United Breweries Ltd.'s share price fell nearly 4% on Monday after Citi Research downgraded the stock to "sell", citing ongoing regulatory and operational challenges impacting the company's margin recovery.

In its second-quarter earnings report, United Breweries announced a 12% increase in revenue to Rs 2,110 crore, supported by 5% growth in volumes despite external pressures. The company's management remains focused on premiumisation, with premium beer volumes surging 27%. Notably, the launch of Amstel Grande, a new India-specific premium strong beer, aims to capture a larger market share, the brokerage said.

However, Citi expressed concerns over the need for significant investments in infrastructure and marketing, which could keep margins under pressure. The brokerage cut its earnings estimates for financial year 2025-27 by 4-8% and maintained a target price of Rs 1,800, reflecting a cautious outlook.

Key upside risks to this target price include legislation, as the brewing industry is highly regulated in India, and easing such regulations could improve UB's competitive positioning. The ongoing trend of premiumisation may benefit UB through brands like Kingfisher Ultra, while a faster resolution of route-to-market changes and easing inflation could further enhance profitability, the firm said.

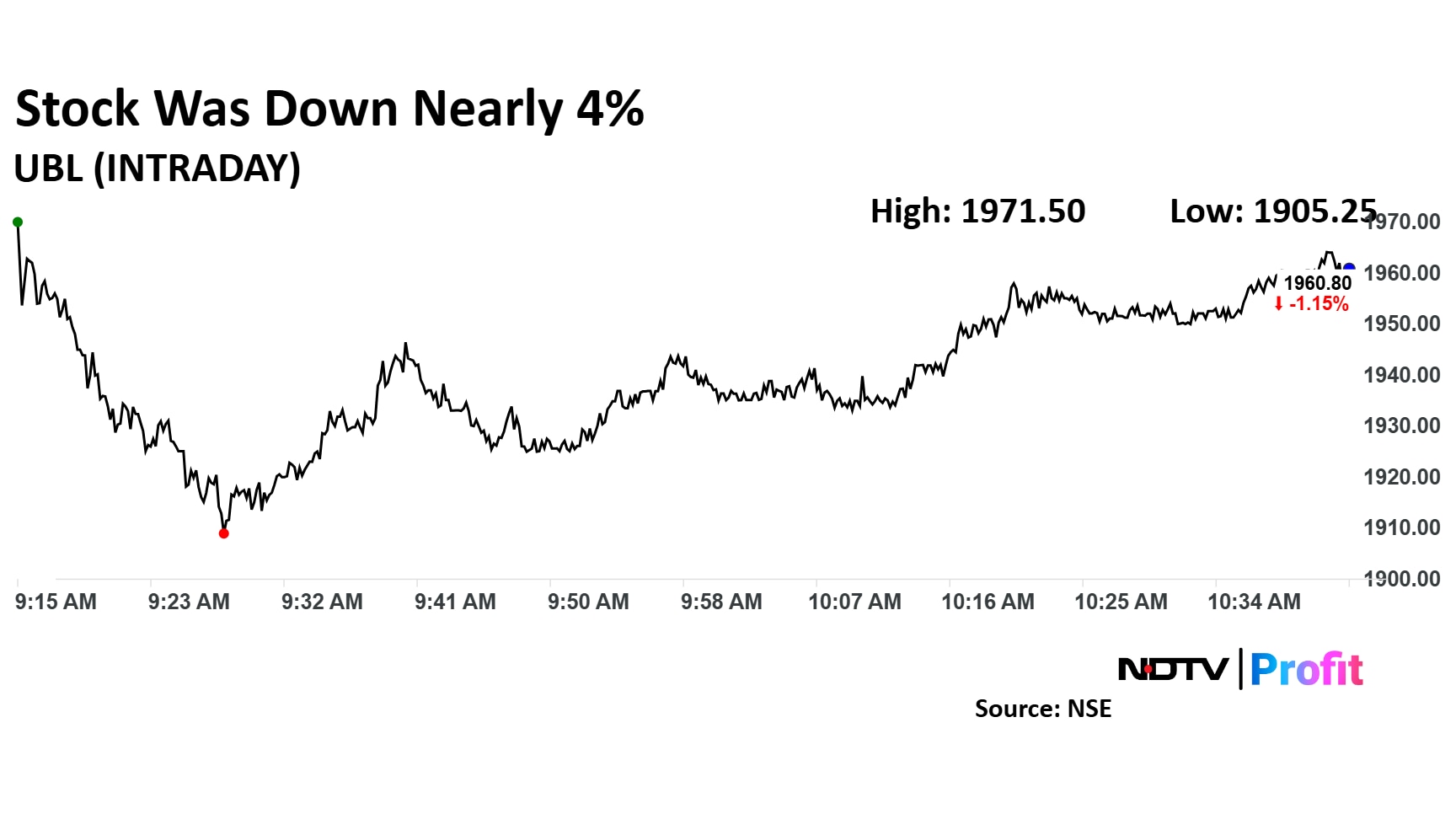

Shares of the company fell as much as 3.95% to 1,905.25 apiece. The stock pared losses to trade 1.38% lower at Rs 1,956.20 apiece as of 10:38 a.m. This compares to a 0.97% advance in the NSE Nifty 50 index.

The stock has risen 21.57% in the last 12 months. Total traded volume so far in the day stood at 1.4 times its 30-day average. The relative strength index was at 37.

Out of 16 analysts tracking the company, seven maintain a 'buy' rating, four recommend a 'hold,' and five suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.1%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.