(Bloomberg) -- Liquidity in the world's largest bond market is evaporating as the US banking crisis muddies the outlook for the Federal Reserve's monetary policy.

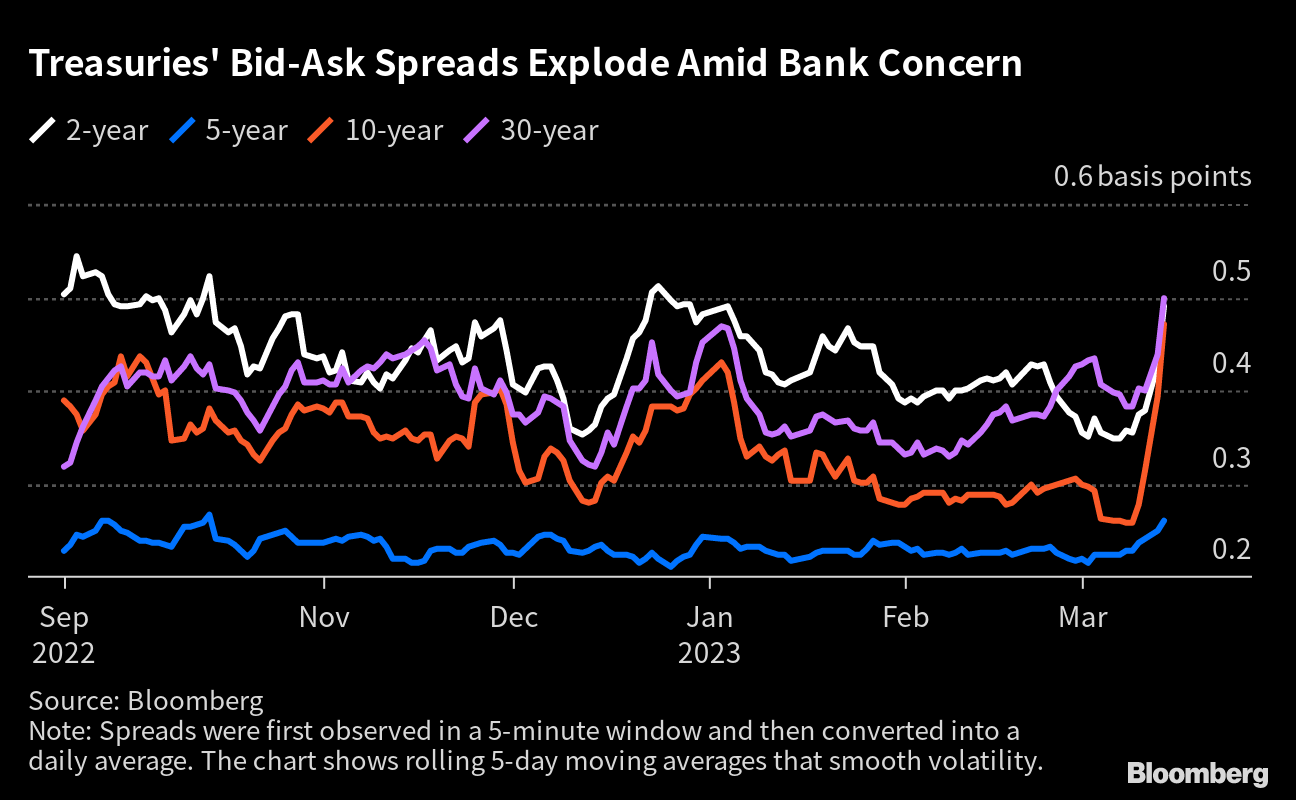

Bid-ask spreads on two-, 10- and 30-year US government bonds jumped to the highest level in at least in six months on Tuesday, according to data compiled by Bloomberg. The 10-year yield swung in a 34-basis point range on Monday, the biggest gap since the onset of the pandemic in 2020.

“Between late cycle dynamics, an aggressive Fed, strong data and contagion risks, these risks are proving hard to stomach,” said Eugene Leow, a senior rates strategist at DBS Bank Ltd. in Singapore. The wider bid-ask spreads reflect elevated volatility that's rendering market participants cautious, he said.

The deterioration in liquidity signals uncertainty about the Fed's rate-hike path after the collapse of three US lenders underscored the damage wrought by higher borrowing costs. The volatility risks spreading into other assets that use Treasuries as a benchmark, with traders fearful that a wider US banking crisis may be brewing.

A gauge of implied volatility in Treasuries soared to the highest since 2009 this week, data from Intercontinental Exchange Inc. show. US authorities moved swiftly to guarantee deposits at Silicon Valley Bank and provide lenders with short-term loans but some analysts remain on guard for further volatility.

“It's probably too early to think that the US banking turmoil is over,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Kokusai Asset Management Co. “In a few months' time, we could see liquidity drying up and prices moving a lot again.”

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.