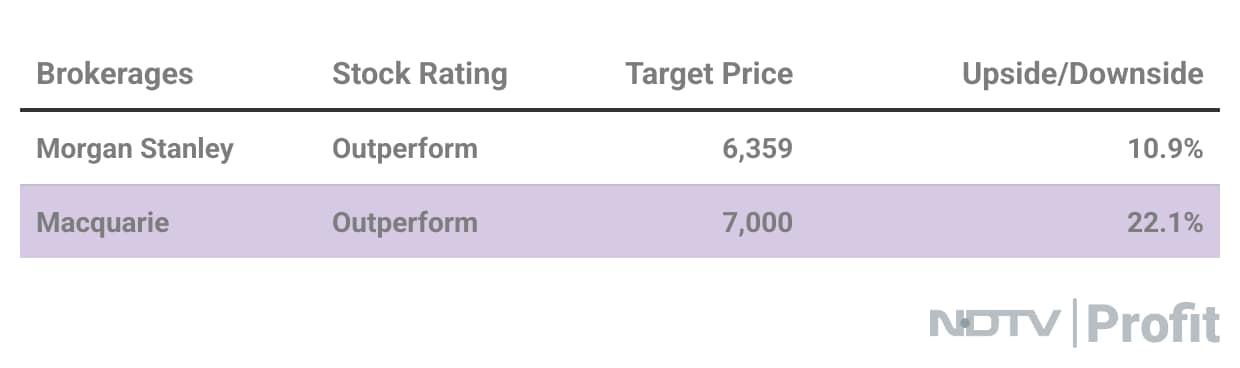

Analysts maintained their stances on Trent Ltd. after it guided for 25% compound annual growth rate for next five to 10 years in its investors' meet. Macquarie and Morgan Stanley maintained their rating and target prices for the stock.

Trent management has said that they will focus on increasing store density, which will likely affect same-store sales, according to Macquarie. The company is planning to grow through expansion of store reach, expansion into adjacent categories and cost control initiatives.

Trent will focus on splitting same store areas in the current financial year as well. This strategy has resulted in sharp moderation in growth rates in the previous financial year, Macquarie said. Store addition will also likely hurt demand recovery on the back of tax rebate-led increase in consumer spends, which will be an offsetting factor.

The management has made clear that it will follow a micro market strategy. The company is presenting itself a multi-category business given strong growth in emerging businesses in last three years, Morgan Stanley said.

Trent is aiming to fulfill aspiration of offering great value to customers at the price points across brands. Westside's price point is 3 times Zudio, and Samoh offers products at the price point of Rs 1,500–1,800 apiece.

Management believes that gross margins are functions of a throughput and this is not a reason for Zudio being online. It is looking to have a critical mass of customers. The company loses one-third of its customers every year.

As far as growth in Star Grocery is concerned, Macquarie remained skeptical. Competition from quick commerce, limited examples of private brands' success in grocery makes the brokerage cautious on Star Grocery formats.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.