.jpg?downsize=773:435)

Union Bank of India Ltd.'s share price declined nearly 6% in Wednesday's session as the lender's advances and deposits declined sequentially in the first quarter of fiscal 2026. Its advances fell 2.4% on the quarter to Rs 12.4 lakh crore in the June quarter.

The lender reported a 1% sequential decline in its advances for the June quarter. Its CASA deposits declined 5% on the quarter to Rs 4.03 lakh crore.

On a year-on-year basis, however, both deposits and advances grew.

Union Bank Of India Q1 Business Update (YoY)

Total business rose 5% to Rs 22.1 lakh crore.

Total deposits rose 3.6% to Rs 12.4 lakh crore.

Domestic deposits grew 3.6% to Rs 12.4 lakh crore.

Global gross advances rose 6.8% to Rs 9.7 lakh crore.

Domestic advances rose 6.7% Rs 9.4 lakh crore.

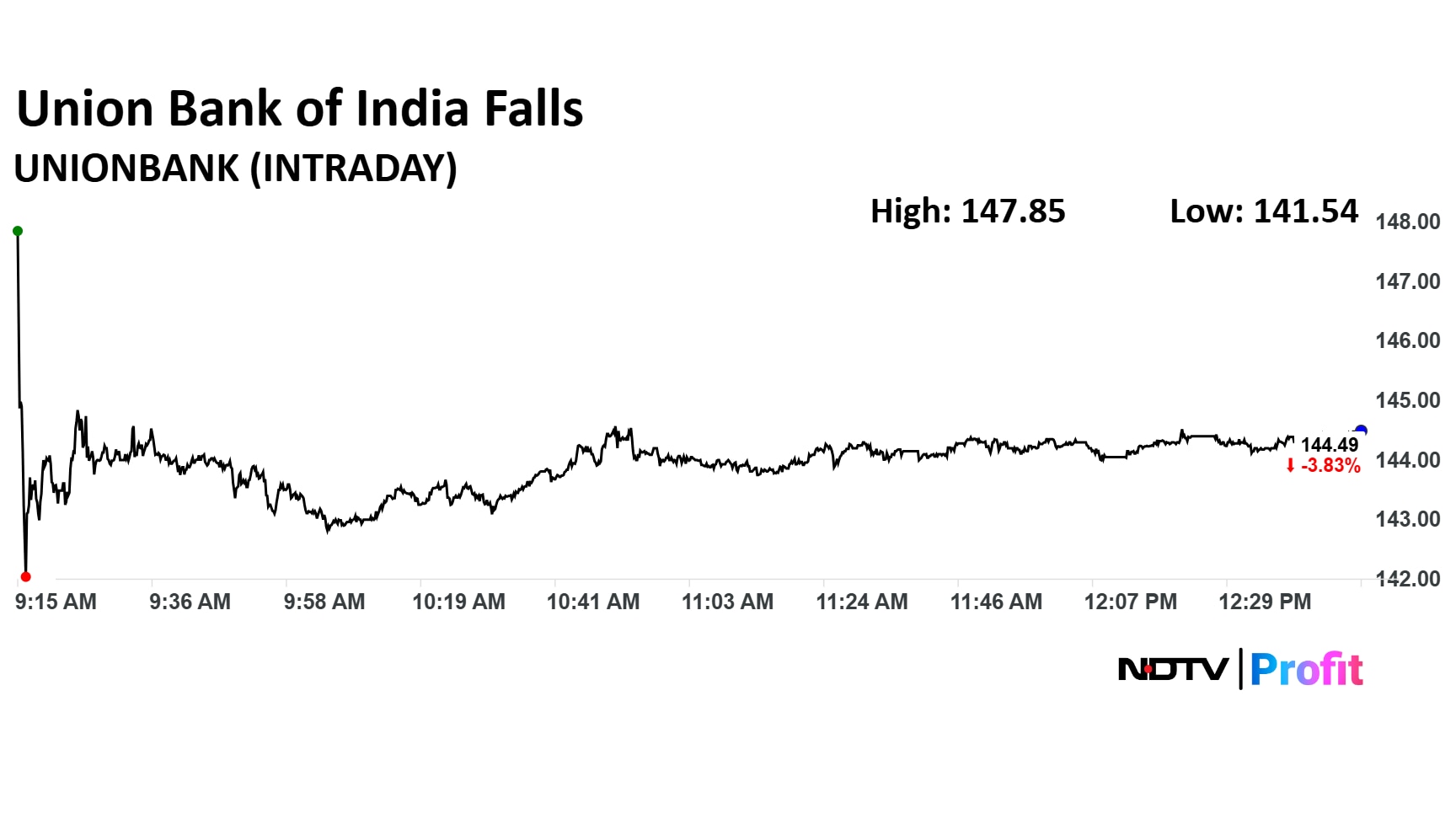

Union Bank Of India Share Price

Union Bank of India share price declined 4.83% to Rs 415.15 apiece. The share price was trading 3.38% down at Rs 421.4 apiece as of 12:48 p.m., as compared to a 0.03% advance in the NSE Nifty 50.

The stock rose 3.31% in 12 months, and 20% on year-to-date basis. Total traded volume so far in the day stood at 3.0 times its 30-day average. The relative strength index was at 45.18.

Out of 12 analysts tracking the company, nine maintain a 'buy' rating, one recommends a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.