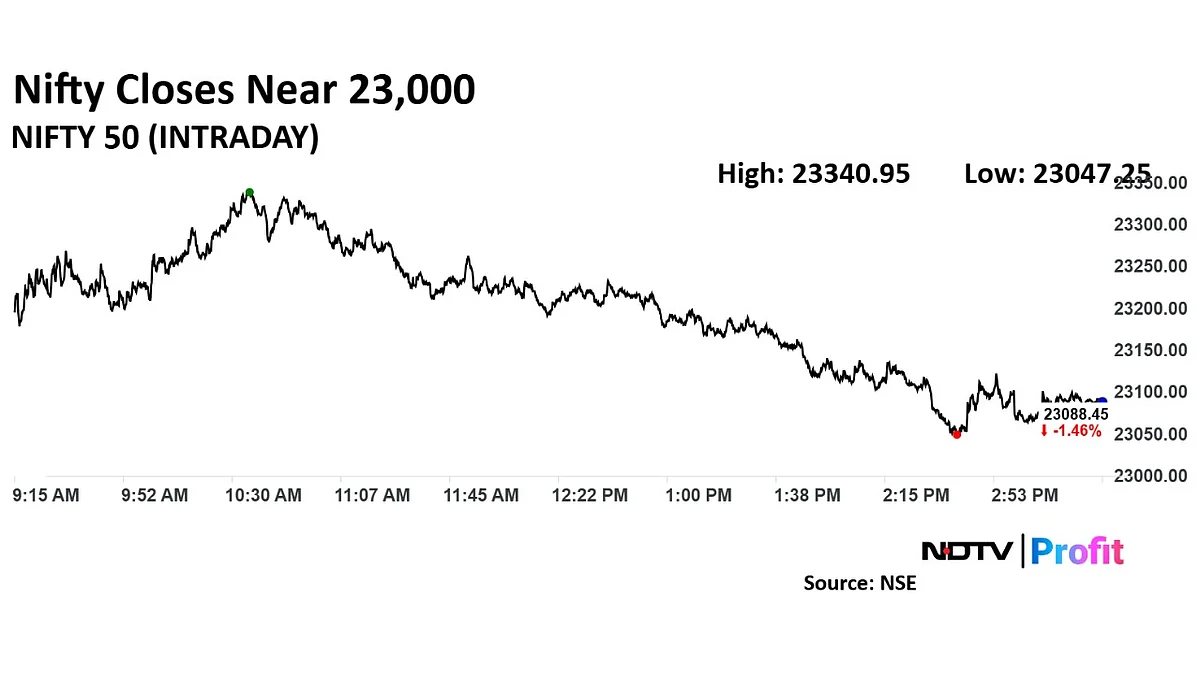

Trade Setup For Jan. 14: Nifty 50 Faces Resistance At 23,260 Levels

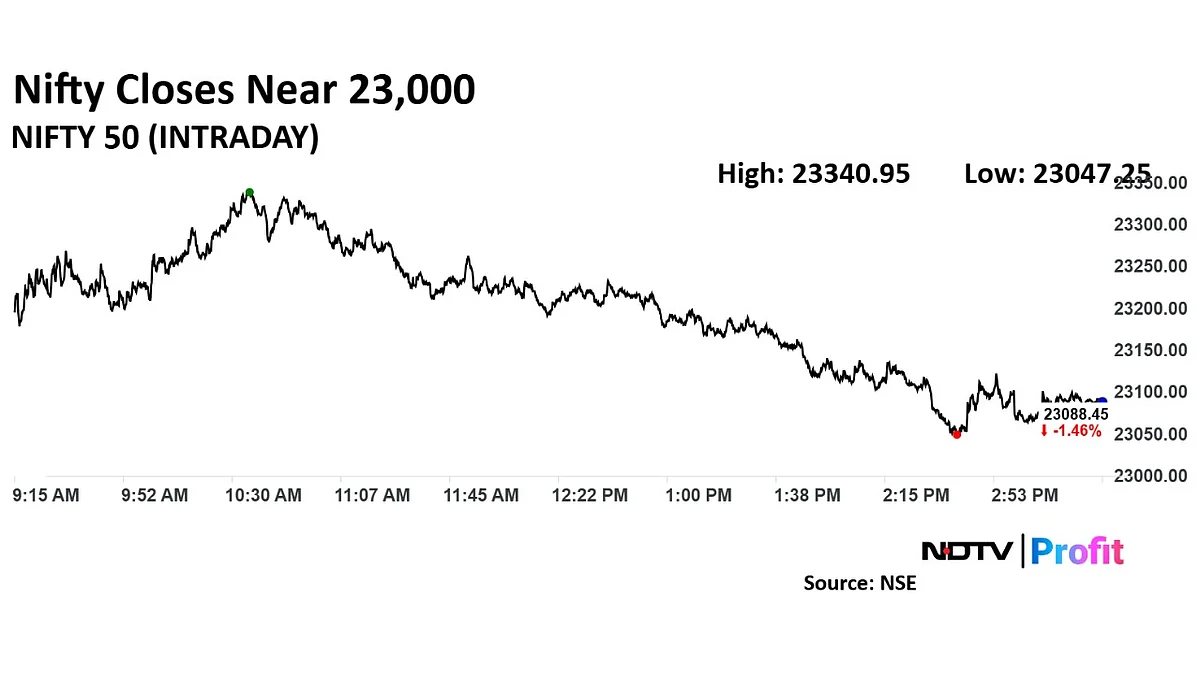

The Nifty 50 is trading under bearish pressure, with resistance at 23,260 and 23,550 near the 250-DSMA, while support levels are at 22,900 and 22,800.

The Nifty 50 is facing bearish pressure, with key levels indicating near-term volatility. Immediate resistance is pegged at 23,260, followed by 23,550, near the 250-DSMA, while crucial support lies at 22,900-22,800. Analysts recommend a sell-on-bounce strategy amid continued weakness.

"As per recent breakdown, index could test the levels of 22,900-22,800 in the short term," according to Hrishikesh Yedve, AVP technical and derivatives research at Asit C Mehta Investment Interrmediates Ltd.

Yedve highlighted that on the upside, 23,260 will act as immediate resistance for the index, followed by 23,550, where the 250-Days Simple Moving Average or 250-DSMA is located. A sell-on-bounce strategy is advisable.

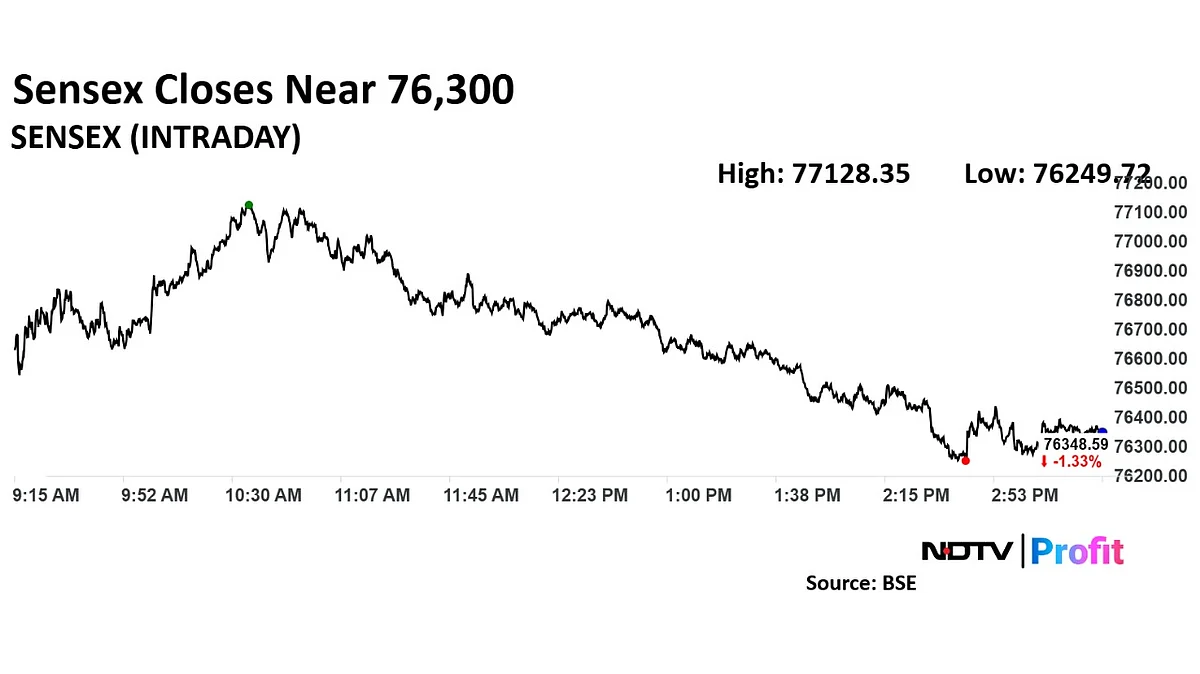

"For day traders, 23,260/77,000 would act as a trend decider level; below this, weak sentiment is likely to continue. If it falls below this level, the market could slip to 22,900-22,800/76.000-75,700. On the flip side, if we move above 23,260/77,000, the pullback could extend to 23,400-23,450/77,300-77,500," according to Shrikant Chouhan, head – equity research, Kotak Securities.

"The strong bearish candle on the daily chart denotes a strong underlying bearish trend; however, the Index is approaching its long-term trendline support (from Covid19 lows) i,e, at 22,800 from where a reversal can be anticipated as the markets have entered the oversold territory," according to Aditya Gaggar, director of Progressive Shares.

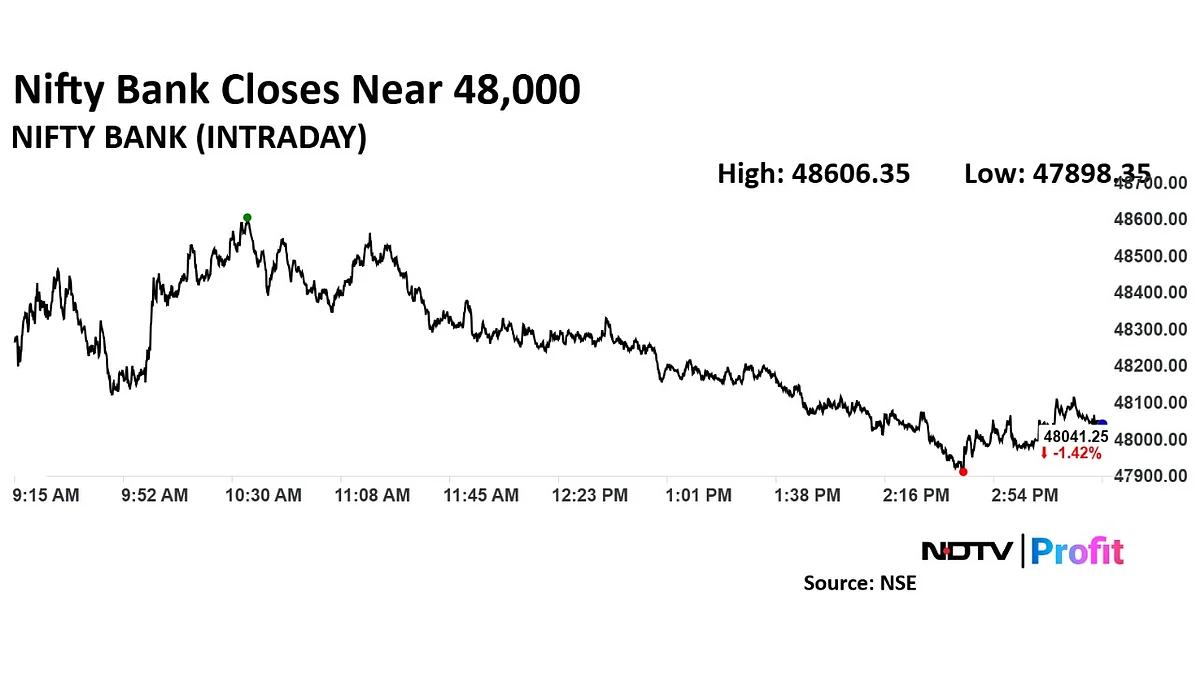

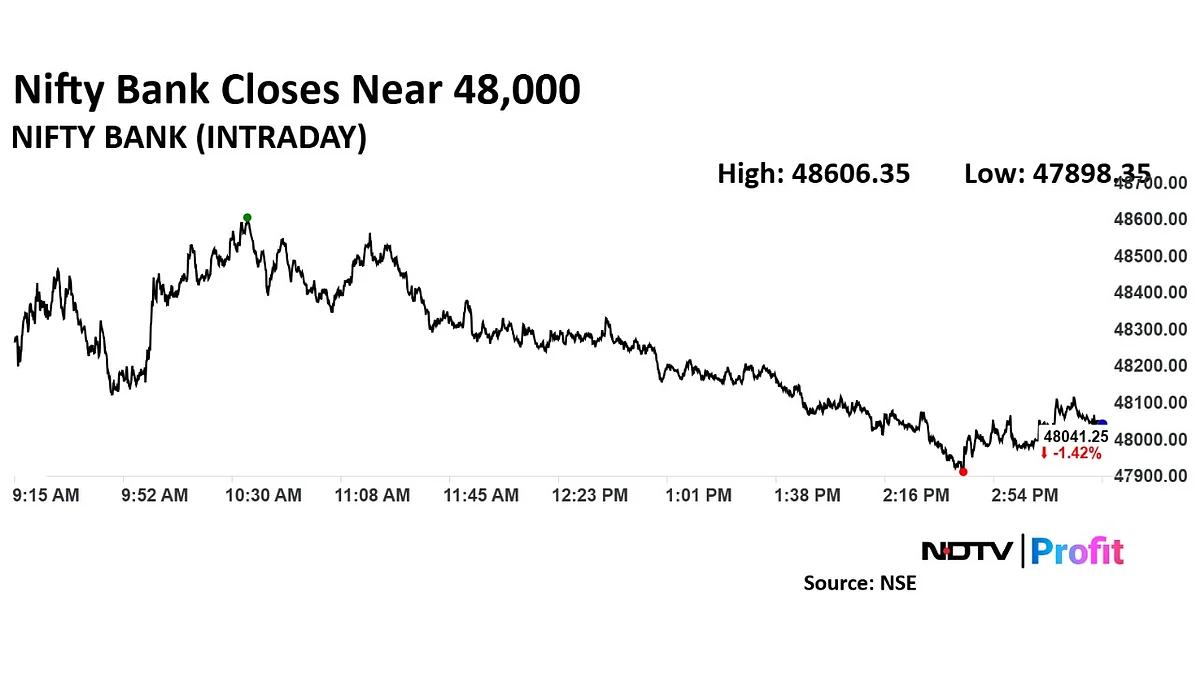

Bank Nifty settled the day on a negative note at 48,041. "Technically speaking, Bank Nifty maintained below its 250-DSMA support which is placed near 49,900 levels and formed a red candle on daily scale, indicating weakness," Yedve said.

"On the downside, 100-WEMA support is placed near 47,300 levels, which will act as key support. As long as Bank Nifty maintains below 49,900 levels, traders are advised to follow a sell-on-rise strategy," he said.

FII/DII Activity

Foreign portfolio investors stayed net sellers of Indian equities for the seventh straight session on Monday, while domestic institutional investors have been buyers for the 19th consecutive session.

FPIs sold stocks worth Rs 4,892.8 crore and domestic institutional investors bought stocks worth Rs 8,066.1 crore, according to provisional data from the National Stock Exchange.

So far in January, the FPIs have sold stakes worth Rs 23,615 crore, according to the National Securities Depository Ltd.

Market Recap

Indian equities extended their fall for the fourth consecutive day, with financials, energy and realty stocks weighed down. Nifty 50 has seen the worst first nine sessions of a year since 2016.

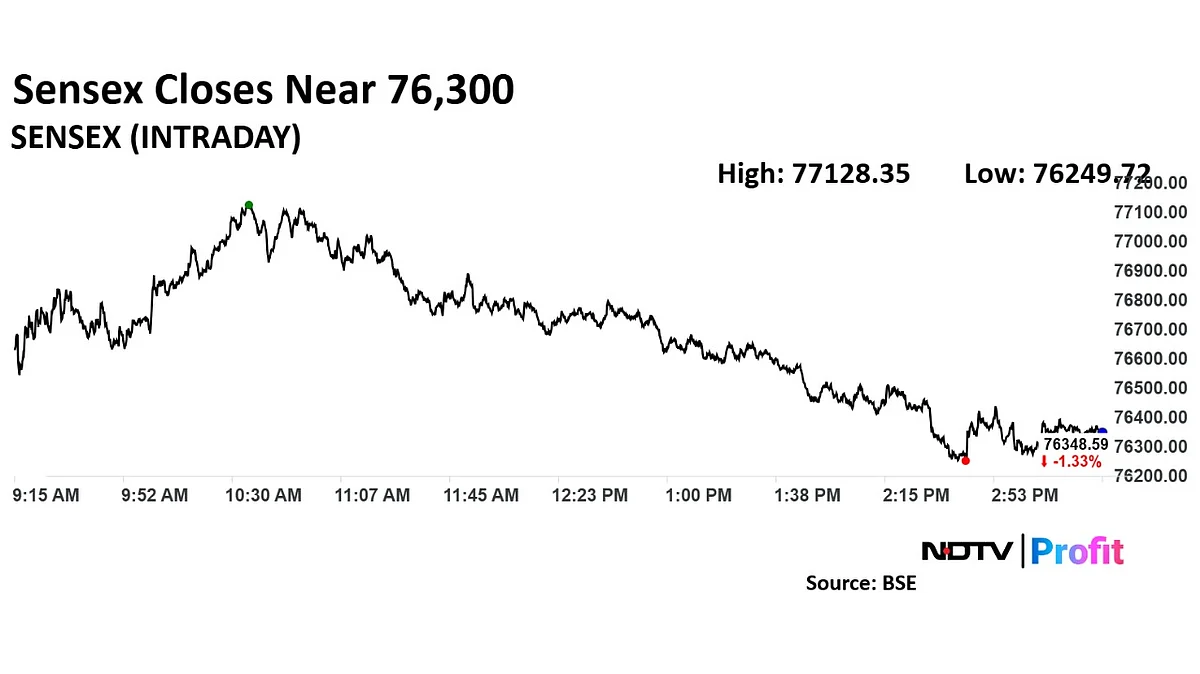

The NSE Nifty 50 ended 345.55 points or 1.47%, lower at 23,085, while the BSE Sensex lost 1,048.90 points or 1.36%, to close at 76,330.01. During the session, the Nifty declined as much as 1.64% to an intraday low of 23,047.25, while the Sensex fell 1.46% to 76,249.72.

Major Stocks In New

Bharat Electronics Ltd: The company has secured an order worth Rs 561 crore for satellite, fire control and radar technology on Monday.

Afcons Infrastructure: The company has emerged as the lowest bidder for a Rs 4,787.20-crore road construction contract received from Maharashtra State Road Development Corp.

HCL Technologies: The company reported net profit up 8.4% to Rs 4,594 crore versus Rs 4,237 crore (Bloomberg Estimate: Rs 4,614 crore) in the third quarter of the fiscal 2024-25.

Global Cues

Stocks in the Asia-Pacific region traded mixed while the dollar rallied on reports that President-elect Donald Trump’s economic team discussed a gradual approach to ramping up tariffs.

Australia's S&P/ASX 200 opened higher with the benchmark index advancing by 0.26%, or 22 points, to 8,213 as of 6:50 a.m. Japan's Nikkei was down 515 points, or 1.31% at 38.675.

Future contracts in Mainland China were to a negative start, while those in the US rose in early trade on Tuesday. Meanwhile, benchmark indices in China and India are seeing their worst start to a year since 2016.

China has ramped up its support for the yuan, with tweaks to its capital controls, Bloomberg News reported. This comes after the currency dropped close to a record low against the dollar in offshore trading.

The dollar index — which tracks the greenback's performance against a basket of 10 leading global currencies — was 0.35% down at 109.57. This comes after the index strengthened to a two-year high on Friday.

As per the latest US jobs data, the economy in December added the most jobs since March and the unemployment rate unexpectedly fell.

The S&P 500 and the Dow Jones Industrial Average rose 0.16% and 0.86%, respectively. The tech-heavy Nasdaq Composite fell 0.38%.

The focus on Wall Street will switch to US inflation data scheduled to be released on Wednesday. The consumer price index excluding food and energy is expected to rise 0.2% in December, after four straight months of 0.3% increases, according to Bloomberg estimates.

Crude oil prices were near a five-month high as US sanctions against Russian flows threatened supply. The Brent crude was trading 0.22% lower at $80.83 a barrel as of 6:50 a.m. IST, and the West Texas Intermediate was down 0.18% at $78.68.

Money Market

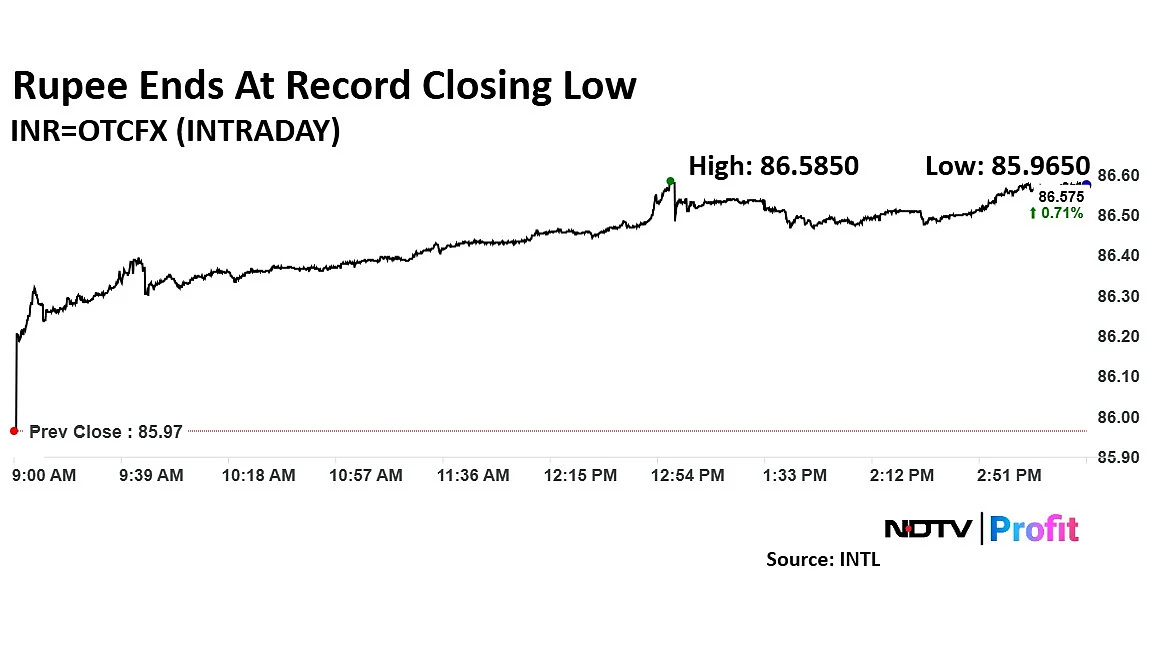

The rupee ended at record closing low against the US dollar for the fourth session in a row on Monday as bank persistently purchased the greenback on fears that the Indian unit will decline further.

The rupee depreciated beyond the psychologically crucial level of 86 per dollar at open, as the dollar index hovered around over two-year high and oil prices surged.

The rupee weakened by 62 paise to a record low of 86.60 against the dollar, marking the worst intraday decline since Feb 6, 2023. It settled at 86.58 a dollar, according to data on Bloomberg.