UBS has upgraded Petronet LNG Ltd. to 'buy', raising the target price for the stock to Rs 400 from Rs 320, citing benefits for the company in meeting India's growing LNG demand.

The target price implies a significant upside as Petronet is strategically positioned to benefit from India's rising LNG dependence, UBS said. Demand is set to grow at 5.6% CAGR over the next three years, outpacing domestic gas output growth at 1.8% CAGR, the brokerage said in a recent note.

Petronet has secured five long-term LNG supply contracts starting from 2026, adding 4.2 MMTPA, a 20% jump from current levels as per the report.

Around 80–85% of incremental gas demand over the next three years expected to be met through imports, stated UBS. Liquified natural gas imports into India are expected to increase by around 11 MMTPA over the fiscal 2024 to 2028. Petronet could cater for half of these incremental imports, the brokerage said.

UBS has based its expectations on expansion of the company's Dahej terminal from 17.5 MMTPA to 22.5 MMTPA by March 2025, and improved pipeline connectivity of its Kochi terminal by mid-2025. Delay in commissioning and ramp-up of competitive terminals in Dabhol and Chhara is also likely to aid the company, UBS noted.

Expansion of the Dahej facility and use-or-pay agreements for new capacity showcase strong earnings visibility, said UBS. Terminal growth rates were increased by 1%, factoring in 3–4% free cash flow growth in later years. With price-to-earnings ratio for fiscal 2026 at 13.6 times, valuations remain attractive, trading at a 15% discount to the historical average, added the brokerage.

Revenues are projected to reach Rs 78,800 crore by financial year 2029, supported by higher LNG import volumes. UBS expects Petronet's EBIT margins to remain robust, even as aggressive capex is spread over the next four years. Dividend payout remains steady due to strong cash flow from operations.

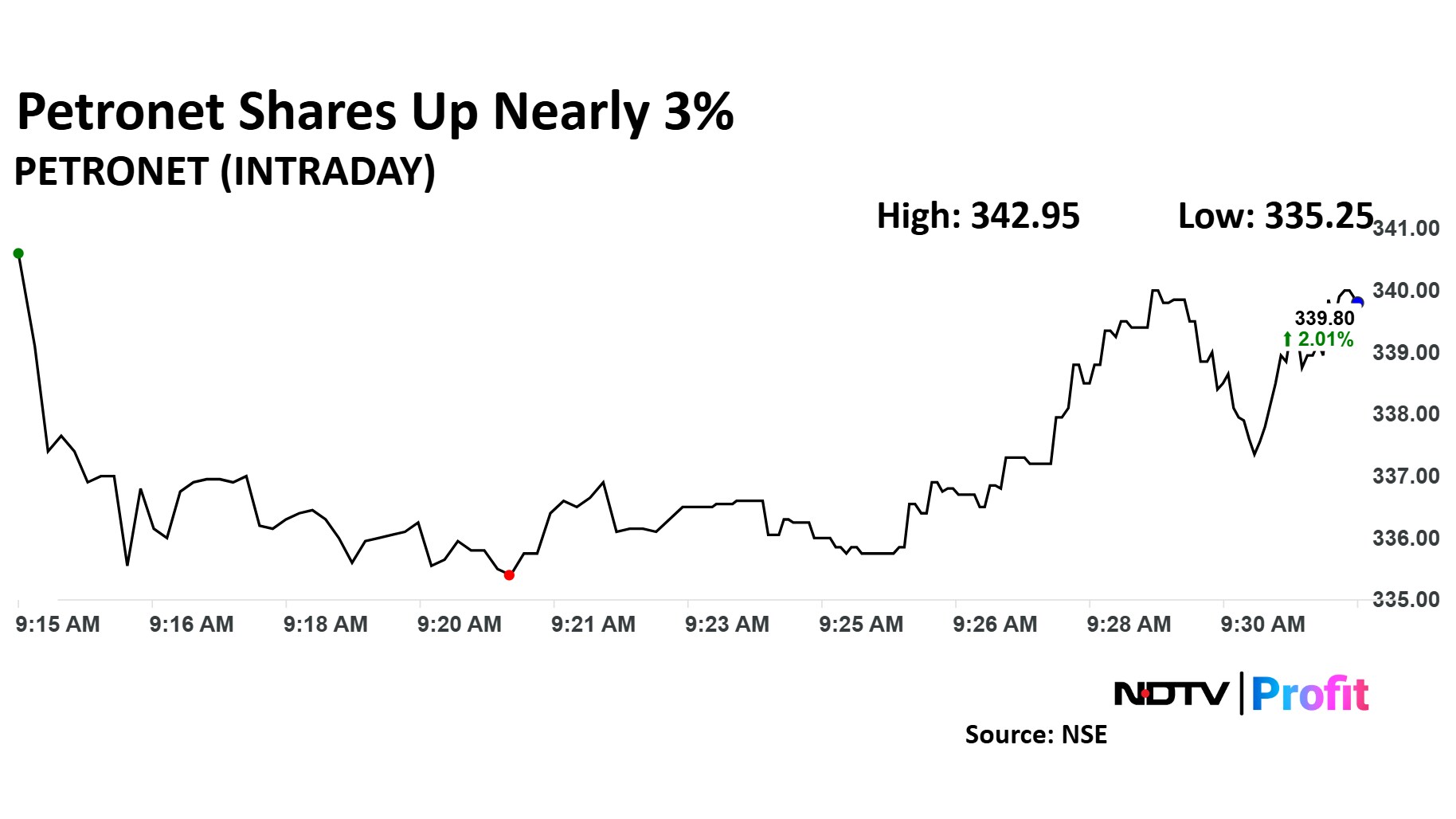

The scrip rose as much as 2.96% to Rs 342.95 apiece in opening trade, the highest level since Nov. 7, 2024. It pared gains to trade 1.08% higher at Rs 336.70 apiece, as of 09:27 a.m. This compares to a 0.04% advance in the NSE Nifty 50 Index.

It has risen 49.02% on a year-to-date basis. The relative strength index was at 56.51.

Out of 36 analysts tracking the company, 10 maintain a 'buy' rating, 12 recommend a 'hold,' and 14 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.