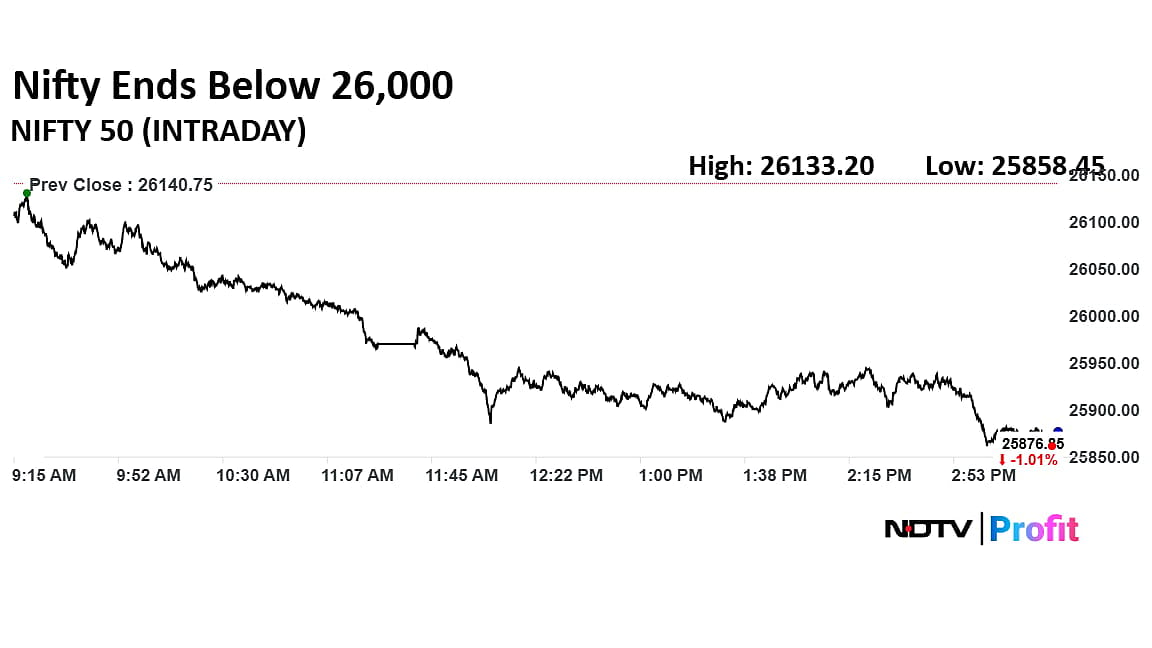

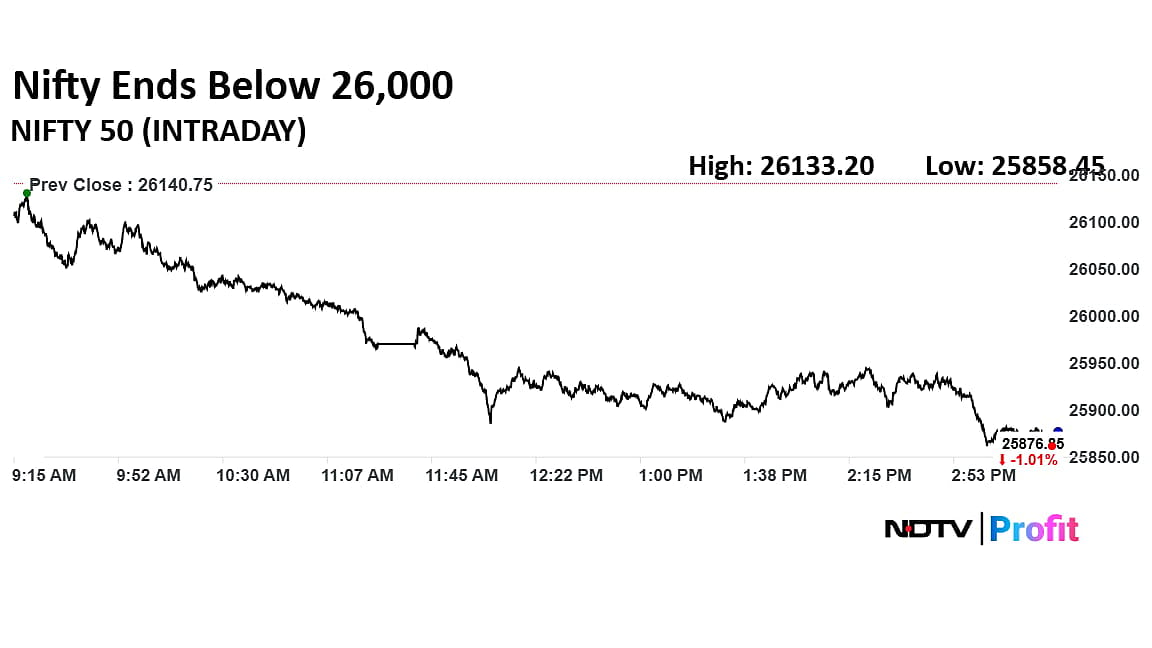

Trade Setup On Jan. 9: Nifty Likely To Sustain Weakness, Key Support At 25,700–25,750

On the upside, a breakout from the immediate resistance level of 26,000 is required to turn the tide.

The Indian stock market indices extended their losses for the fourth consecutive session on Thursday and slipped below their previous key support levels, indicating sustenance of weakness in the coming sessions.

"The index formed a sizable bearish candle with a lower high and a lower low, indicating an extension of the corrective decline for the fourth consecutive session," Bajaj Broking Research said.

Other factors, such as FPI exodus and global trade issues, are fuelling fear in investors, according to Mayank Jain, market analyst at Share.Market.

"Options data shows that traders are betting against a quick recovery. Meanwhile, the India VIX (fear index) jumped over 6.5%, showing that investors are becoming more nervous due to global trade issues and foreign investors selling off their shares," Jain added.

The short-term price structure has also deteriorated, as per Bajaj Broking.

The next key support zones for the index lie between 25,700 and 25,750, whereas on the upside, a breakout from the immediate resistance level of 26,000 is required to turn the tide.

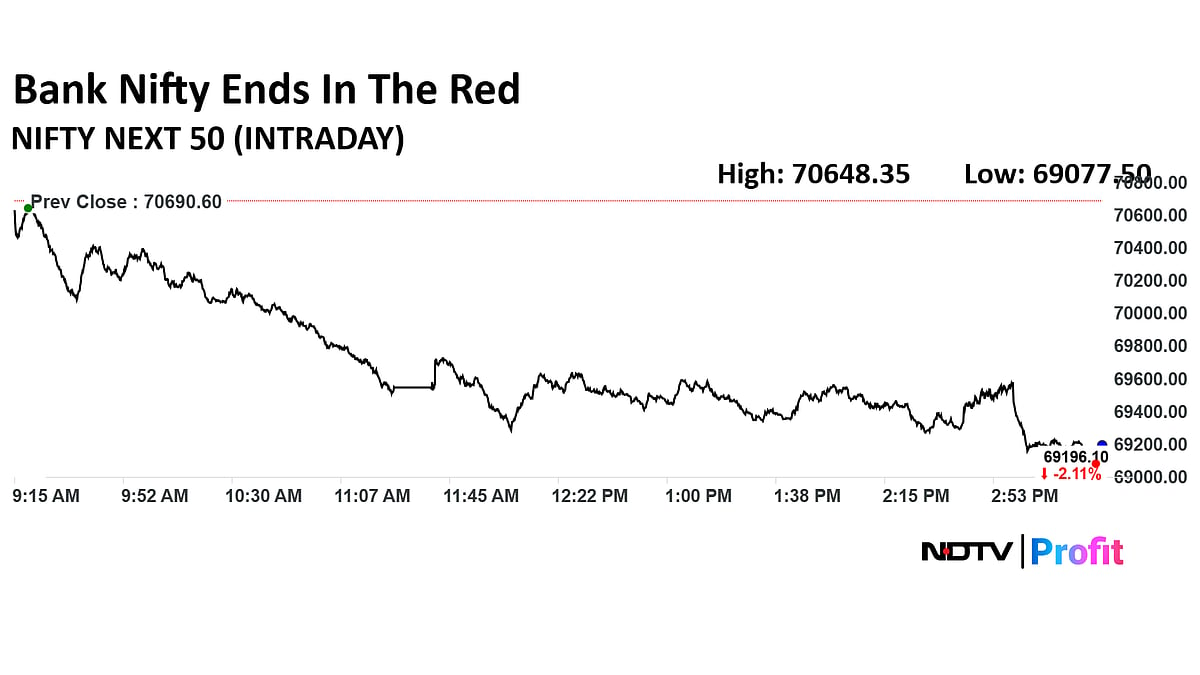

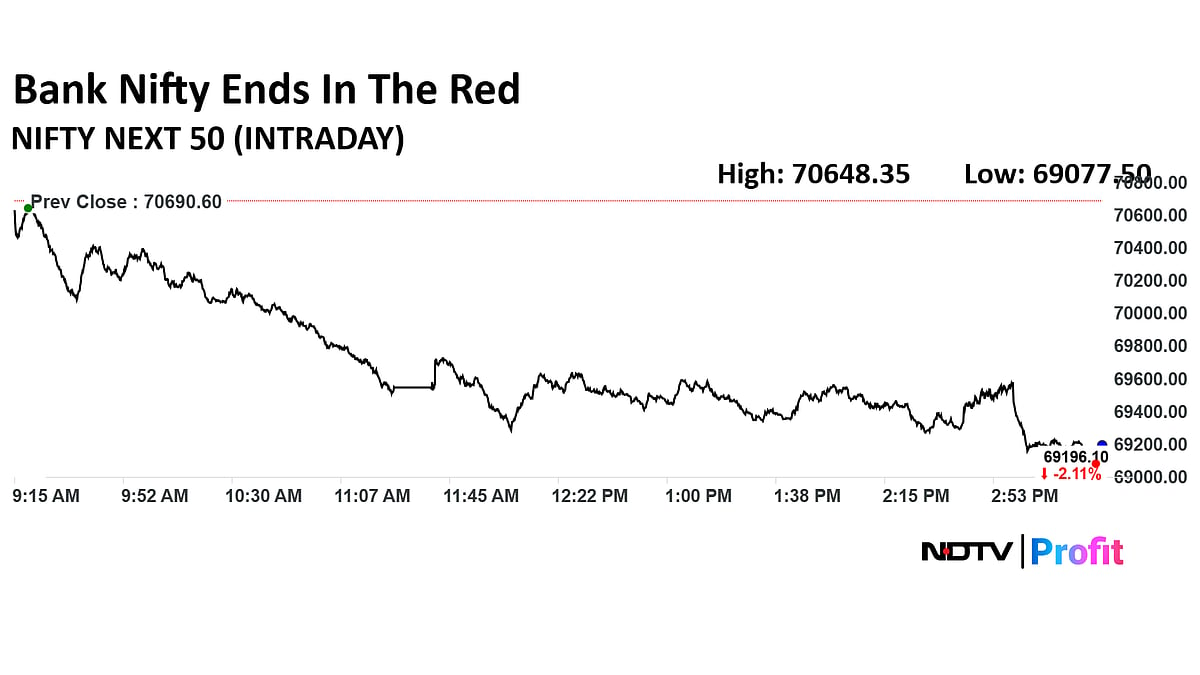

Bank Nifty Outlook

Analysts expect the sector to remain in the consolidation phase.

"Bank Nifty formed a bearish candle, marked by a lower high and a lower low, indicating a continuation of the ongoing corrective decline," said Bajaj Broking Research.

The 59,300–59,400 zone are key support zones for the index, as per Aakash Shah, technical research analyst at Choice Broking.

While on the upside, the 59,900–60,000 resistance zone remains "an important resistance that needs to be reclaimed for upside momentum to stabilise", Shah said.

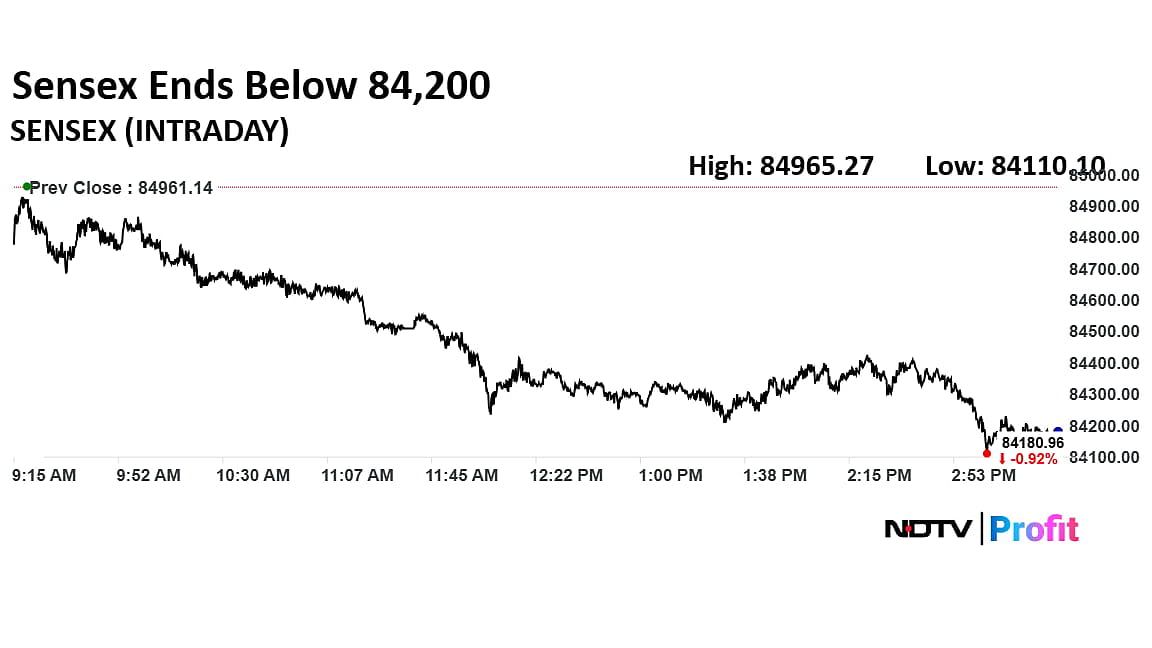

Market Recap

Indian equities end lower for the fourth consecutive day. Nifty had fallen below the 26,000 levels.

Intraday, both Nifty and Sensex fell nearly 1%. Nifty ended 263.90 points or 1% lower at 25,876.85, Sensex ended 780.18 points or 0.92% down at 84,180.96.

Broader indices also ended in the negative. Nifty Midcap 150 ended 1.88% higher and Nifty Smallcap 250 closed 1.94% lower. All sectoral indices fell with Nifty Metal and Nifty Energy leading the decline.

The market breadth was skewed in the favour of sellers, as 3,153 stocks declined, 1,045 advanced and 175 remained unchanged on the BSE.