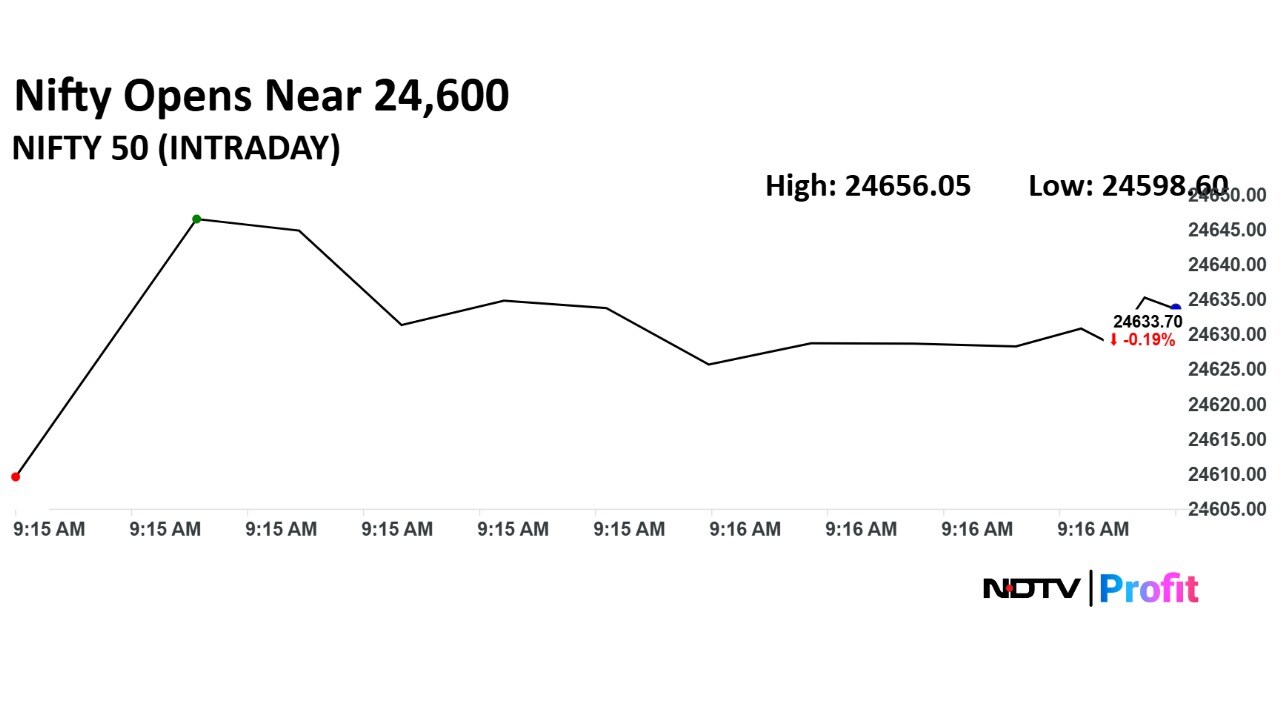

The NSE Nifty 50's key support is placed at the 24,500–24,400 level, making it a crucial demand zone that can attract buying interest, according to analysts at Bajaj Broking Research.

The 24,500–24,400 region is the "confluence of the previous swing low, the 100-day EMA and the 61.8% Fibonacci retracement level of the recent rally from 23,935 to 25,669", it said.

The Nifty formed a bullish engulfing candle in the daily chart, signalling buying demand around the 100-day exponential moving average as it snapped its three-session losing streak, according to Bajaj Broking.

The index is likely to enter a consolidation phase in the range of 24,500–25,000 in the coming sessions. While a move above 25,000 will open further upside towards the last two weeks' highs placed at 25,250, it added.

A bullish candle formation with strong volume suggests buying interest at lower levels, according to Mandar Bhojane, senior technical and derivative analyst at Choice Broking.

"If the index sustains above 24,800, we could witness a further rally towards 25,000 and 25,200 in the near term. On the downside, 24,600 remains the immediate support; a break below this could invite further correction toward 24,200–24,160," Bhojane said.

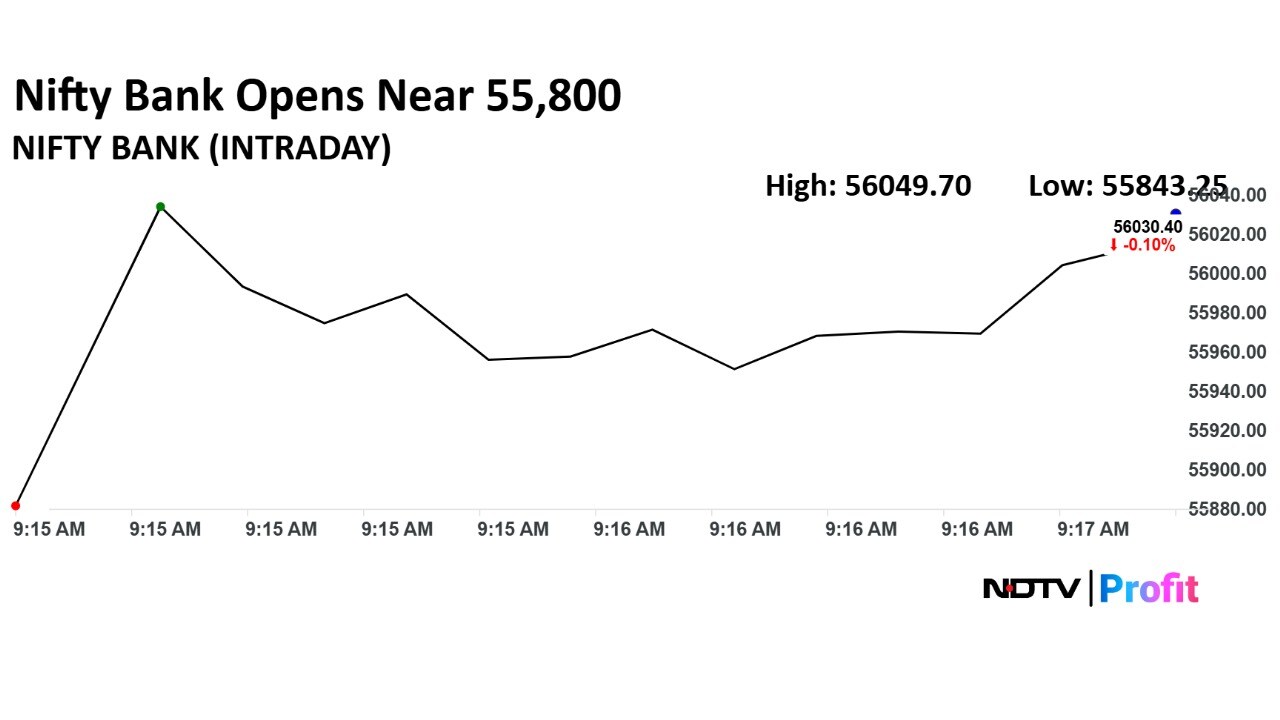

The Bank Nifty formed a bull candle as it similarly stopped a three-day session of ending in the red. The index is likely to extend decline towards the 55,500 mark in the near term, according to Bajaj Broking.

Bhojane identified support for the index at 55,500–55,150 levels.

Market Recap

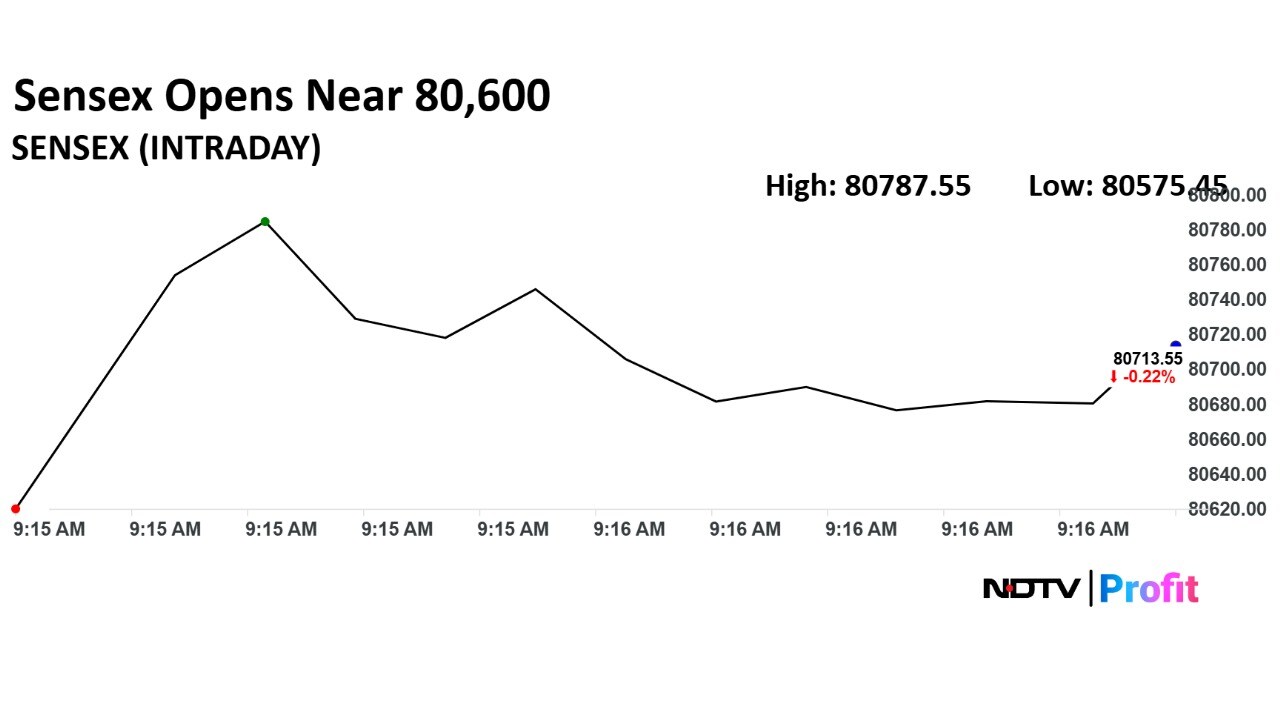

India's benchmark equity indices snapped a three-session decline to close higher on Tuesday as investors bought into large-cap heavyweights Reliance Industries Ltd. and HDFC Bank Ltd.

The NSE Nifty 50 settled 140.2 points or 0.57% higher at 24,821.1, while the BSE Sensex added 446.95 points or 0.55% to close at 81,337.95.

Currency Recap

The Indian rupee closed at its lowest level in over four months on Tuesday, ending the session at Rs 86.82 against the US dollar, down 15 paise from Rs 86.67 a day ago.

This marks the weakest closing level for the currency since March 13, reflecting persistent pressure from global risk-off sentiment and foreign fund outflows.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.