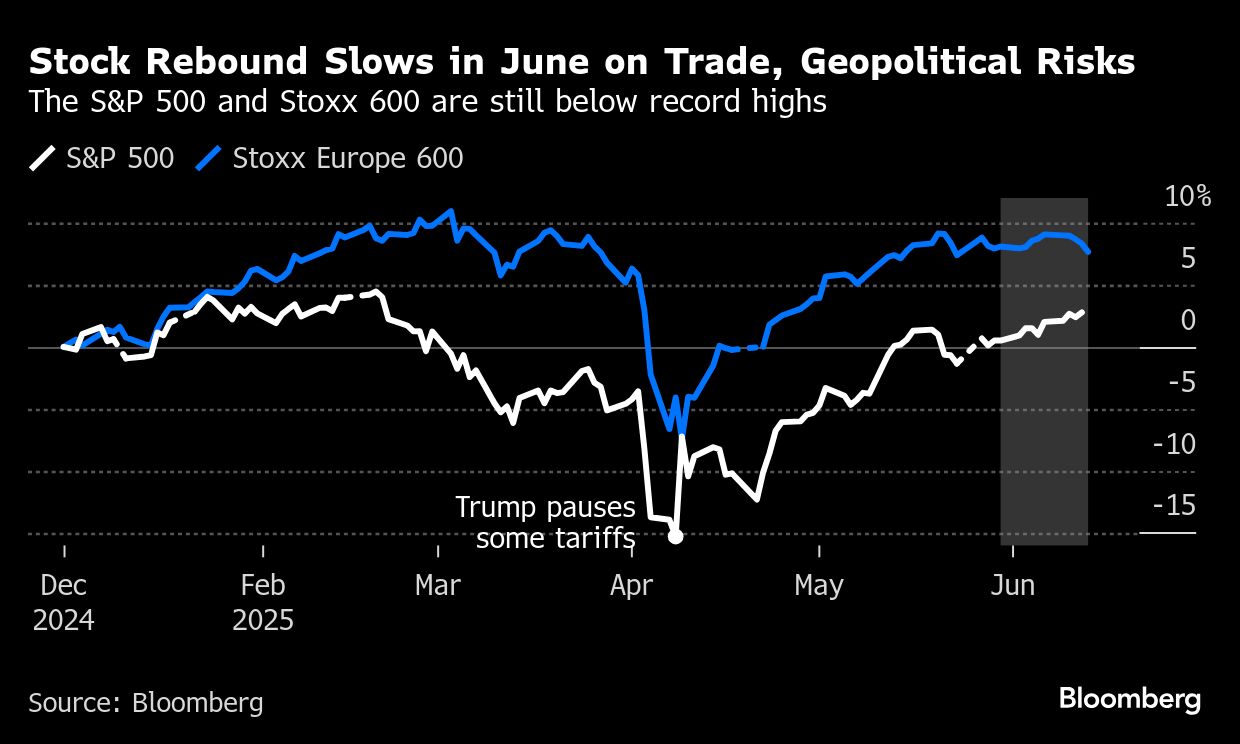

An equity rebound from April lows has slowed this month as the outlook for global trade remains uncertain. While latest US data eased worries about an imminent recession in the world's biggest economy, investors are closely watching the outlook for stagflation and potential rate cuts from the Federal Reserve.

Tensions in the Middle East have also ratcheted up as Israel launched airstrikes across Iran on Friday, targeting nuclear facilities and killing senior military commanders. S&P 500 futures fell 1.2%, while the Stoxx 600 slipped 0.8%.

Bank of America strategist Michael Hartnett said signs of economic resilience and expected tax cuts had left the “door wide open for stock bulls.” However, he said further gains in US equities would be healthy only if they included a broad section of the market.

Meanwhile, a stalled rally in European stocks and Japanese banks would be the first signs of a “global equity bull trap” in the third quarter, he said.

The strategist has recommended international equities to US peers this year.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.