The NSE Nifty 50 is likely to consolidate in the coming weeks as the short-term market texture still appears to be positive, according to analysts.

On the weekly chart, the Nifty has formed a small bear candle with a higher high and higher low, signalling consolidation amid stock-specific action after the recent strong upmove, according to Bajaj Broking Research.

The brokerage added that going ahead, the index will extend consolidation with positive bias in the range of 25,200-25.700.

"Technically, on intraday charts, it is holding a lower top formation, and on weekly charts, it has formed a bearish candle, which is largely negative. However, the short-term market texture still appears to be positive," said Amol Athawale, vice president of technical research at Kotak Securities.

"We believe that currently, the market is witnessing non-directional activity; perhaps traders are waiting for either-side breakout," Athawale said.

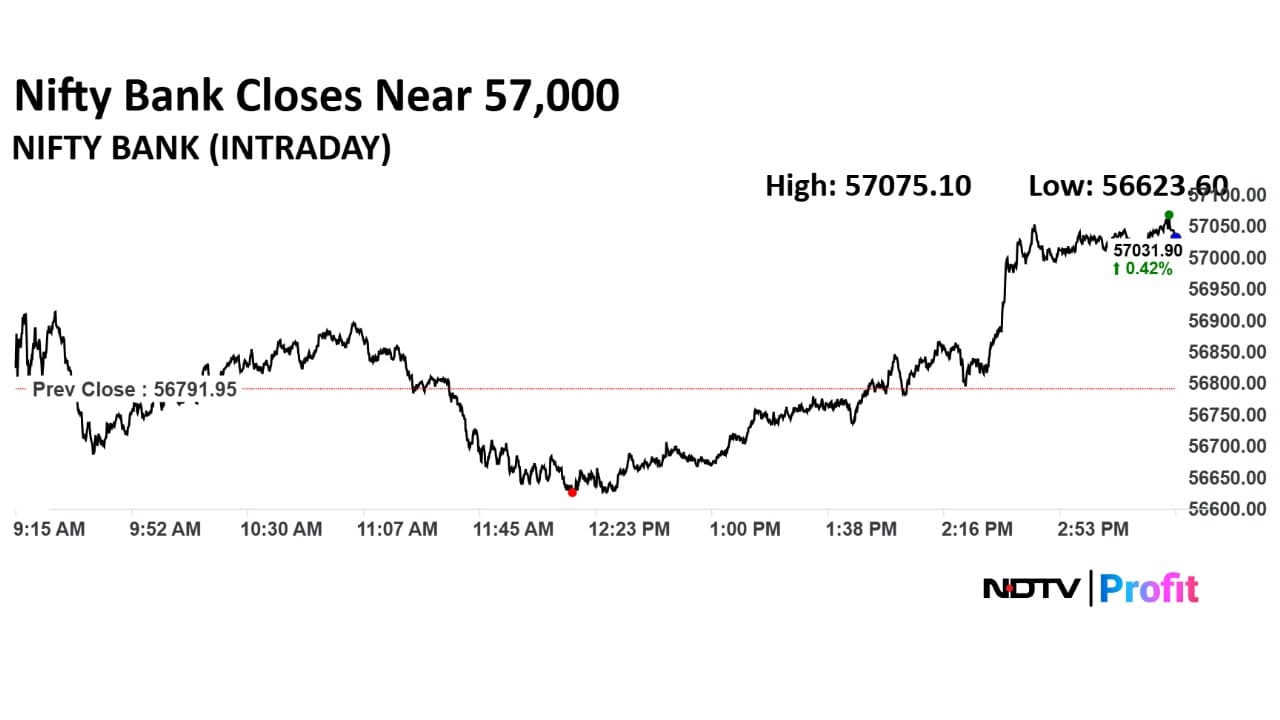

For Bank Nifty, the 20-day Simple Moving Average or SMA at 56,500 is a key level to watch, according to Athawale.

"Below this, Bank Nifty could decline to 56,200–56,000. On the other hand, as long as it remains above 56,500, the chance of reaching 57,500–57,800 remains bright," he added.

Market Recap

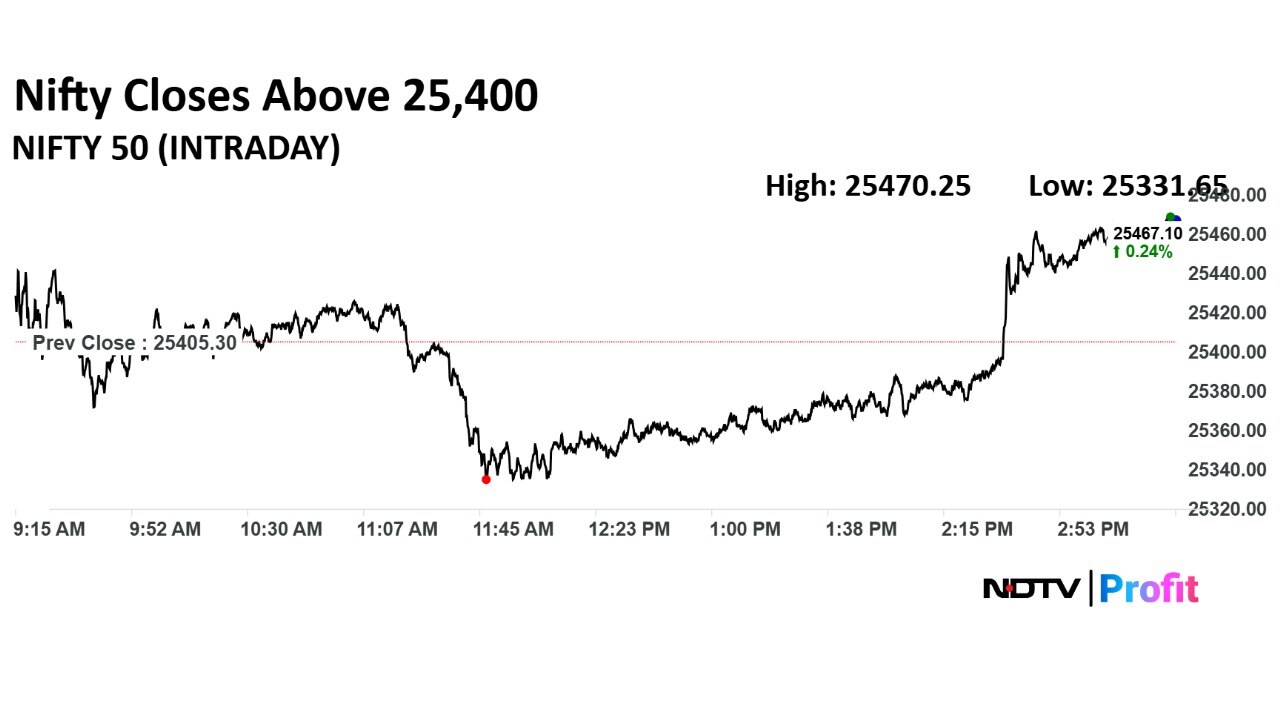

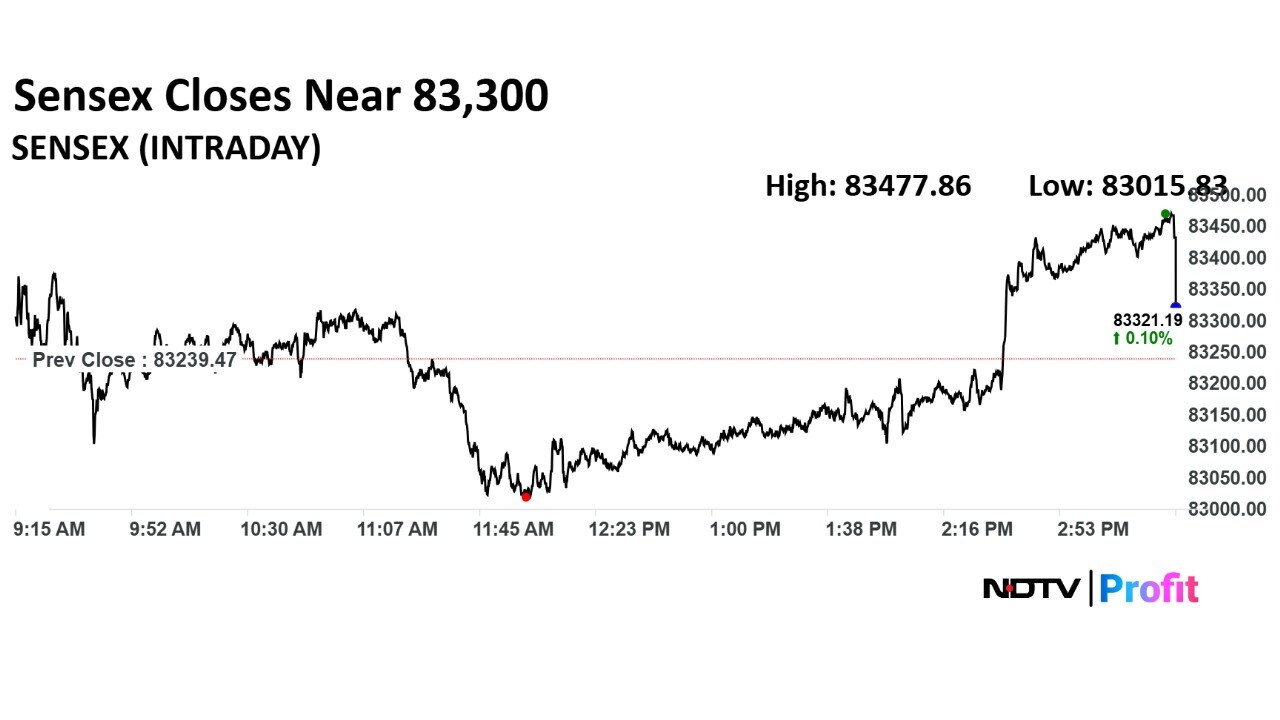

Benchmark indices broke a two-day losing streak to settle higher on Friday but on a weekly basis, the Nifty 50 and Sensex declined over 0.75%.

The NSE Nifty 50 ended 55.70 points or 0.22% higher at 25,461, while the BSE Sensex closed 193.42 points or 0.23% up at 83,432.89.

Currency Update

The Indian rupee marginally weakened against the US dollar on Friday, while posting a second consecutive weekly gain.

The local currency closed seven paise lower at 85.39 against the greenback on Friday, coming off a one-month peak achieved in the session earlier. Intraday, the unit fell 16 paise.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.