.png?downsize=773:435)

The shares of Trent fell 6.50% on Monday after it posted softer revenue growth in quarter ended September and brokerages cut its target price. The company shares hits 52-week low making it the only Nifty 50 company to hit the level in day's trade.

The company posted a 17% growth in revenue in the second quarter of this fiscal, below the guided range of 20-25%. The decline in shares also comes as growth deceleration continued during the quarter, with expansion into tier-2 markets and new store formats impacted short-term performance due to longer gestation periods.

In addition, muted consumer sentiment, unseasonal rains have also impacted the second quarter sales.

Among other reasons contributing to the decline, Jefferies lowered its target price to Rs 5,000 from Rs 6,000, citing continued growth deceleration in the company's key fashion segment. The brokerage noted that store additions picked up sequentially, but like-for-like growth in fashion categories remained in low single digits.

Non-apparel categories, however, continued to perform well, and online sales gained further share for Westside. Despite healthy operational execution, Jefferies sees limited near-term re-rating potential as Trent navigates a more normalised growth phase following its rapid post-pandemic expansion.

In a separate development, Trent announced it will tender approximately 15% of its stake in Zara India for Rs 150 crore as part of a buyback by Inditex Trent Retail. The company will sell 94,900 shares at Rs 15,422 per share, reducing its holding in the joint venture to 20%.

The transaction implies a modest valuation of around Rs 780 crore for Zara India. Analysts view the move as part of Trent's broader portfolio rebalancing, allowing it to focus capital allocation toward its faster-growing domestic retail brands such as Westside and Zudio.

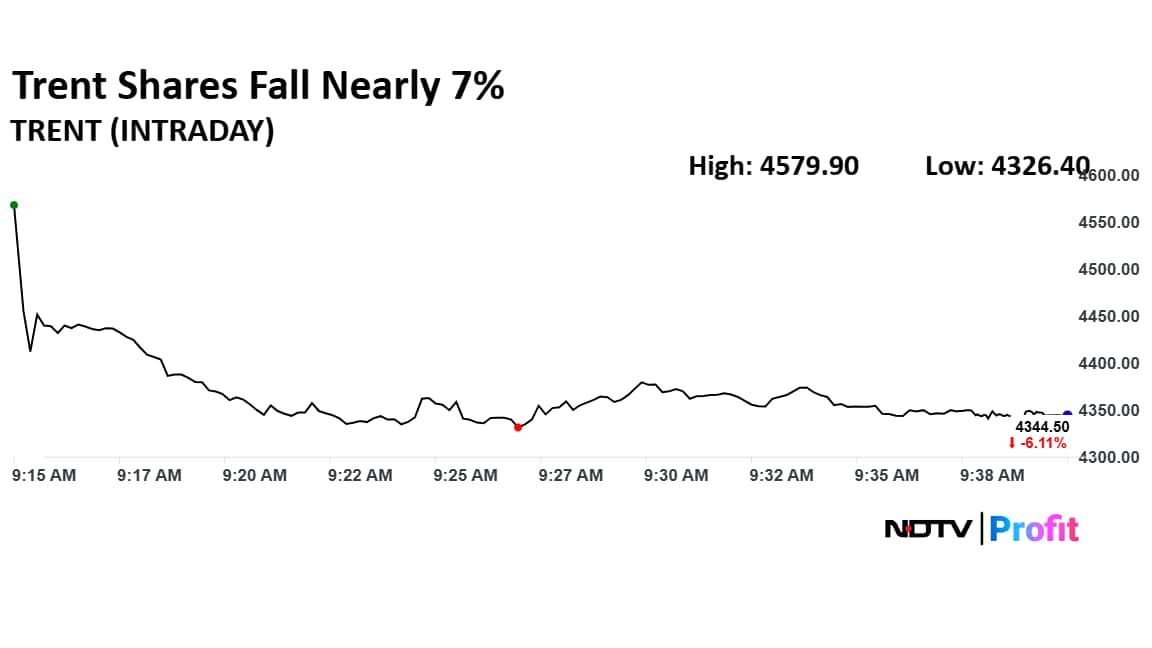

Trent Share Price Today

The scrip fell as much as 6.50% to Rs 4,326.40 apiece on Monday. It pared losses to trade 6.06% lower at Rs 4,347.10 apiece, as of 9:37 a.m. This compares to a 0.31% advance in the NSE Nifty 50 Index.

It has fallen 30.94% in the last 12 months and 38.93% year-to-date. Total traded volume so far in the day stood at 0.83 times its 30-day average. The relative strength index was at 36.85.

Out of 27 analysts tracking the company, 16 maintain a 'buy' rating, five recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 5,454.64 implies an upside of 25.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.