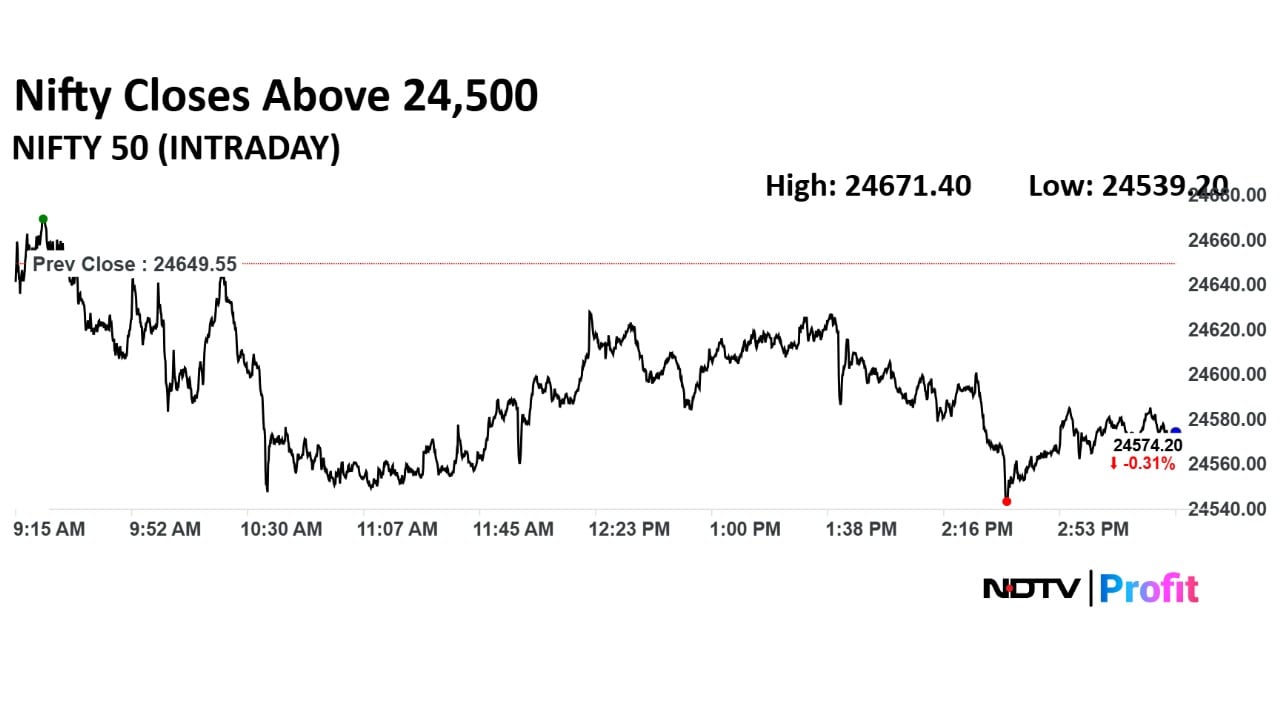

The NSE Nifty 50's support zone moved to 24,500 levels, while resistance was seen at 24,700, analysts said on Wednesday, after the benchmark index ended in the red for the second time.

"On the downside, 24,500 continues to be a promising support zone, while 24,700 would act as a crucial resistance area for the bulls," Shrikant Chouhan, head of equity research at Kotak Securities, said in a note.

A pullback is likely to continue above 24,700 up to 24,850–24,900. Conversely, a decline below 24,500 could push the market down to 24,350–24,300, according to the brokerage.

The Nifty formed a bearish-bodied candle on daily charts with both upper and lower wicks formed, indicating indecision and selling pressure at higher levels, according to Hardik Matalia, derivative analyst at Choice Broking.

Matalia identified immediate support on the downside at 24,500, followed by a stronger support near 24,400. A breach below this zone may lead to further downside pressure, he said. On the upside, Matalia saw immediate resistance at 24,700, followed by 24,800 and 25,000.

"A decisive breakout above 25,000 is essential to signal a pause in the ongoing downtrend and open the door for fresh buying opportunities," Matalia said.

The Bank Nifty's immediate support is placed in the 55,200–55,000 zone. A breach below this range could invite further selling pressure and weaken the short-term structure. On the upside, immediate resistance is seen around 55,700, followed by a key hurdle near 56,00, he said.

Market Recap

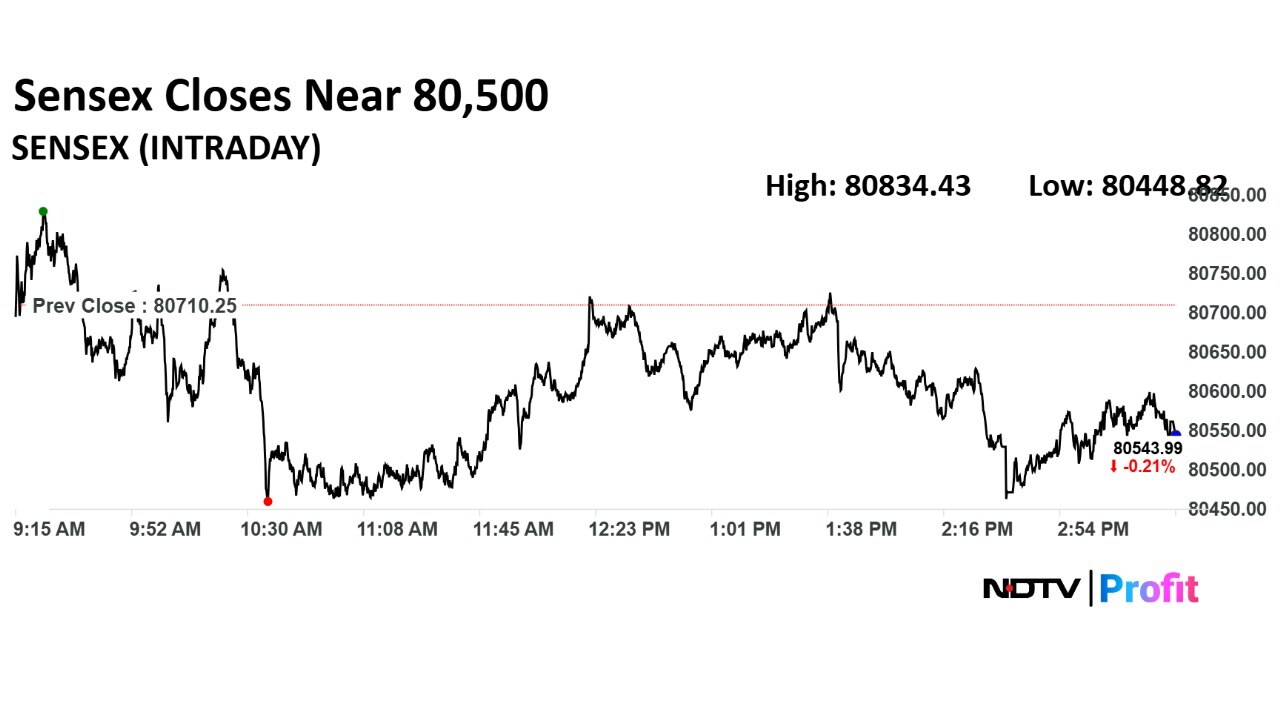

The Indian equity benchmark indices closed lower for the second consecutive day as Wipro, Sun Pharma, Jio Finance along with others weighed on the index.

The NSE Nifty 50 benchmark ended 75 points, or 0.31% lower at 24,574, and the 30-stock BSE Sensex ended 166.26 points, or 0.21% lower at 80,543.

Currency Recap

The Indian rupee closed stronger against the US dollar on Wednesday after the Reserve Bank of India's monetary policy committee kept repo rates unchanged. The local currency closed 7 paise stronger at 87.73 against the greenback compared to previous close at 87.80.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.