The NSE Nifty 50's counter-attack bearish line candle highlights profit-booking at higher levels after a gap-up opening and a close near the previous session close, according to analysts.

"Going ahead, a follow through weakness below 24,700 will open further downside towards 24,500-24,400 levels," Bajaj Broking Research said. "Overall, we expect the index to consolidate in the range of 24,400-25,000 amid stock-specific actions."

Immediate support is placed at 24,400-24,337 levels being the confluence of the recent lows and the key retracement area, the brokerage said.

"A breach below the same will signal acceleration of decline towards the key support area of 24,000-23,800 levels in the coming week being the confluence of the 52-week extended moving average and the previous major lows and the previous major breakout area," it added.

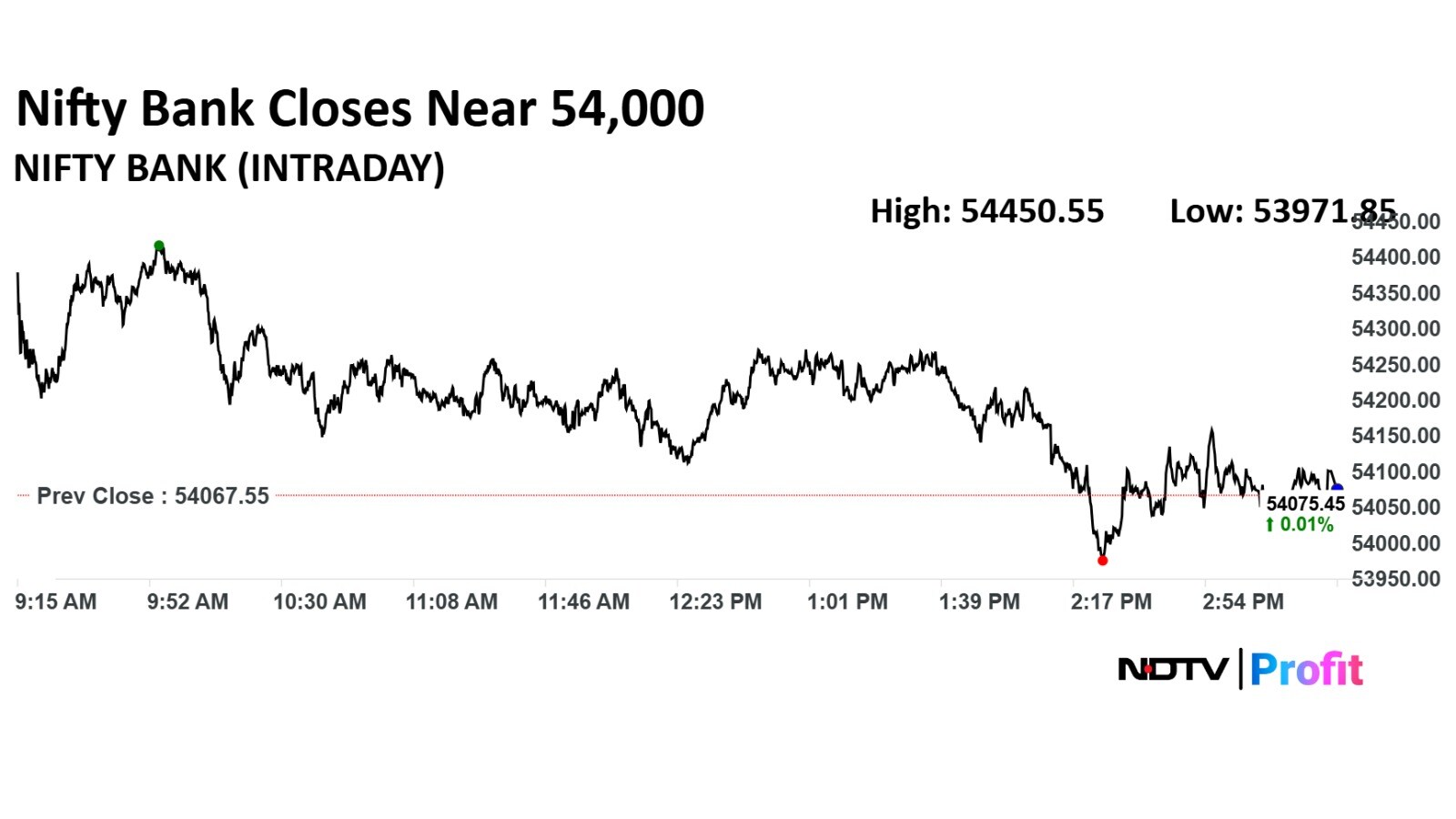

The Bank Nifty has immediate support at 53,500-53,300 levels being the confluence of the 200-day EMA and the low of May 2025. A breach below the same will signal acceleration of decline towards the key support area of 52,500-52,000 levels in the coming week, Bajaj Broking said.

Market Recap

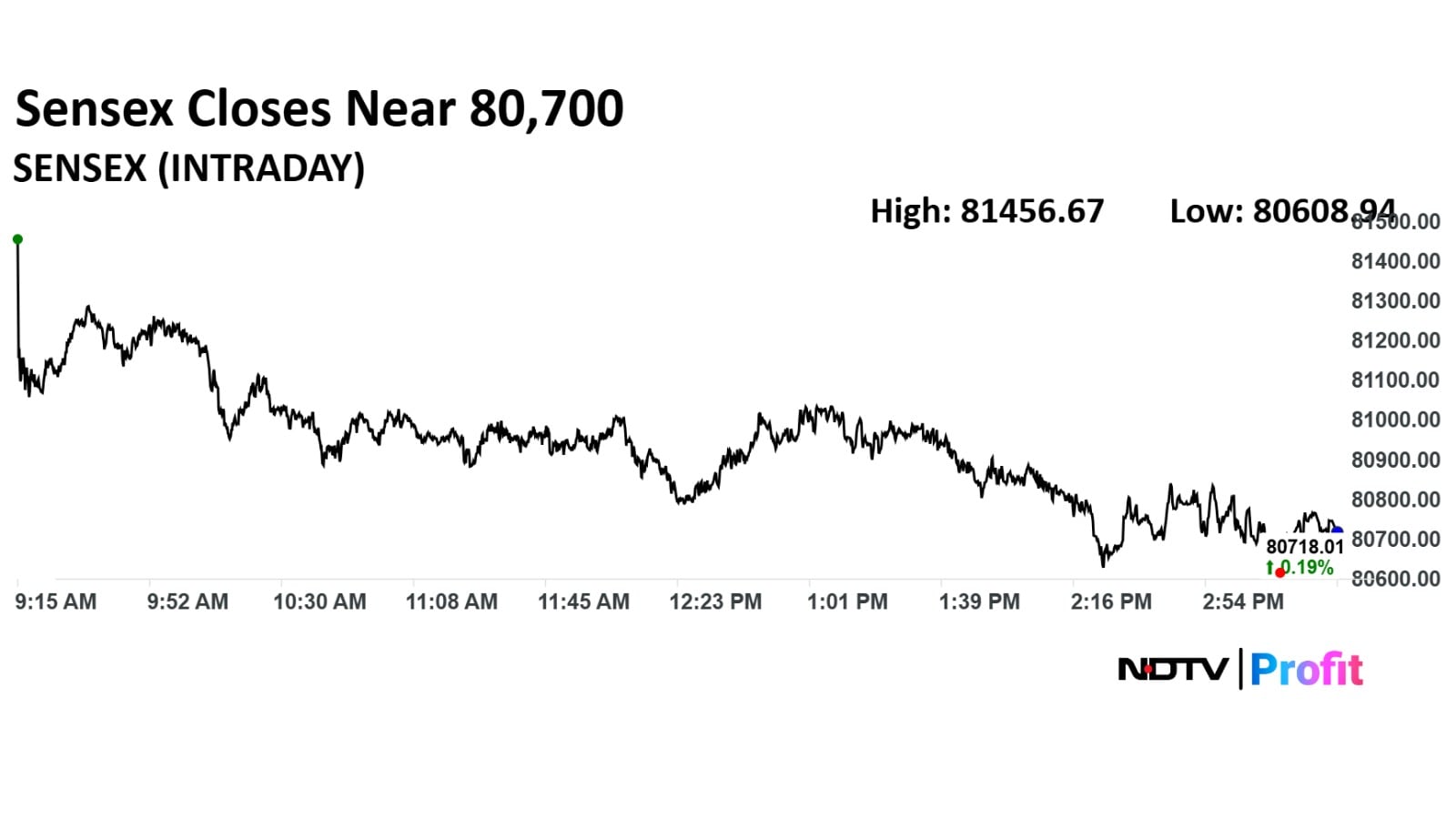

The benchmark equity indices ended in the green on Thursday after a positive boost on consumption came in from GST rate cuts.

The NSE Nifty 50 settled 19.25 points or 0.08% higher at 24,734.3 and the BSE Sensex closed 150.3 points or 0.19% up at 80,718.01. The Nifty rose as much as 1.08% during the day to 24,980.75, while the Sensex was up 1.10% to 81,456.67.

Currency Update

The rupee closed 11 paise weaker at 88.18 against US dollar. It settled at 88.07 on Wednesday

Watch LIVE TV, Get Stock Market Updates, Top Business, IPO and Latest News on NDTV Profit.