Shares of UltraTech Cement Ltd. fell on Friday despite the third quarter numbers being slightly ahead of expectations. However, while most analysts remain positive, CLSA remains cautious on the stock's valuation, suggesting a balanced risk-reward profile at current levels.

The cement major reported third quarter results beating street expectations on most metrics, primarily driven by cost reductions and the recovery in demand.

With volumes up 10% year-on-year, and Ebitda per tonne rising by 32% sequentially to Rs 964, the cement company continues to lead in both growth and profitability, CLSA said. Furthermore, cement prices have rebounded, surpassing previous declines, with a 3% increase from third quarter levels.

Despite these growth drivers, the brokerage maintained a 'hold' rating, highlighting a balanced risk-reward scenario. It did upgrade its target price to Rs 12,100 from Rs 12,015.

While volumes were in line with expectations, cement realisations remained flat quarter-on-quarter, leading to a slight miss, JPMorgan said. The brokerage expects cement demand and pricing to improve sequentially in the near term, supported by industry consolidation, which should boost Ebitda per million tonne.

The cement company has made significant strides with its acquisitions, including India Cements, and plans to complete the Kesoram acquisition by March 2025, said JPMorgan. It maintains an 'overweight' rating, highlighting the long-term growth potential.

Goldman Sachs also maintains a 'buy' rating on UltraTech and raised the target price to Rs 12,580 from Rs 12,460 per share. The company's volume growth recovery and lower costs contributed to a margin beat. UltraTech stands out due to its solid balance sheet, ongoing cost-saving initiatives, timely capacity expansions, and superior pricing power, compared to competitors, said the brokerage.

These factors position the company favourably, especially in a market that may experience further consolidation. Successful execution in turning around India Cements and Kesoram will be key factors to monitor.

UltraTech Cement's strong cost-saving measures, such as reduced lead distance and higher green power capacity, are expected to continue, Jefferies said, with a target of Rs 300 per tonne in savings.

The company forecasts a 14% volume CAGR from financial year 2024-2027 and aims to reach a capacity of approximately 200MTPA by financial year 2026. With further price improvements expected in fourth quarter, Jefferies retained UltraTech as its top cement pick and values the stock at Rs 13,265.

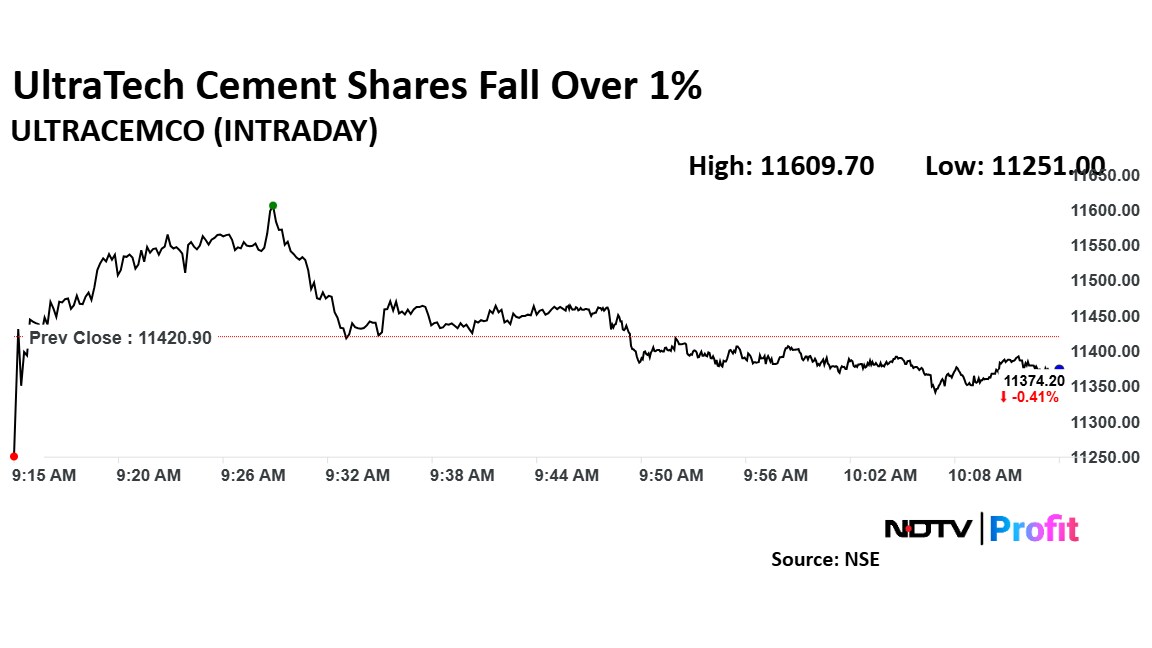

UltraTech Cement Shares Fall Over 1%

Shares of UltraTech Cement fell as much as 1.49% to Rs 11,251 apiece during opening and it pared losses to trade 0.79% lower at Rs 11,376 apiece, as of 10:04 a.m. This compares to a 0.28% decline in the NSE Nifty 50.

The stock has risen 13.87% in the last 12 months. Total traded volume so far in the day stood at 6 times its 30-day average. The relative strength index was at 56.

Out of 42 analysts tracking the company, 35 maintain a 'buy' rating, four recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 9.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.