Trent Ltd. share price fell to six-month low on Tuesday as the second quarter business update started to reflect moderating growth, which fuelled worries for future outlook. Equirus has downgraded the Tata-Group stock and Goldman Sachs cut target price for the same.

Trent Q2 Business Update Key Highlights

Standalone revenue rose 17% to 5,002 crore (YoY)

Opened 13 Stores of Westside and 40 Stores of Zudio

Store portfolio includes 261 Westside, 806 Zudio and 34 stores across other lifestyle concepts

Equirus downgraded Tata-Group's Trent Ltd. to Reduce as it expects that the premium will decline on slowing growth. The target price is Rs 4,474 apiece, which implied 5% downside from Monday's close.

Trent's standalone revenue growth in July–September marks the lowest performance in past 18 quarters. It has also underperformed peers like VMart and V2, according to Equirus. The brokerage sees valuation compression ahead despite recent correction.

Goldman Sachs maintained Neutral rating but reduced the target price to Rs 5,300 from Rs 5,600. The current target price indicated an upside potential of 13% from Monday's close.

Track live updates on Indian stock markets, share price movements, and latest insights from analysts here.

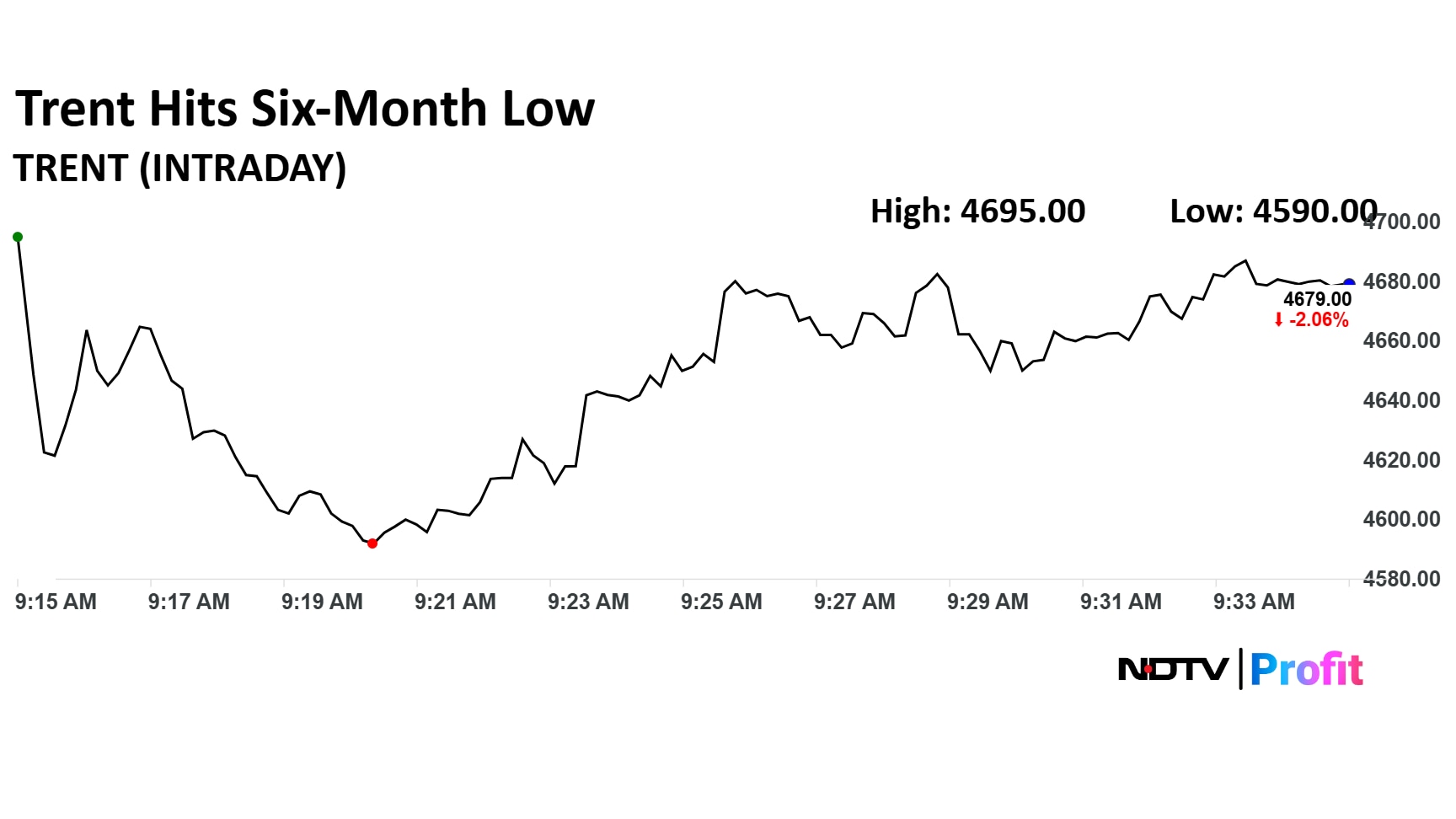

Trent Ltd. share price declined 1.72% to Rs 4,590 apiece, the lowest level since April 7, 2025. It was trading 2.06% down at Rs 4,679 apiece as of 9:37 a.m. compared to 0.17% advance in the NSE Nifty 50.

The stock slumped 37.19% in 12 months, and 34.36% on year-to-date basis. Total traded volume on National Stock Exchange stood at 0.75 times its 30-day average so far in the day. The relative strength index was at 31.17.

Out of 26 analysts tracking the company, 16 maintain a 'buy' rating, five recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside 27%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.