The NSE Nifty 50's immediate support is placed at 24,500-24,600 levels after the stock market ended in the green on Tuesday, according to analysts.

"Key support is placed around 24,000–24,200 range marked by the confluence of the 200-days EMA and an ascending trendline drawn from the February and March 2025 swing highs, making it a key demand zone for the near term," Bajaj Broking Research said in a note.

As long as the market trades above 24,875, the uptrend wave is likely to continue on the higher side, potentially moving up to 25,150-25,250, according to Shrikant Chouhan, head of equity research at Kotak Securities. "On the flip side, below 24,875, the uptrend would become vulnerable."

He advised investors to exit their long positions under the aforementioned conditions.

The index formed a bullish candlestick pattern, which remained enclosed inside previous session price range, signalling consolidation with positive bias while holding above the 20- & 50-day extended moving average, according to Bajaj Broking Research.

Market Recap

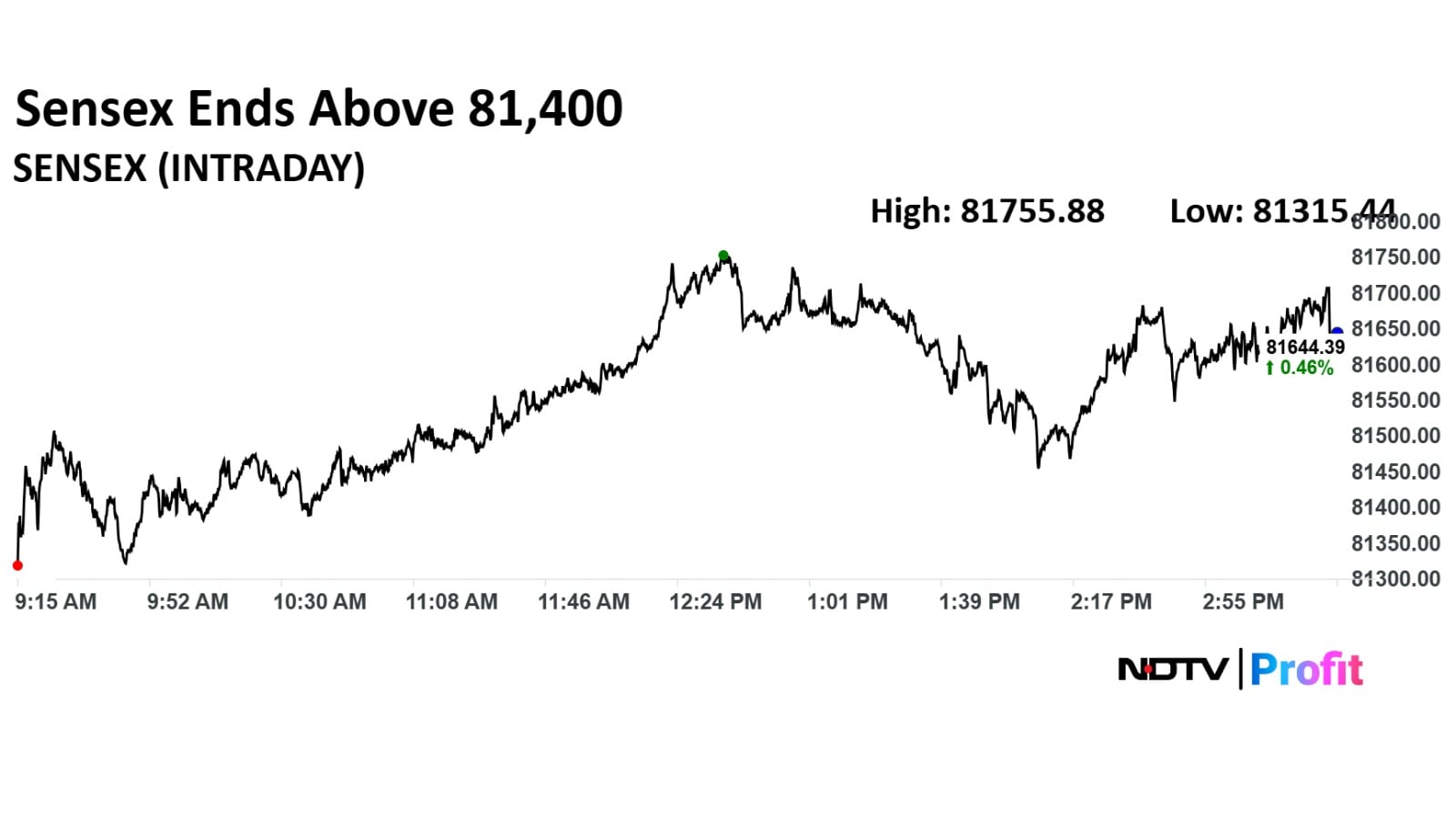

The benchmark equity indices closed in the green for the fourth straight session on Tuesday as shares of Reliance Industries Ltd led the gains.

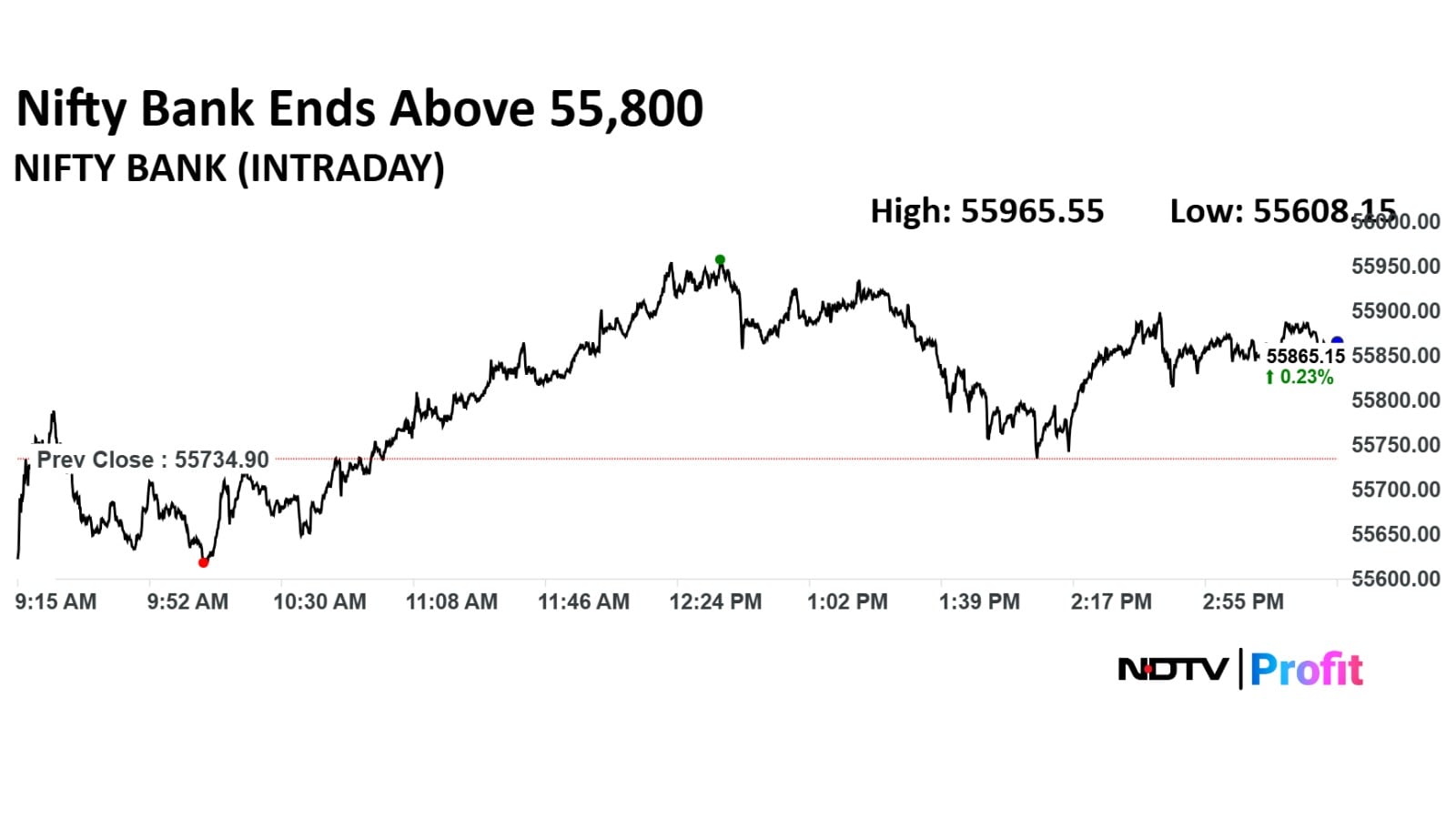

The NSE Nifty 50 ended 103.7 points or 0.42% higher at 24,980.65 and the BSE Sensex closed 370.64 points or 0.46% up at 81,644.39.

Currency Recap

The Indian rupee closed 39 paise stronger at 86.96 a dollar on Tuesday. It closed at 87.35 a dollar on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.