Shares of liquor companies fell in early trade on Friday after India and the United Kingdom signed a landmark free trade agreement (FTA) that includes steep reductions in import duties on Scotch whisky and gin. The pact, which marks India's first major FTA in over a decade, triggered a cautious reaction from investors amid concerns over pricing dynamics and competitive pressures in the premium alcohol segment.

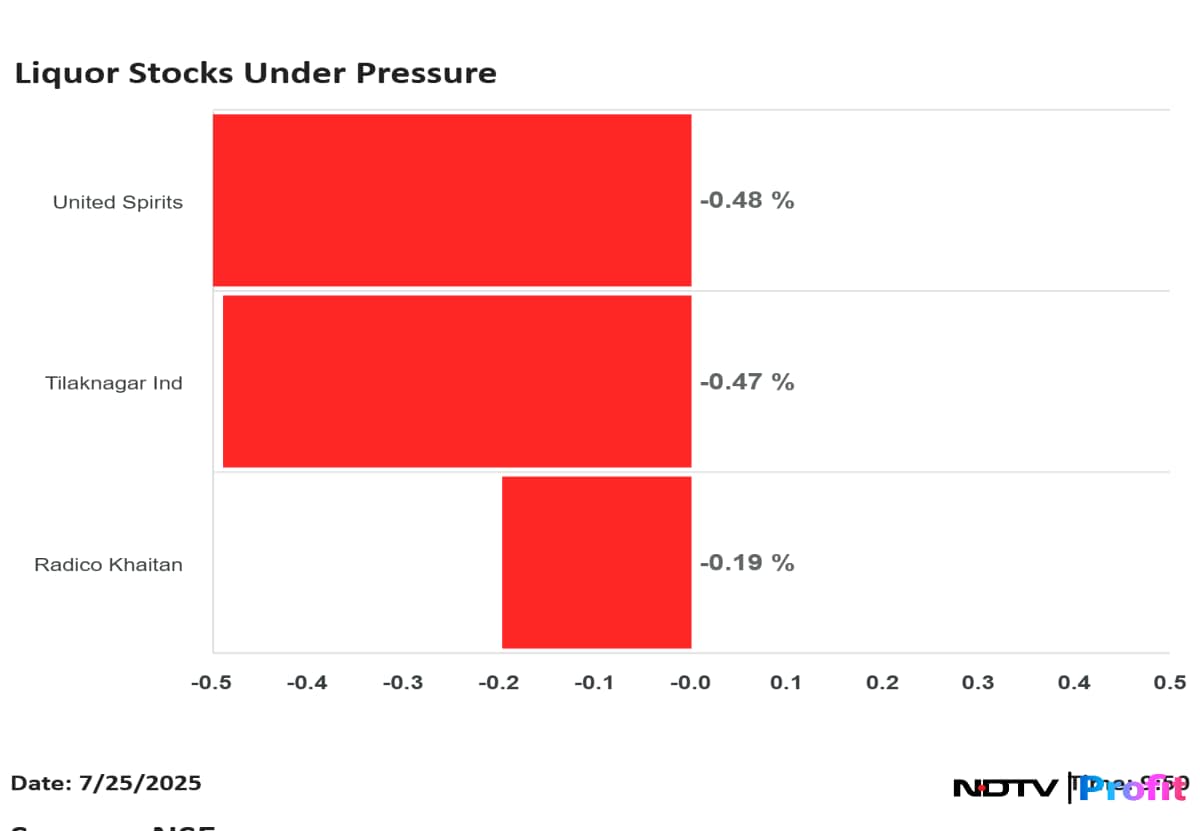

Radico Khaitan dropped 1.69%, Tilaknagar Industries fell 2.09%, and United Spirits was down 0.69% as the market digested the implications of the deal. The FTA will immediately cut import duties on Scotch and gin from 150% to 75%, with a further reduction to 40% over the next ten years. This could lead to lower consumer prices for imported spirits.

The agreement is expected to benefit multinational brands like Johnnie Walker, Chivas Regal, and Ballantine's, with price reductions ranging from Rs 100 to Rs 300 per bottle depending on the segment. However, the extent of these cuts will depend heavily on state-level pricing mechanisms, including excise duties and ex-distillery pricing, which are major sources of revenue for state governments.

As a result, any consumer-facing price drop may be limited or temporary, said Vinod Giri, Director General of the Brewers Association of India.

Despite the broader economic promise of the India-UK FTA—which spans 26 chapters including trade, services, and intellectual property—the immediate stock reaction in the liquor sector reflects investor caution.

Out of 25 analysts tracking United Spirits Ltd. 16 maintain a 'buy' call, three maintain a 'hold' call and six suggest a 'sell' on the stock.

Similarly, for Radico Khaitan out of 15 analysts tracking the company 10 maintain 'buy' call, three maintain 'hold' call and two suggest a 'buy'.

Only one analyst is tracking Tilaknagar and they maintain 'buy' call on the stock.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.